Introduction

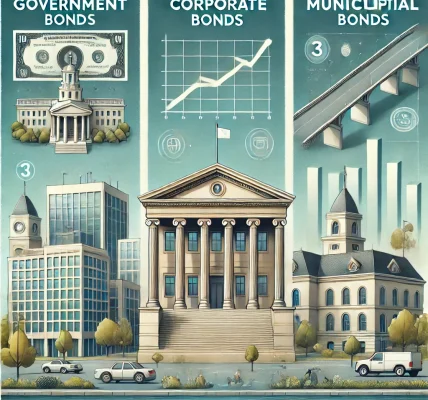

The bond market can be a complex world to navigate, especially for first-time investors. One of the key factors that can help guide your investment decisions is understanding the bond rating system. Whether you’re considering government, corporate, or municipal bonds, knowing the rating assigned to each bond can help you evaluate its risk and return potential. But what exactly is the bond rating system, and why does it matter for investors?

In this blog, we will delve into the bond rating system, how it works, the agencies that provide ratings, and why these ratings are crucial for making informed investment choices. Whether you’re looking for safety, income, or diversification, understanding bond ratings can help you build a more resilient investment portfolio.

What Is a Bond Rating?

A bond rating is an evaluation of the creditworthiness of the bond issuer and the likelihood that it will be able to meet its debt obligations. This rating is typically assigned by credit rating agencies based on their analysis of the issuer’s financial health, economic environment, and other relevant factors.

Bond ratings are usually expressed in the form of letter grades. These grades indicate the level of risk involved with the bond—whether the issuer is likely to default on its interest payments or principal repayment at maturity.

Bond Rating Scale

The bond rating system typically uses a combination of letter grades and sometimes numbers to indicate the quality of the bond. The most commonly used bond rating agencies are Standard & Poor’s (S&P), Moody’s, and Fitch, and each has its own rating scale.

- Investment-Grade Bonds

Investment-grade bonds are those rated as having a low risk of default. These bonds are typically issued by financially stable governments or corporations, making them a safe investment for those seeking steady income and lower risk. The rating scale for investment-grade bonds is as follows:- S&P and Fitch:

- AAA: Extremely strong creditworthiness and very low risk.

- AA: Very strong creditworthiness with low risk.

- A: Strong creditworthiness, but with some vulnerability to economic downturns.

- BBB: Adequate creditworthiness, but more susceptible to adverse conditions.

- Moody’s:

- Aaa: Exceptional creditworthiness.

- Aa: High creditworthiness with minimal risk.

- A: Good credit quality but susceptible to economic changes.

- Baa: Adequate credit quality with some risk during downturns.

- S&P and Fitch:

- Non-Investment-Grade Bonds (High-Yield or Junk Bonds)

Bonds rated below BBB (S&P/Fitch) or Baa (Moody’s) are considered non-investment-grade bonds, also known as high-yield or junk bonds. These bonds carry a higher risk of default but often offer higher yields as compensation for the increased risk. The rating scale for non-investment-grade bonds includes:- S&P and Fitch:

- BB: Moderate risk of default but still has the potential to pay higher yields.

- B: Higher risk, may face financial difficulties.

- CCC: Substantial risk of default, with only a slim chance of paying back investors.

- C: Extremely speculative, high risk of default.

- Moody’s:

- Ba: High-risk bonds, vulnerable to adverse conditions.

- B: Very high risk, bonds may default during difficult conditions.

- Caa: Substantial risk of default, very speculative bonds.

- Ca: Extremely risky, close to default.

- S&P and Fitch:

Why Does Bond Rating Matter?

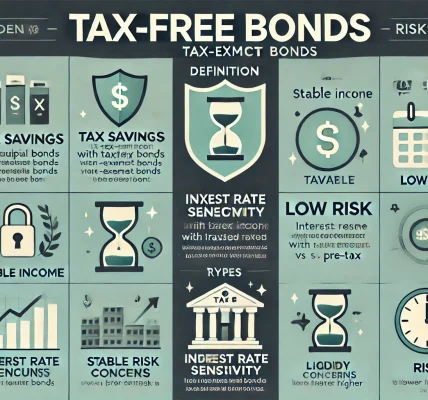

- Assessing Credit Risk The primary reason bond ratings matter is that they give investors a clear indication of the credit risk associated with the bond issuer. A higher rating means that the issuer is more likely to make its interest payments and repay the principal when the bond matures. Conversely, lower-rated bonds have a higher likelihood of default, which can jeopardize your investment.

- Interest Rate Sensitivity Bonds with higher ratings generally have lower yields because they carry less risk. Conversely, bonds with lower ratings offer higher yields as compensation for their increased risk. As an investor, bond ratings help you understand the risk-return trade-off. If you’re looking for steady income with minimal risk, investment-grade bonds are your best bet. On the other hand, if you’re willing to take on more risk for higher returns, you might consider high-yield bonds.

- Determining Bond Prices Bond ratings play a significant role in determining the price of a bond in the market. When a bond’s rating is downgraded, its price typically falls because investors demand a higher yield to compensate for the increased risk. Similarly, when a bond is upgraded, its price may rise. If you plan to buy or sell bonds in the secondary market, keeping an eye on ratings changes is crucial for maximizing your investment.

- Portfolio Diversification Understanding the bond rating system is essential for building a diversified investment portfolio. By investing in a mix of investment-grade and high-yield bonds, you can balance risk and return based on your investment goals and risk tolerance. Bond ratings help you allocate your investments effectively across various types of bonds to achieve the best risk-adjusted returns.

- Regulatory and Institutional Requirements Many institutional investors, such as pension funds, insurance companies, and mutual funds, have guidelines that require them to hold only investment-grade bonds in their portfolios. If a bond is downgraded from investment-grade to junk status, these investors may be forced to sell the bond, which can lead to a decrease in its price.

How Are Bond Ratings Determined?

Credit rating agencies, such as S&P, Moody’s, and Fitch, determine bond ratings by analyzing a variety of factors related to the issuer. These factors include:

- Issuer’s Financial Health: Analyzing the issuer’s financial statements, cash flow, debt levels, and profitability.

- Economic Conditions: Considering the overall economic environment and how it might impact the issuer’s ability to repay the bond.

- Debt Structure: Examining the issuer’s overall debt levels and whether it has the capacity to meet its obligations.

- Management and Governance: Evaluating the issuer’s leadership and corporate governance practices.

Once these factors are analyzed, the agencies assign a bond rating, which can be upgraded, downgraded, or affirmed based on future developments.

Conclusion

The bond rating system is an essential tool for investors looking to understand the risk and return potential of different bonds. By considering bond ratings, investors can make more informed decisions about which bonds to buy, sell, or hold, depending on their investment objectives and risk tolerance. Whether you’re focused on safety, income, or diversification, bond ratings provide crucial information for building a well-balanced investment portfolio.