Tax-free bonds offer investors a unique opportunity to generate steady income while minimizing their tax burden. Understanding how these bonds work and how to strategically invest in them can help you optimize your financial returns. Here’s a breakdown of tax-free bonds, their benefits, and how to leverage them for maximum advantage.

✅ What Are Tax-Free Bonds?

Tax-free bonds are debt instruments issued by government entities, municipal bodies, or public sector organizations. The primary appeal of these bonds is that the interest earned is exempt from federal income tax—and in some cases, state and local taxes.

Common Types of Tax-Free Bonds:

- Municipal Bonds (Munis): Issued by state or local governments.

- Government-Backed Bonds: Issued by federal or state-backed organizations.

- Infrastructure Bonds: Issued for public projects like highways, schools, or hospitals.

📊 Benefits of Investing in Tax-Free Bonds

- Tax Savings: Interest income is not subject to federal tax; certain bonds may also be exempt from state and local taxes.

- Steady Income: Provides a reliable source of fixed income through regular interest payments.

- Low Risk: Backed by government entities, these bonds carry lower credit risk compared to corporate bonds.

- Portfolio Diversification: Adds a conservative, income-generating component to a diversified investment strategy.

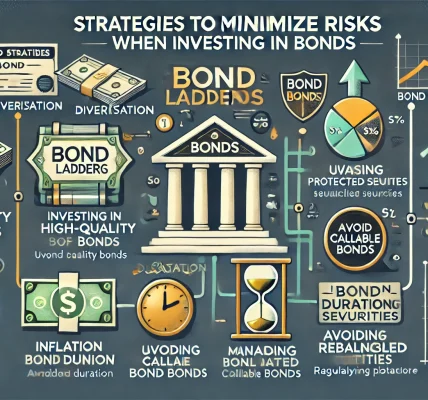

💡 Strategies to Maximize Your Tax-Free Bond Investments

- Invest in State-Issued Bonds: If you live in a high-tax state, prioritize municipal bonds issued by your home state for triple-tax exemption (federal, state, and local).

- Long-Term Holding: Tax-free bonds are ideal for long-term investors seeking predictable income without increasing their tax liability.

- Bond Laddering: Spread investments across bonds with staggered maturity dates to balance liquidity needs while maximizing returns.

- Credit Quality Assessment: Focus on bonds with high credit ratings (AAA or AA) for greater security while balancing yield.

- Tax Bracket Consideration: Investors in higher tax brackets benefit the most from the tax-exempt nature of these bonds.

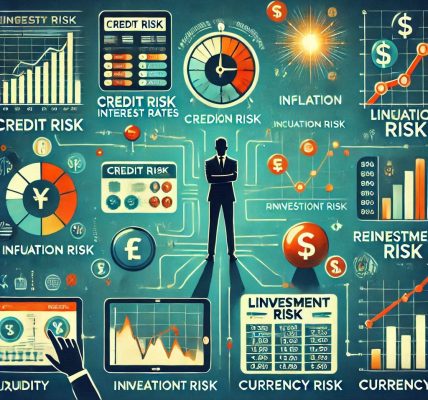

📈 Risks to Consider

- Interest Rate Sensitivity: Bond prices may decline if interest rates rise, affecting the resale value.

- Liquidity Issues: Some municipal bonds may have lower trading volumes, making them harder to sell quickly.

- Credit Risk: While rare, defaults on municipal bonds can occur, especially in financially unstable regions.

🧮 How to Calculate Tax-Equivalent Yield

To compare tax-free bonds with taxable investments, use this formula: Tax-Equivalent Yield=Tax-Free Yield1−Tax Rate\text{Tax-Equivalent Yield} = \frac{\text{Tax-Free Yield}}{1 – \text{Tax Rate}}Tax-Equivalent Yield=1−Tax RateTax-Free Yield

For example, if a tax-free bond offers a 3% yield and your tax rate is 35%: Tax-Equivalent Yield=31−0.35=4.62%\text{Tax-Equivalent Yield} = \frac{3}{1 – 0.35} = 4.62\%Tax-Equivalent Yield=1−0.353=4.62%

This means a taxable bond would need to yield 4.62% to match the tax-free bond’s return.

📌 Is It Right for You?

Tax-free bonds are ideal if you:

- Are in a high tax bracket seeking to minimize tax liability.

- Value safety and predictable income.

- Have a long-term investment horizon.