When it comes to bond investing, most investors are familiar with concepts like yield, duration, and interest rate risk. However, one of the most crucial yet often overlooked concepts is bond convexity. Understanding bond convexity helps investors gauge how sensitive a bond’s price is to changes in interest rates, allowing for more informed and strategic investment decisions.

In this blog, we will explore what bond convexity is, how it works, its impact on bond prices, and why it is essential for portfolio management.

📚 What is Bond Convexity?

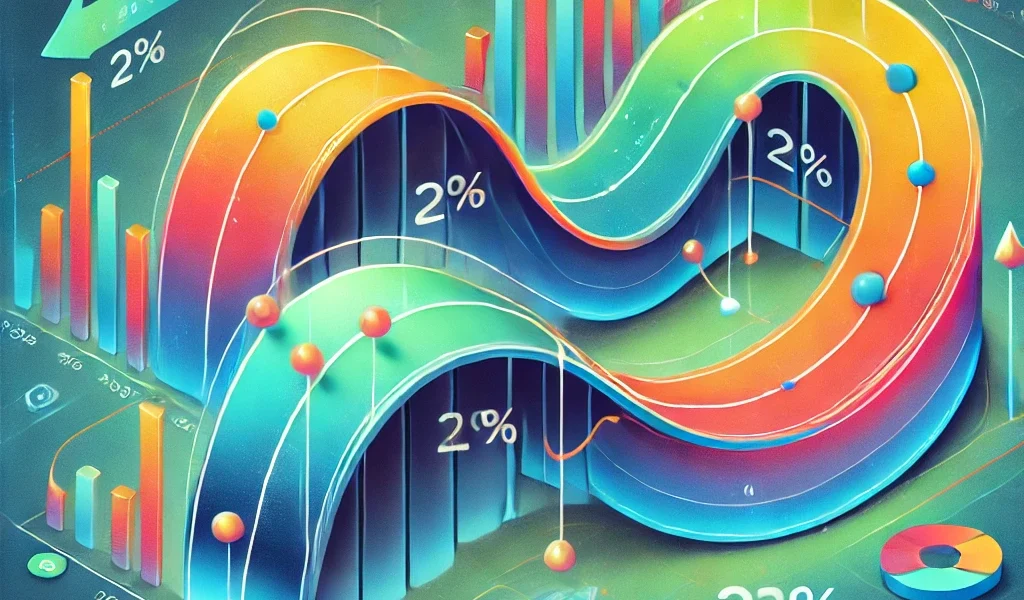

Bond convexity measures the degree of curvature in the relationship between bond prices and interest rates. While duration estimates the percentage change in a bond’s price for a 1% change in interest rates, convexity accounts for the fact that this relationship is not perfectly linear. Convexity helps refine duration estimates by considering how the rate of change in price accelerates or decelerates as interest rates move.

🔍 In Simple Terms:

- Positive Convexity: Bond prices rise faster when interest rates fall and decline slower when interest rates rise.

- Negative Convexity: Bond prices rise slower when interest rates fall and decline faster when interest rates rise.

🔢 Formula for Bond Convexity

Convexity is typically calculated using the following formula: Convexity=1Price×∑(CFt×t×(t+1))(1+y)2\text{Convexity} = \frac{1}{\text{Price}} \times \frac{\sum \left(CF_t \times t \times (t+1)\right)}{(1 + y)^2}Convexity=Price1×(1+y)2∑(CFt×t×(t+1))

Where:

- CFt = Cash flows (coupon payments and principal)

- t = Time period until payment

- y = Yield to maturity (YTM)

- Price = Current bond price

📈 How Bond Convexity Works

✅ 1. Understanding Duration and Its Limitation

Duration measures a bond’s sensitivity to changes in interest rates, assuming a linear relationship. However, bond price movements are not perfectly linear, especially for large changes in interest rates. Convexity provides a more accurate estimate by considering the curvature in the price-yield relationship.

✅ 2. Positive vs. Negative Convexity

- Positive Convexity:

Bonds with positive convexity see price increases that accelerate as interest rates fall and price declines that decelerate as interest rates rise. Most traditional bonds exhibit positive convexity.

Example:

A long-term bond with low coupon payments tends to have high positive convexity. - Negative Convexity:

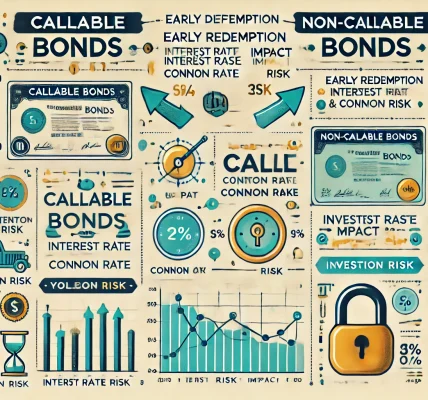

Bonds with negative convexity show price increases that decelerate when interest rates fall and price declines that accelerate when interest rates rise. Bonds with embedded options, such as callable bonds or mortgage-backed securities (MBS), typically exhibit negative convexity.

