Capital gains tax can take a significant chunk out of your investment profits, but with careful planning, you can legally minimize your tax liability. Whether you’re selling stocks, real estate, or other investments, knowing the right strategies can help you keep more of your hard-earned money. In this comprehensive guide, we will explore legal and effective ways to reduce your capital gains tax burden while staying fully compliant with tax laws.

Understanding Capital Gains Tax

Capital gains tax is imposed on the profit made from selling an asset, such as stocks, real estate, or other investments. The amount of tax you owe depends on two main factors:

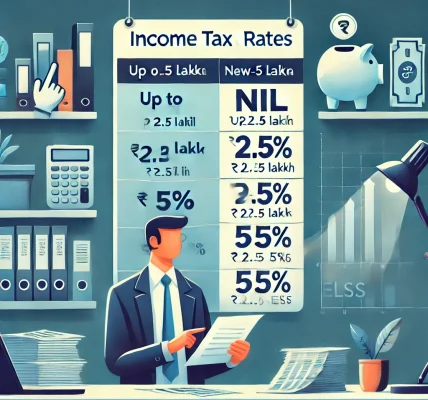

- Short-Term vs. Long-Term Capital Gains

- Short-term capital gains apply to assets held for one year or less and are taxed at your ordinary income tax rate.

- Long-term capital gains apply to assets held for more than one year and are taxed at lower rates, typically ranging from 0% to 20% depending on your income level.

- Capital Gains Tax Rates (2024)

- 0% for individuals with taxable income up to $44,625 (single filers) or $89,250 (married filing jointly).

- 15% for individuals with taxable income between $44,626 and $492,300 (single) or $89,251 and $553,850 (married filing jointly).

- 20% for individuals with taxable income above $492,300 (single) or $553,850 (married filing jointly).

Knowing these rates is crucial for making informed investment decisions and implementing tax-saving strategies.

Legal Strategies to Reduce Capital Gains Tax

1. Hold Investments for More Than One Year

- One of the simplest ways to reduce capital gains tax is to hold assets for more than a year before selling.

- Long-term capital gains tax rates are significantly lower than short-term rates.

- Example: Selling a stock after 13 months instead of 11 months could lower your tax rate from 37% (short-term) to 15% (long-term).

2. Utilize Tax-Loss Harvesting

- Offset capital gains by selling underperforming investments at a loss.

- These losses can be used to reduce taxable capital gains and even offset up to $3,000 of ordinary income per year.

- Unused losses can be carried forward to future years.

3. Make Use of the Primary Residence Exclusion

- If selling a home, you may exclude up to $250,000 ($500,000 for married couples) in capital gains if you have lived in the home for at least two out of the past five years.

- This exclusion applies only to primary residences, not investment properties.

4. Invest in Opportunity Zones

- Opportunity Zones are designated areas that offer tax incentives for investors.

- By reinvesting capital gains into a Qualified Opportunity Fund (QOF), you can defer capital gains taxes and potentially eliminate them if held long enough.

5. Take Advantage of 1031 Exchanges (For Real Estate Investors)

- A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from a property sale into another similar investment property.

- This strategy enables investors to grow their real estate portfolio while postponing tax payments.

6. Gift Assets to Family Members in Lower Tax Brackets

- If you gift investments to family members in lower income brackets, they may qualify for the 0% capital gains tax rate.

- Be mindful of annual gift tax exclusions ($18,000 per recipient in 2024).

7. Contribute to Tax-Advantaged Accounts

- Invest in Roth IRAs, Traditional IRAs, and 401(k)s to defer or eliminate capital gains taxes.

- Roth IRAs allow tax-free withdrawals on qualified investments, avoiding capital gains tax altogether.

- Health Savings Accounts (HSAs) can also grow tax-free if used for medical expenses.

8. Donate Appreciated Assets to Charity

- Donating stocks or other assets directly to a qualified charity can eliminate capital gains tax.

- You may also receive a charitable tax deduction for the fair market value of the asset.

9. Use an Installment Sale Strategy

- Instead of selling an asset all at once, consider an installment sale.

- This allows you to spread the capital gains over multiple years, potentially reducing your overall tax rate.

10. Take Advantage of the Annual Capital Gains Exemption (For Small Business Owners)

- Certain small business stock sales may qualify for an exclusion of up to 100% of capital gains if held for more than five years (Section 1202 of the IRS Code).

- This applies to Qualified Small Business Stock (QSBS) in eligible industries.

Additional Tips to Reduce Capital Gains Tax

1. Keep Track of Investment Expenses

- Brokerage fees, investment advisory fees, and other related expenses may be deductible.

2. Monitor Capital Gains Tax Brackets

- If you’re close to a lower tax bracket, deferring a sale to the next tax year may help you qualify for a reduced tax rate.

3. Diversify Your Portfolio Wisely

- Investing in tax-efficient funds or ETFs can reduce unnecessary capital gains distributions.

4. Consult a Tax Professional

- A Certified Public Accountant (CPA) or financial advisor can help tailor a tax-saving strategy based on your specific situation.

Conclusion

Capital gains tax is a reality for investors, but with careful planning and strategic decision-making, you can significantly reduce your tax liability. From tax-loss harvesting to taking advantage of tax-deferred investment accounts, there are multiple ways to minimize your tax burden while remaining compliant with the law.

By implementing these legal and effective strategies, you can optimize your investment returns and keep more of your hard-earned money. Always consult a tax professional before making major financial decisions to ensure compliance with current tax laws and regulations.