In today’s world, where inflation is on the rise, and traditional saving options offer lower returns, it’s important to find high-yield saving plans that can help your money grow faster. With 2025 just around the corner, it’s time to think about how you can boost your savings and maximize returns. Whether you’re saving for short-term goals or planning for long-term financial stability, choosing the right high-yield saving plan is essential.

In this blog, we’ll take a look at the best high-yield saving plans for 2025 and provide you with insights into each option, helping you make an informed decision on where to invest your hard-earned money.

What Is a High-Yield Saving Plan?

A high-yield saving plan is an investment that offers a higher return on your deposited funds compared to traditional savings options, such as regular savings accounts or fixed deposits. These plans are designed to help your money grow faster, thanks to better interest rates or returns, often with a higher level of risk or a longer investment horizon.

When selecting a high-yield saving plan, it’s important to consider factors like risk tolerance, investment horizon, and liquidity needs.

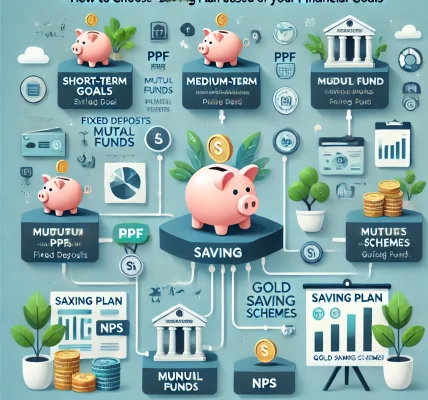

Top High-Yield Saving Plans for 2025

Here are some of the best high-yield saving plans that you should consider for 2025, offering a good balance between risk and return potential:

1. Fixed Deposits with Higher Interest Rates

Fixed deposits (FDs) have been a popular choice for conservative investors. However, several banks and financial institutions are now offering high-interest FDs with rates ranging from 6.5% to 8.5%, depending on the tenure and type of FD.

Why Choose Fixed Deposits for 2025?

- Low risk: FDs are relatively safe, especially when chosen with established banks.

- Tax Benefits: Some FDs offer tax-saving options under Section 80C of the Income Tax Act.

- Higher Interest Rates: Many financial institutions are offering increased rates to attract more customers.

Tip: If you are looking for guaranteed returns with low risk, fixed deposits with higher interest rates are ideal for 2025.

2. Public Provident Fund (PPF)

The Public Provident Fund (PPF) is one of the most popular long-term investment options in India, offering tax-free returns and a guaranteed interest rate of around 7.1% to 7.75% per annum.

Why Choose PPF for 2025?

- Long-term security: The PPF has a 15-year lock-in period, making it a great option for long-term savings.

- Tax-free interest: The interest earned on PPF is completely exempt from tax.

- Government-backed: As a government-backed scheme, it carries zero risk.

PPF is an ideal choice for those looking for safe, long-term wealth-building with tax advantages.

3. Systematic Investment Plans (SIPs)

SIPs in mutual funds allow you to invest regularly in a portfolio of equities, which have the potential for much higher returns than traditional saving plans. The average annual returns of well-managed equity funds can range from 12% to 15%, making SIPs one of the best high-yield investment options for 2025.

Why Choose SIPs for 2025?

- High returns: Mutual funds typically generate higher returns than traditional savings plans, especially over the long term.

- Flexible investment amounts: You can invest as little as ₹500 every month, making it accessible to most investors.

- Compounding returns: By investing regularly, your money compounds, leading to more significant returns over time.

SIPs in equity funds are perfect for investors with a long-term horizon who are willing to take on a moderate level of risk.

4. Equity-Linked Savings Scheme (ELSS)

An ELSS (Equity-Linked Savings Scheme) is a type of mutual fund that offers tax-saving benefits under Section 80C of the Income Tax Act. ELSS is considered to be one of the most tax-efficient high-yield plans because it offers exposure to the equity market while providing tax deductions.

Why Choose ELSS for 2025?

- Tax benefits: You can claim deductions up to ₹1.5 lakh under Section 80C.

- Potential for high returns: The returns from ELSS have the potential to range from 12% to 18% annually, depending on market performance.

- Shorter lock-in period: ELSS has a lock-in period of only 3 years, making it more liquid compared to other saving plans.

For those seeking both tax benefits and higher returns, ELSS is a great option.

5. National Pension Scheme (NPS)

The National Pension Scheme (NPS) is a long-term retirement-focused investment plan that allows you to invest in a mix of equity, corporate bonds, and government securities. The returns from NPS can vary, but they have the potential to provide attractive returns in the range of 8% to 10% per annum.

Why Choose NPS for 2025?

- Tax benefits: NPS offers additional tax deductions of up to ₹50,000 under Section 80CCD(1B), over and above the Section 80C limit.

- Long-term wealth creation: It’s a great option for retirement planning, with returns that typically outpace inflation.

- Low fees: NPS has lower management fees compared to other investment options.

If you’re focused on retirement savings and want to build wealth over the long term, NPS is a strong option.

6. Corporate Bonds

Investing in corporate bonds is another way to earn higher returns, especially when compared to government-backed schemes like PPF. Bonds issued by top-rated corporations offer returns in the range of 8% to 10% annually.

Why Choose Corporate Bonds for 2025?

- Higher returns: Corporate bonds typically offer higher returns than FDs or PPF.

- Tax efficiency: Interest earned on bonds can be tax-efficient if they are held in a tax-free bond category.

- Diversification: Adding bonds to your portfolio provides diversification beyond equity-based instruments.

Corporate bonds can be a great addition to your portfolio if you’re looking to earn steady returns with moderate risk.

Conclusion

Choosing the right high-yield saving plan is crucial for building wealth in 2025. By carefully selecting a mix of investment options—such as high-interest FDs, SIPs, PPF, ELSS, NPS, and corporate bonds—you can boost your savings, maximize returns, and ensure a secure financial future.