Introduction

Retirement planning is one of the most crucial financial decisions an individual can make. As life expectancy increases, ensuring a steady income post-retirement has become essential. Mutual funds provide an effective and flexible investment option for building a strong retirement corpus. They offer diversification, professional fund management, and the potential for long-term wealth accumulation.

This blog explores the importance of mutual funds in retirement planning, the different types of mutual funds suitable for retirees, and strategies to maximize returns while minimizing risks.

1. Why Mutual Funds for Retirement Planning?

Mutual funds offer several advantages that make them an ideal investment vehicle for retirement planning:

a) Diversification

Mutual funds invest in a diversified portfolio of stocks, bonds, and other securities, reducing the risk associated with investing in a single asset class.

b) Professional Management

Fund managers with expertise manage mutual funds, ensuring that investments are optimized based on market conditions.

c) Flexibility

Investors can choose from various mutual fund types based on their risk appetite, financial goals, and investment horizon.

d) Systematic Investment Plan (SIP)

SIPs allow investors to invest small amounts regularly, enabling disciplined savings and the benefits of rupee-cost averaging.

e) Liquidity

Unlike other retirement-focused investments, mutual funds provide higher liquidity, allowing withdrawals in case of emergencies.

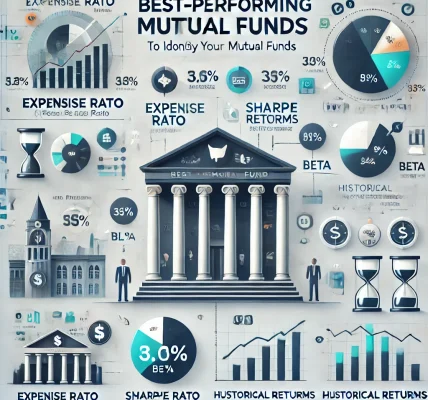

2. Best Types of Mutual Funds for Retirement Planning

a) Equity Mutual Funds (For Long-Term Growth)

Equity mutual funds are suitable for individuals with a long-term investment horizon (more than 10-15 years before retirement). These funds provide high returns but come with volatility.

- Large-Cap Funds – Invest in stable, well-established companies.

- Multi-Cap Funds – Offer exposure across different market capitalizations.

- Index Funds – Track market indices and provide low-cost passive investing.

b) Debt Mutual Funds (For Stability and Lower Risk)

Debt funds are ideal for retirees or individuals nearing retirement who prefer stable returns with lower risk.

- Gilt Funds – Invest in government securities with minimal credit risk.

- Corporate Bond Funds – Provide higher returns compared to fixed deposits.

- Short-Term Debt Funds – Suitable for those who want liquidity with moderate returns.

c) Hybrid Mutual Funds (For Balanced Growth and Safety)

Hybrid funds combine equity and debt components, offering a balance between risk and returns.

- Aggressive Hybrid Funds – Higher allocation to equities for long-term growth.

- Conservative Hybrid Funds – More exposure to debt for stability.

- Balanced Advantage Funds – Dynamically manage asset allocation between equity and debt based on market conditions.

d) Retirement or Pension Funds

These funds are designed specifically for retirement planning with a lock-in period and structured withdrawal options to provide regular income post-retirement.

3. Retirement Investment Strategies Using Mutual Funds

a) Start Early and Stay Consistent

- The earlier you start investing, the more you benefit from the power of compounding.

- Consistent SIP investments ensure disciplined saving habits.

b) Asset Allocation Based on Age

Your portfolio should be adjusted based on your age and risk tolerance. Below is a general allocation guide:

| Age Group | Equity (%) | Debt (%) | Others (Gold, International) (%) |

|---|---|---|---|

| 20-35 Years | 80 | 10 | 10 |

| 36-50 Years | 60 | 30 | 10 |

| 51-60 Years | 40 | 50 | 10 |

| 60+ Years | 20 | 70 | 10 |

c) Transition from Growth to Stability

- As retirement approaches, gradually shift from equity-heavy funds to debt and hybrid funds to reduce risk.

- Use Systematic Transfer Plans (STPs) to move funds from equity to debt funds over time.

d) Generate a Regular Post-Retirement Income

- Systematic Withdrawal Plan (SWP): This allows retirees to withdraw a fixed amount periodically from their mutual fund investments while keeping the remaining invested.

- Dividend-Paying Mutual Funds: Some funds provide regular dividends, acting as an additional income source.

4. Tax Implications of Mutual Funds in Retirement Planning

Understanding taxation is essential to maximize post-retirement income.

a) Tax on Equity Mutual Funds

- Short-Term Capital Gains (STCG): 15% if sold within one year.

- Long-Term Capital Gains (LTCG): 10% for gains exceeding ₹1 lakh per financial year.

b) Tax on Debt Mutual Funds

- Taxed based on the investor’s income tax slab under the new tax regime.

c) Tax-Efficient Withdrawal Strategy

- Use SWP from debt funds to manage tax-efficient withdrawals.

- Stay updated with tax laws to optimize returns while reducing tax liability.

5. Common Mistakes to Avoid in Retirement Planning with Mutual Funds

🚫 Delaying Investment: The later you start, the more you need to invest to achieve the same corpus. 🚫 Investing Only in One Asset Class: Over-reliance on equity or debt increases risk. 🚫 Not Reviewing Portfolio Regularly: Market conditions and personal financial needs change over time. 🚫 Ignoring Inflation: Factor in inflation while planning your retirement corpus. 🚫 Making Emotional Investment Decisions: Stick to your strategy rather than reacting to short-term market fluctuations.

6. Conclusion: Secure Your Retirement with Mutual Funds

Mutual funds play a vital role in retirement planning, offering flexibility, diversification, and professional management. Whether you’re starting early or approaching retirement, there are suitable mutual fund options to help you build a secure financial future.

Key Takeaways:

✅ Start early and invest consistently through SIPs. ✅ Maintain a balanced asset allocation strategy as you age. ✅ Use tax-efficient withdrawal methods like SWP post-retirement. ✅ Regularly review and rebalance your portfolio. ✅ Consider seeking financial advice for personalized investment plans.

By making informed investment decisions, you can ensure a financially independent and comfortable retirement.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a certified financial advisor before making any investment decisions.