Stock splits and reverse stock splits are common corporate actions that can impact a company’s share price, investor perception, and overall market sentiment. While stock splits make shares more affordable by increasing the number of shares outstanding, reverse stock splits reduce the number of shares to boost the stock price. Understanding these mechanisms can help investors make informed decisions.

In this article, we’ll cover:

- What is a stock split?

- Why do companies perform stock splits?

- How stock splits impact investors

- What is a reverse stock split?

- Reasons for reverse stock splits

- Effects of reverse stock splits on investors

- Key considerations for investors

1. What is a Stock Split?

A stock split is a corporate action where a company increases the number of its outstanding shares by issuing additional shares to existing shareholders. The stock price is adjusted accordingly so that the company’s overall market capitalization remains the same.

Example of a Stock Split

If a company announces a 2-for-1 stock split, it means each existing share will be split into two. If you owned 100 shares at $200 per share, after the split, you would own 200 shares at $100 each. The total investment value remains unchanged at $20,000.

Common Stock Split Ratios

- 2-for-1 (Each share splits into two)

- 3-for-1 (Each share splits into three)

- 5-for-1 (Each share splits into five)

2. Why Do Companies Perform Stock Splits?

Companies split their stocks for several reasons:

A. Improving Liquidity

Lower share prices make stocks more affordable to retail investors, increasing trading volume and liquidity.

B. Attracting More Investors

A high stock price may deter small investors. A split reduces the price, making shares more accessible.

C. Psychological Impact

Investors often perceive a stock split as a positive signal, believing the company is growing and performing well.

D. Aligning with Market Trends

Many major companies, including Apple, Tesla, and Amazon, have performed stock splits to maintain accessibility and competitiveness in the market.

3. How Stock Splits Impact Investors

Stock splits do not directly affect a company’s fundamentals, but they can impact investors in the following ways:

A. Increased Affordability

Since share prices drop after a split, more investors can purchase shares, potentially increasing demand.

B. Improved Liquidity

With more shares available, trading activity often increases, reducing bid-ask spreads and making it easier to buy and sell shares.

C. No Immediate Impact on Portfolio Value

Although the number of shares increases, the total investment value remains unchanged unless market conditions influence the price.

D. Potential for Future Gains

Historically, many companies that split their stocks have experienced price appreciation due to increased demand.

4. What is a Reverse Stock Split?

A reverse stock split is the opposite of a stock split. It reduces the number of outstanding shares and increases the stock price proportionally.

Example of a Reverse Stock Split

If a company announces a 1-for-5 reverse stock split, it means every 5 shares will be consolidated into 1. If you owned 100 shares at $2 each before the split, you would own 20 shares at $10 each after the split. The total investment value remains unchanged at $200.

Common Reverse Stock Split Ratios

- 1-for-2 (Every two shares combine into one)

- 1-for-5 (Every five shares combine into one)

- 1-for-10 (Every ten shares combine into one)

5. Reasons for Reverse Stock Splits

Companies may perform reverse stock splits for various reasons:

A. Avoiding Delisting

Stocks trading below a minimum price (e.g., $1 per share on NASDAQ) risk being delisted. A reverse split helps maintain compliance with exchange requirements.

B. Enhancing Market Perception

Very low stock prices can signal financial instability. Increasing the stock price through a reverse split may improve investor confidence.

C. Attracting Institutional Investors

Many institutional investors and mutual funds have policies against investing in low-priced stocks. A higher share price can make a company more attractive to institutional investors.

6. Effects of Reverse Stock Splits on Investors

Unlike a regular stock split, a reverse stock split can sometimes be a red flag for investors.

A. No Immediate Change in Investment Value

Although the share count is reduced, the total value of an investor’s holdings remains the same.

B. Potential Negative Market Perception

Reverse splits can signal financial distress, leading to selling pressure and further price declines.

C. Reduced Liquidity

With fewer shares available, trading volume may decrease, making it harder to buy or sell shares at desirable prices.

D. Possible Future Growth

If a reverse split is part of a broader strategy to improve business performance, the stock may recover and appreciate in value over time.

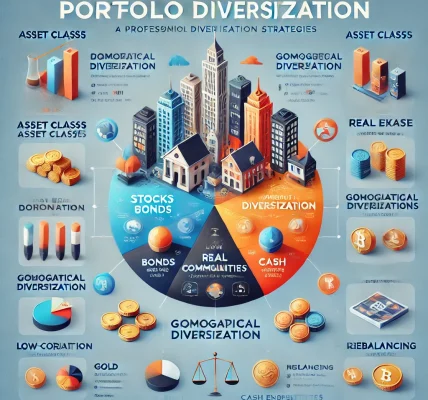

7. Key Considerations for Investors

Before investing in a stock undergoing a split or reverse split, consider the following:

A. Assess the Company’s Fundamentals

- A stock split from a financially strong company is typically a positive sign.

- A reverse stock split in a struggling company may indicate trouble ahead.

B. Monitor Market Reaction

Investor sentiment can influence stock performance post-split. Keep an eye on how the market reacts.

C. Long-Term Growth Potential

A stock split itself does not guarantee future gains. Look at earnings growth, competitive position, and overall industry trends.

D. Understand Tax Implications

Stock splits and reverse splits generally have no tax impact since they do not alter the total value of holdings. However, investors should consult with a tax advisor for specific situations.

Conclusion

Stock splits and reverse stock splits are important corporate actions that can influence stock prices and investor sentiment. While stock splits are often seen as bullish, reverse stock splits may raise concerns. By understanding these mechanisms and analyzing the company’s financial health, investors can make informed decisions about their portfolios.

Key Takeaways:

- Stock splits increase share count and lower price per share, making stocks more accessible and liquid.

- Reverse stock splits reduce share count and raise price per share, often to avoid delisting or improve perception.

- Both actions do not directly change a company’s fundamentals or an investor’s total holdings.

- Investors should evaluate the company’s financial health and market conditions before reacting to stock split news.

By staying informed and conducting due diligence, investors can navigate stock splits and reverse stock splits strategically to maximize their portfolio performance.