Introduction

Sovereign bonds have long been considered a safe haven for investors seeking stable returns and low risk. Issued by national governments, these bonds offer an opportunity to invest in a country’s economic future while earning periodic interest. However, despite their reputation, are sovereign bonds truly risk-free? This comprehensive guide explores the nature of sovereign bonds, their benefits, potential risks, and whether they are a secure investment choice.

What Are Sovereign Bonds?

Sovereign bonds are debt securities issued by a national government to raise capital for public spending. In exchange, the government promises to pay back the principal amount along with periodic interest, known as a coupon, over a predetermined period.

Types of Sovereign Bonds:

- Domestic Sovereign Bonds: Issued in the local currency to domestic investors.

- Foreign Sovereign Bonds: Issued in a foreign currency, attracting international investors.

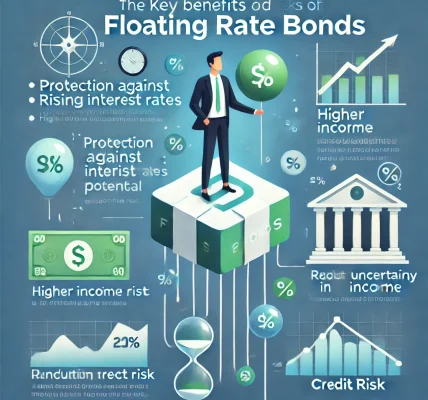

- Inflation-Linked Bonds: Designed to protect against inflation by adjusting interest payments based on inflation indices.

- Eurobonds: Issued in a currency different from the issuing country’s national currency.

Why Do Investors Consider Sovereign Bonds Risk-Free?

Sovereign bonds issued by stable governments, especially in developed economies, are often perceived as risk-free due to the belief that a government cannot default on its debt. This assumption relies on the government’s ability to print money or collect taxes to meet debt obligations. For instance, U.S. Treasury bonds are often considered the gold standard for low-risk investments.

Key Benefits of Investing in Sovereign Bonds

- Safety and Stability: Sovereign bonds from developed nations provide a relatively safe investment due to government backing.

- Predictable Returns: Regular interest payments offer a steady income stream for investors.

- Diversification: Adding sovereign bonds to a portfolio reduces overall risk by balancing more volatile assets like stocks.

- Liquidity: Many sovereign bonds are traded in highly liquid markets, ensuring easy buy and sell options.

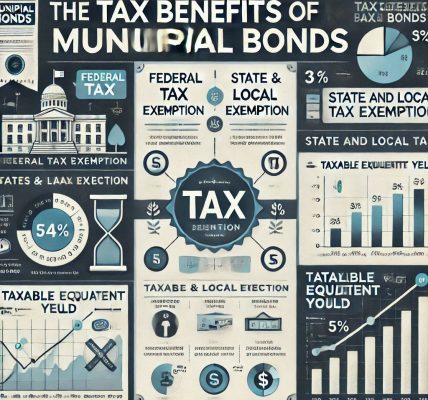

- Tax Benefits: Some sovereign bonds offer tax exemptions on interest income, depending on the country’s regulations.

Are Sovereign Bonds Truly Risk-Free?

While sovereign bonds from major economies are considered low-risk, they are not entirely risk-free. Several factors can affect their safety:

1. Credit Risk (Default Risk)

Although rare, sovereign defaults do occur. Countries with weak economies, political instability, or high debt levels are more prone to default. Notable examples include Argentina (2001) and Greece (2012).

2. Inflation Risk

Inflation erodes the purchasing power of future coupon payments, reducing real returns. Fixed-rate sovereign bonds are particularly vulnerable to rising inflation.

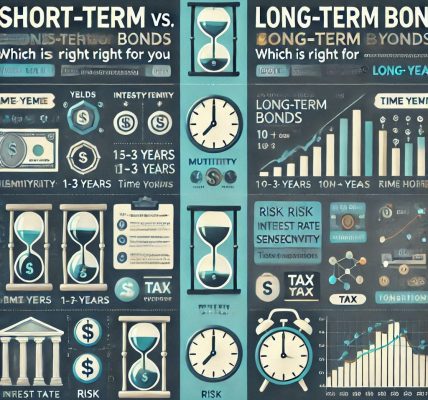

3. Interest Rate Risk

When interest rates rise, the market value of existing bonds falls. Investors may face capital losses if they need to sell bonds before maturity.

4. Currency Risk

Foreign sovereign bonds expose investors to exchange rate fluctuations, which can significantly impact returns when converted back to the investor’s home currency.

5. Political and Economic Risk

Political instability, economic mismanagement, and policy changes can negatively affect sovereign bond markets.

How to Evaluate Sovereign Bonds for Risk

When assessing the safety of sovereign bonds, consider these factors:

- Credit Ratings: Agencies like Moody’s, S&P, and Fitch assign credit ratings to sovereign bonds. Higher ratings (AAA, AA) indicate lower default risk.

- Economic Indicators: Analyze GDP growth, inflation rates, and fiscal policies to gauge the issuing country’s financial health.

- Yield Spreads: Compare the bond’s yield against a benchmark (e.g., U.S. Treasuries) to measure relative risk.

- Political Environment: Stable governments with transparent policies pose less risk.

Sovereign Bonds from Developed vs. Emerging Markets

- Developed Market Bonds: Considered safer due to stronger economies and established regulatory frameworks (e.g., U.S. Treasury bonds, UK Gilts, German Bunds).

- Emerging Market Bonds: Offer higher yields to compensate for greater risks like currency volatility and political uncertainty (e.g., bonds from Brazil, India, South Africa).

Strategies to Mitigate Sovereign Bond Risks

- Diversification: Invest across multiple countries and currencies to spread risk.

- Laddering Strategy: Purchase bonds with staggered maturities to reduce interest rate sensitivity.

- Inflation Protection: Consider inflation-linked sovereign bonds to preserve purchasing power.

- Research and Monitoring: Regularly review economic and political developments impacting bond markets.

The Role of Sovereign Bonds in an Investment Portfolio

Sovereign bonds play a crucial role in balancing and stabilizing investment portfolios. They offer a counterbalance to riskier assets, provide consistent income, and can act as a safe-haven during market downturns.

Who Should Invest in Sovereign Bonds?

- Risk-Averse Investors: Seeking stability and predictable returns.

- Retirees: Interested in regular income with low capital risk.

- Institutional Investors: For long-term liability matching and portfolio diversification.

Conclusion

While sovereign bonds from stable governments are often viewed as low-risk, they are not entirely risk-free. Factors such as credit risk, inflation, and political uncertainty can impact their safety and returns. Careful evaluation, diversification, and staying informed about economic conditions are key to making sound sovereign bond investments.

By understanding the risks and benefits, investors can effectively incorporate sovereign bonds into their portfolios to achieve financial stability and long-term growth.

Always consult with a financial advisor to ensure sovereign bonds align with your investment goals and risk tolerance.