When it comes to managing personal finances, one of the most important distinctions you can make is between short-term and long-term financial goals. While long-term goals like retirement or buying a home often require years of planning, short-term goals—such as saving for a vacation, buying a gadget, or building an emergency fund—require a different approach.

The key to successfully achieving short-term goals is to use the right saving plans. A well-chosen saving plan not only helps you accumulate the money you need but also ensures that you are doing so safely and efficiently without taking excessive risks.

In this blog post, we will explore the best saving plans for short-term financial goals, discuss their benefits, and help you choose the right option based on your needs.

What Are Short-Term Financial Goals?

Short-term financial goals are those objectives you aim to achieve within a relatively short time frame, typically within 1 to 3 years. These goals tend to be more immediate and less complex than long-term goals. Common examples of short-term financial goals include:

- Saving for an emergency fund (usually 3–6 months of expenses)

- Funding a vacation or travel plans

- Purchasing a new gadget, car, or home appliance

- Building a down payment for a house or a car

- Paying off short-term debts or loans

Since these goals require quicker access to your funds and less time to grow, choosing a safe and liquid savings option is essential.

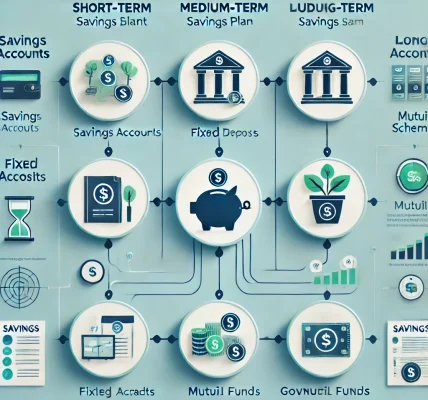

Best Saving Plans for Short-Term Financial Goals

When it comes to saving for short-term goals, it’s important to prioritize liquidity, low risk, and minimal fees. Let’s take a look at some of the best saving plans that can help you achieve your short-term financial goals.

1. High-Interest Savings Accounts

A high-interest savings account is one of the simplest and most accessible options for saving money over a short period. Many banks and financial institutions offer accounts that provide higher interest rates than traditional savings accounts, allowing your savings to grow while still giving you easy access to your funds.

Why choose a high-interest savings account?

- Liquidity: You can withdraw your money anytime without penalties, making it ideal for goals like building an emergency fund.

- Safety: Your savings are generally insured, so you don’t have to worry about losing your money.

- Ease of Access: You can access your savings at any time, making it suitable for short-term goals that require quick access.

2. Fixed Deposits (FD)

A Fixed Deposit (FD) is one of the most popular saving instruments in India for individuals looking for low-risk, predictable returns over a fixed period. In a fixed deposit, you deposit a lump sum amount for a fixed tenure, and the bank pays you interest on that amount. FDs are typically offered with tenures ranging from 7 days to 5 years, making them suitable for short-term goals.

Why choose Fixed Deposits?

- Guaranteed Returns: FDs offer a fixed interest rate, so you know exactly how much you will earn by the end of the tenure.

- Safety: Being a low-risk investment, FDs are safe and backed by the government.

- Short-Term Flexibility: You can choose a tenure that matches your goal’s timeline, such as 1–2 years for short-term goals.

3. Recurring Deposits (RD)

A Recurring Deposit (RD) allows you to contribute a fixed amount every month toward a deposit over a fixed period. This option is perfect for those who may not have a lump sum to invest upfront but want to save consistently toward a short-term goal.

Why choose Recurring Deposits?

- Discipline: RDs help you build a disciplined saving habit by requiring regular monthly contributions.

- Higher Interest Rates: RDs typically offer slightly higher interest rates than savings accounts, helping your savings grow faster.

- Short-Term Commitment: You can select the tenure (usually between 6 months to 2 years) based on your short-term financial needs.

4. Systematic Investment Plans (SIPs) in Debt Funds

While equity investments are typically considered long-term, Systematic Investment Plans (SIPs) in debt mutual funds are an excellent option for short-term goals. SIPs allow you to invest a fixed amount in a mutual fund at regular intervals, spreading the investment risk over time. Debt mutual funds, which invest in safer instruments like bonds and treasury bills, can offer stable returns over a short period.

Why choose SIPs in Debt Funds?

- Higher Returns than Savings Accounts: Debt funds tend to provide higher returns than traditional savings accounts, especially over a 1–2 year horizon.

- Diversification: Investing in a range of debt instruments can reduce risk compared to investing in a single asset.

- Liquidity: While not as immediate as a savings account or FD, you can redeem your investment in debt funds relatively quickly.

5. Liquid Funds

Liquid funds are a type of mutual fund that invests in very short-term instruments like treasury bills, certificates of deposit, and other low-risk, short-term instruments. Liquid funds provide better returns than savings accounts while maintaining high liquidity.

Why choose Liquid Funds?

- High Liquidity: Liquid funds are one of the most liquid investments, allowing you to redeem your units in a day or two.

- Low Risk: These funds invest in safe, short-term instruments, making them ideal for short-term goals.

- Tax Efficiency: Liquid funds are more tax-efficient than traditional savings accounts, especially for investors in higher tax brackets.

6. Government Bonds or Savings Schemes

For those who prefer guaranteed returns but are looking for a little more stability than a fixed deposit, government bonds or savings schemes such as the National Savings Certificate (NSC) or Post Office Monthly Income Scheme (POMIS) can be a good choice. These investments offer fixed returns and are backed by the government, making them a safe option for saving for short-term goals.

Why choose Government Bonds or Savings Schemes?

- Guaranteed Returns: Government-backed instruments offer fixed and secure returns.

- Low Risk: These are considered extremely safe investments as they are backed by the government.

- Tax Benefits: Certain government savings schemes offer tax-saving benefits under Section 80C.

How to Choose the Right Saving Plan for Your Short-Term Goals?

Choosing the best saving plan depends on a few key factors:

- Time Horizon: How long do you need to save? If it’s within a year, a high-interest savings account or a liquid fund might be ideal. For goals within 1-3 years, FDs or RDs are great choices.

- Risk Tolerance: Are you okay with a little risk for potentially higher returns, or do you prefer guaranteed returns? Debt funds or SIPs might be suitable for those willing to take a little risk, while FDs or savings accounts are for those who prefer safety.

- Liquidity Needs: Do you need easy access to your funds, or are you comfortable locking in your money for a period? Savings accounts and liquid funds offer high liquidity, while FDs and NSC offer lower liquidity.

Conclusion

Short-term financial goals are essential to your overall financial planning. Whether you’re saving for a vacation, emergency fund, or a new purchase, choosing the right saving plan can help you achieve those goals with ease. By opting for safe, liquid, and low-risk saving plans like high-interest savings accounts, FDs, RDs, or debt funds, you can accumulate the funds you need in a disciplined and effective way.