Example:

Callable bonds show negative convexity because the issuer can redeem them when rates fall, limiting price appreciation.

✅ 3. Convexity’s Role in Large Interest Rate Changes

For small interest rate changes, duration alone is often sufficient to estimate price changes. However, for larger rate fluctuations, convexity becomes critical.

- High Convexity Bonds: Benefit more in falling interest rate environments as price appreciation accelerates.

- Low or Negative Convexity Bonds: Experience limited upside in falling rate scenarios and faster price declines when rates rise.

📊 Bond Convexity vs. Duration: Key Differences

| Feature | Duration | Convexity |

|---|---|---|

| Definition | Measures bond price sensitivity to interest rate changes | Measures the curvature in the price-yield relationship |

| Type of Relationship | Linear approximation | Curved or non-linear relationship |

| Accuracy for Small Changes | High | Moderate |

| Accuracy for Large Changes | Low | High |

| Risk Indicator | Interest rate risk | Second-level interest rate risk |

🎯 Why Bond Convexity Matters for Investors

📈 1. More Accurate Interest Rate Sensitivity

Convexity refines duration estimates by providing a more precise measurement of how bond prices respond to interest rate changes. This is especially important when rates move significantly.

💸 2. Reduced Portfolio Volatility

Bonds with higher convexity experience less price decline when interest rates rise, reducing overall portfolio volatility. Adding bonds with positive convexity can stabilize a fixed-income portfolio.

🔄 3. Protection in a Falling Rate Environment

Bonds with higher positive convexity benefit more from falling interest rates by appreciating faster, providing better returns for investors.

📊 4. Better Management of Callable and Complex Bonds

For bonds with embedded options, such as callable or mortgage-backed securities, convexity helps investors understand the risks of price movements under different interest rate scenarios.

⚠️ 5. Mitigating Negative Convexity Risks

Identifying bonds with negative convexity allows investors to avoid or hedge against potential downside risks, particularly in rising rate environments.

💡 Examples of Bonds with Different Convexity Profiles

✅ 1. Government Bonds (Positive Convexity)

- Typically show high positive convexity.

- Prices increase sharply when interest rates fall.

- Ideal for conservative investors seeking stable returns.

✅ 2. Callable Bonds (Negative Convexity)

- Callable bonds have negative convexity due to the issuer’s ability to redeem the bond when rates fall.

- Limits upside potential for investors during falling rate periods.

✅ 3. Mortgage-Backed Securities (Negative Convexity)

- Prepayment risks in MBS lead to negative convexity.

- Investors may experience limited gains even if interest rates decline.

✅ 4. High Duration Bonds (High Positive Convexity)

- Long-term bonds with low coupon payments exhibit high convexity.

- Their prices are more sensitive to changes in interest rates.

📉 Risks and Limitations of Bond Convexity

⚠️ 1. Complexity and Misinterpretation

Understanding and calculating convexity requires advanced financial knowledge. Misinterpretation can lead to poor investment decisions.

⚠️ 2. Impact of Callable Features

Bonds with callable features may exhibit negative convexity, which limits upside potential and increases risk during falling rate environments.

⚠️ 3. Higher Sensitivity to Market Conditions

High convexity bonds may experience sharper price movements, making them more sensitive to changes in market conditions.

📊 How to Use Convexity to Improve Portfolio Performance

🎯 1. Combine High and Low Convexity Bonds

Balancing high convexity bonds with lower convexity bonds can reduce overall portfolio volatility and enhance returns during different interest rate environments.

🎯 2. Hedge Against Rising Interest Rates

Use low convexity or floating-rate bonds to mitigate losses in rising rate environments.

🎯 3. Favor High Convexity in Falling Rate Periods

During periods of declining interest rates, prioritize high convexity bonds to maximize potential price appreciation.

🤔 When to Consider Bond Convexity in Investment Decisions

✅ 1. During Volatile Interest Rate Environments

In times of significant interest rate fluctuations, understanding bond convexity helps predict and mitigate potential price changes.

✅ 2. When Managing Callable or Complex Bonds

For portfolios containing callable bonds, mortgage-backed securities, or other complex instruments, convexity provides a clearer picture of price sensitivity.

✅ 3. To Enhance Portfolio Diversification

Incorporating bonds with varying convexity profiles adds diversification and protects against market volatility.

📊 Bond Convexity vs. Bond Duration: A Comparative Overview

| Feature | Bond Duration | Bond Convexity |

|---|---|---|

| Definition | Sensitivity to interest rate changes | Curvature of price-yield relationship |

| Accuracy for Small Changes | High | Moderate |

| Accuracy for Large Changes | Low | High |

| Application | Basic interest rate analysis | Advanced risk management |

🎨 Final Verdict: Why Bond Convexity is Essential for Investors

Bond convexity plays a critical role in enhancing investment decision-making by offering a deeper understanding of how bond prices respond to interest rate changes. By incorporating convexity analysis into your investment strategy, you can better manage risk, improve portfolio diversification, and maximize returns, especially during periods of market volatility.

For investors who seek to balance fixed-income stability with equity growth or manage portfolios with complex bond structures, understanding convexity is a powerful tool for long-term success.