Investing in bonds is a popular way to generate steady returns while preserving capital. However, not all bonds carry the same level of risk or reward. Bond ratings are a crucial tool investors use to assess the safety and profitability of different bonds. This guide will help you understand bond ratings, their importance, and how to use them to make informed investment decisions in 2024.

What Are Bond Ratings?

Bond ratings are evaluations of the creditworthiness of a bond issuer. They reflect the likelihood that the issuer will meet its debt obligations, including paying interest and repaying the principal. Independent credit rating agencies assign these ratings based on a thorough assessment of the issuer’s financial health and market conditions.

Major Bond Rating Agencies

The primary credit rating agencies globally recognized are:

- Moody’s Investors Service

- Standard & Poor’s (S&P) Global Ratings

- Fitch Ratings

Each agency uses a unique rating scale to grade bonds, but the core idea remains the same: higher ratings indicate lower risk, while lower ratings suggest higher risk but often offer greater returns.

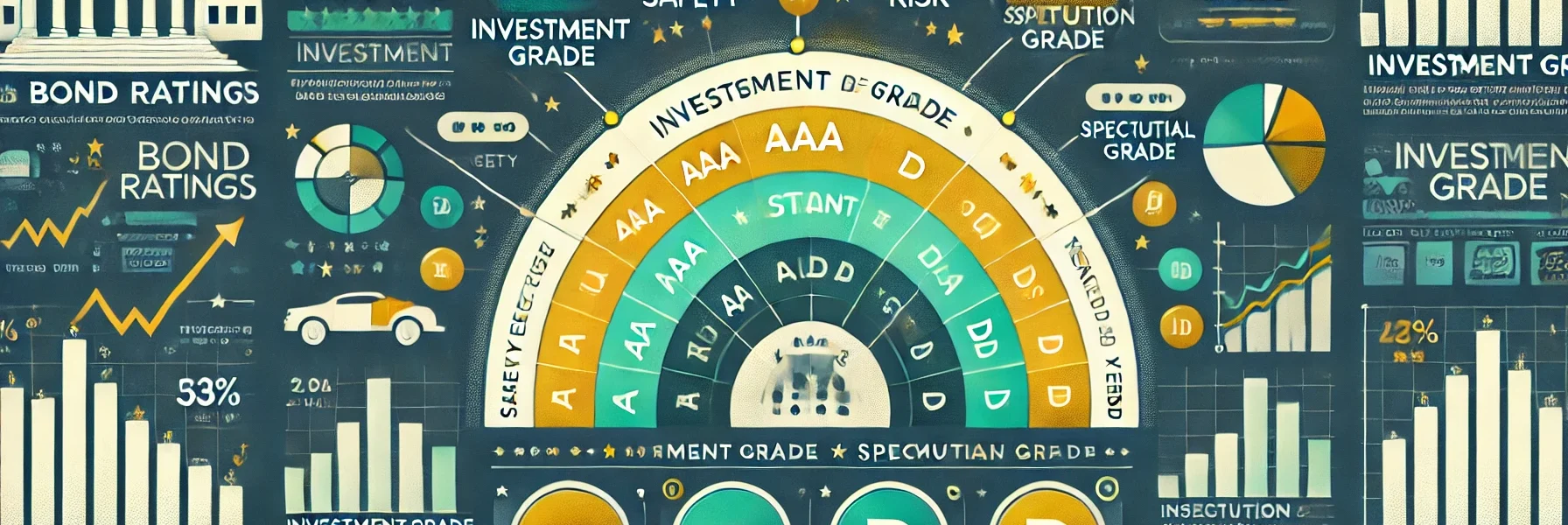

Understanding Bond Rating Scales

Here is a breakdown of the typical rating scales used by the three major rating agencies:

| Rating Agency | Investment Grade (Safer) | Speculative Grade (Riskier) |

|---|---|---|

| Moody’s | Aaa, Aa, A, Baa | Ba, B, Caa, Ca, C |

| S&P | AAA, AA, A, BBB | BB, B, CCC, CC, C, D |

| Fitch | AAA, AA, A, BBB | BB, B, CCC, CC, C, D |

- Investment-grade bonds (AAA to BBB) are considered low-risk and are suitable for conservative investors.

- Speculative-grade bonds (BB and below) offer higher yields but come with an increased risk of default.

Why Are Bond Ratings Important?

Understanding bond ratings helps investors in several ways:

- Risk Assessment: Ratings indicate how likely the issuer is to repay the debt.

- Investment Comparison: Allows investors to compare bonds from different issuers.

- Informed Decisions: Helps align investment choices with risk tolerance and financial goals.

- Regulatory Compliance: Some institutions can only invest in investment-grade bonds.

