Inflation is one of the most pervasive economic forces, and its effects on investments, particularly bonds, can significantly influence an investor’s returns. Whether you are a seasoned investor or just starting, understanding how inflation impacts bond investments is crucial for making well-informed decisions and protecting your portfolio from the harmful effects of rising prices.

In this guide, we will explore the relationship between inflation and bond investments, how inflation erodes bond returns, and strategies you can use to safeguard your bond investments from inflation risks.

What is Inflation?

Inflation is the rate at which the general price level of goods and services rises over time, causing a decline in the purchasing power of money. In other words, the same amount of money will buy fewer goods and services as inflation increases. For investors, inflation is a crucial factor to consider because it can reduce the real value of returns, especially for long-term investments like bonds.

How Inflation Affects Bond Prices and Yields

Bonds are essentially loans issued by governments or corporations in exchange for regular interest payments (known as the coupon rate) over the bond’s term. When inflation rises, the real value of these interest payments declines. Let’s break it down:

- Fixed Interest Payments: Bonds typically offer fixed interest payments. If inflation increases, these fixed payments lose purchasing power. For example, if you hold a bond with a 5% annual interest rate, but inflation rises to 6%, your real return is effectively negative because inflation outpaces the bond’s yield.

- Rising Interest Rates: To combat inflation, central banks often raise interest rates. When interest rates increase, newly issued bonds offer higher yields. This makes older, lower-yielding bonds less attractive in the market. As a result, the price of existing bonds tends to fall because their fixed interest payments are less appealing compared to the higher yields on new bonds.

- The Real Yield: The real yield of a bond is its nominal yield minus inflation. When inflation rises, the real yield on your bond investment decreases. For instance, if you have a bond with a 4% yield, but inflation is 3%, your real yield is only 1%. As inflation increases, the real value of your bond’s income declines.

Why Bonds Are Vulnerable to Inflation

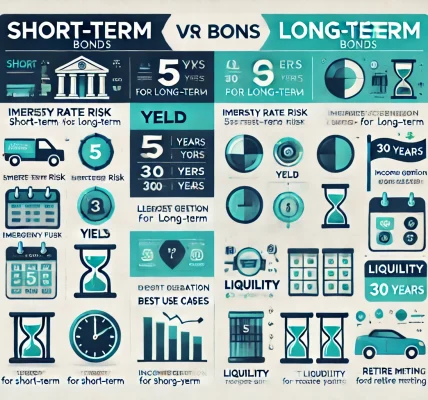

Bonds are generally considered safer investments compared to stocks, as they provide predictable income streams. However, their vulnerability to inflation arises from their fixed nature. The longer the bond’s maturity, the more susceptible it is to inflationary pressures. Long-term bonds lock in a fixed coupon rate for many years, so if inflation rises significantly over time, the investor is stuck with lower real returns.

Strategies to Protect Your Bond Portfolio from Inflation

While inflation can hurt bond investments, there are several strategies you can employ to mitigate its effects:

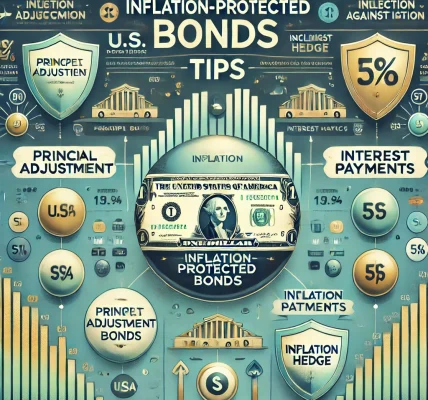

- Invest in Inflation-Protected Bonds: One of the best ways to protect your bond investments from inflation is to invest in Treasury Inflation-Protected Securities (TIPS). TIPS are government-issued bonds whose principal value is adjusted based on changes in the Consumer Price Index (CPI). As inflation rises, the principal value of TIPS increases, ensuring that your bond’s value keeps up with inflation.

- Shorten Your Bond Duration: The longer the duration of a bond, the more it is affected by interest rate changes and inflation. By shortening your bond duration, you reduce your exposure to inflation risk. Short-term bonds are less sensitive to interest rate hikes, and they allow you to reinvest your principal at higher rates when they mature.

- Diversify Your Portfolio: To minimize inflation risk, consider diversifying your portfolio by including different asset classes such as stocks, real estate, or commodities, which tend to perform better in inflationary environments. Diversification can help offset the negative impact of inflation on your bond holdings.

- Consider Floating Rate Bonds: Floating rate bonds have interest rates that adjust periodically based on market conditions or benchmark rates, such as LIBOR. These bonds offer a better hedge against rising inflation, as their interest payments increase when interest rates go up in response to inflation.

- Monitor Economic Indicators: Stay informed about inflation trends and economic policies. Understanding the direction of inflation and interest rates will allow you to make proactive adjustments to your portfolio before inflation takes a significant toll on your bond investments.

The Bottom Line

While bonds are generally seen as a stable and safe investment, their performance can be severely affected by inflation. Rising inflation erodes the purchasing power of bond interest payments and can cause bond prices to fall. As a result, it’s important to consider inflation when managing your bond portfolio.

By adopting strategies such as investing in inflation-protected securities, diversifying your portfolio, and being mindful of bond duration, you can minimize the impact of inflation and ensure that your bond investments continue to generate stable returns in the face of rising prices.

Conclusion Inflation is an inevitable part of the economic cycle, and it plays a significant role in determining the returns on bond investments. Understanding its impact allows you to make informed decisions and take the necessary steps to protect your investment portfolio. By strategically positioning your bond investments and staying ahead of inflation trends, you can continue to benefit from the security and income that bonds offer, even in challenging economic times.