Factors Affecting Bond Ratings

Credit rating agencies analyze multiple factors to assign a bond rating, including:

- Issuer’s Financial Health: Examines cash flow, revenue, and profitability.

- Economic Environment: Evaluates the impact of broader economic conditions.

- Debt Level: Considers the issuer’s outstanding debt and repayment capacity.

- Market Conditions: Reviews industry-specific risks and competition.

- Management Quality: Analyzes the issuer’s governance and leadership effectiveness.

How Bond Ratings Affect Investment Decisions

Bond ratings directly impact your investment strategy in the following ways:

- Interest Rates (Yield): Lower-rated bonds offer higher yields to compensate for increased risk.

- Liquidity: Higher-rated bonds are easier to buy or sell in the market.

- Portfolio Diversification: Helps balance high-risk and low-risk investments.

- Tax Implications: Municipal bonds often offer tax advantages but may carry different risks.

Example:

- AAA Bond: Low risk, lower yield (e.g., 3% annually).

- BB Bond: High risk, higher yield (e.g., 8% annually).

How to Choose Safe and Profitable Bonds

1. Define Your Investment Goals

- Conservative Investors: Prefer AAA to A-rated bonds for security.

- Balanced Investors: Consider BBB-rated bonds for a blend of safety and returns.

- Aggressive Investors: May explore BB-rated or lower bonds for higher yields.

2. Analyze the Bond Rating and Financial Reports

- Check Recent Ratings: Use official sources like Moody’s, S&P, or Fitch.

- Review the Prospectus: Understand bond maturity, interest structure, and issuer health.

3. Diversify Your Bond Portfolio

Avoid concentrating on a single type of bond. Consider:

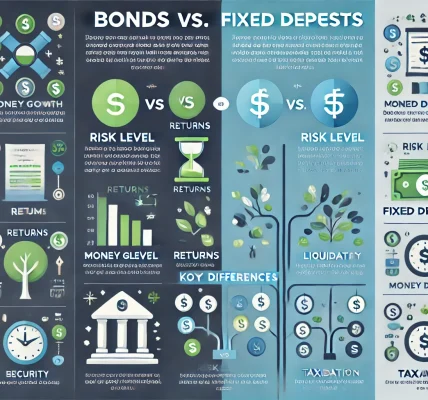

- Government Bonds: Ultra-safe and ideal for low-risk investors.

- Corporate Bonds: Offer higher returns but carry default risks.

- Municipal Bonds: Tax-exempt and suitable for long-term income.

4. Monitor Rating Changes

Bond ratings can change over time based on the issuer’s performance. Regularly review:

- Upgrades: Indicate improved financial stability.

- Downgrades: Signal increased risk and possible default.

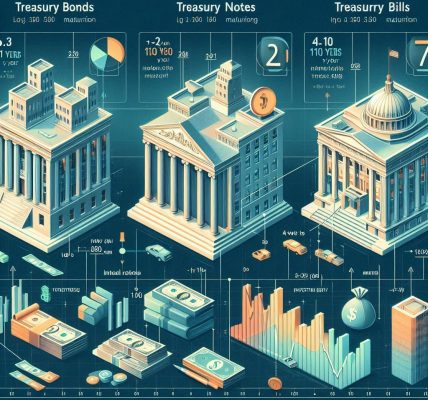

5. Consider Bond Duration

- Short-Term Bonds: Lower risk and less sensitive to interest rate changes.

- Long-Term Bonds: Offer higher returns but are more vulnerable to rate changes.

Common Myths About Bond Ratings

- Higher Ratings Always Mean Lower Risk: While true generally, other factors like economic changes can still affect bond safety.

- Only Low-Rated Bonds Are Profitable: Investment-grade bonds can still provide substantial returns if selected wisely.

- Bond Ratings Never Change: Ratings are dynamic and adjusted as issuers’ financial situations evolve.

Tools to Evaluate Bond Ratings

- Rating Agency Websites: Official portals for Moody’s, S&P, and Fitch provide up-to-date ratings.

- Financial News Platforms: Monitor rating changes and economic trends.

- Bond Screeners: Online tools to filter bonds by rating, yield, and duration.

Legal Considerations When Investing in Bonds

- Disclosures: Ensure the issuer provides comprehensive and accurate information.

- Regulatory Compliance: Follow regional and national guidelines for bond investments.

- Financial Advisor Consultation: Seek expert advice to align investments with your goals and legal standards.

Final Thoughts

Understanding bond ratings is essential for making informed and confident investment decisions. By focusing on credit ratings, analyzing issuer health, and diversifying your bond portfolio, you can strike a balance between safety and profitability.

In 2024, as economic landscapes evolve, staying informed about rating changes and market conditions will give you a competitive edge. Always prioritize due diligence and seek professional guidance to ensure your bond investments align with your financial objectives.