As a parent, your first priority is ensuring the well-being and future of your family. From meeting day-to-day expenses to securing your children’s education and your own retirement, the responsibilities can feel overwhelming. One of the most effective ways to manage these financial responsibilities and build a secure future for your loved ones is by adopting a structured saving plan.

In this blog, we will guide you through various saving plans that can help parents plan for a secure financial future. Whether you are saving for your children’s education, buying a home, or preparing for retirement, these saving plans will provide you with the tools to achieve financial stability and independence.

Why Is It Important for Parents to Have a Saving Plan?

Parents face unique financial challenges. Not only do you have to support your family now, but you also have to plan for future expenses such as:

- Children’s education

- Healthcare costs

- Retirement

- Homeownership

- Emergency funds

Without a clear financial plan, these goals can feel unattainable. That’s why a saving plan tailored to your family’s needs is essential. It helps ensure that you’re financially prepared for both expected and unexpected expenses, creating peace of mind and stability for your family.

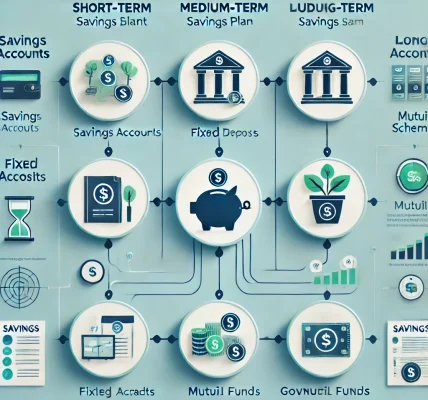

Types of Saving Plans Parents Should Consider

1. Child Education Plans

One of the most important financial goals for parents is ensuring that their children have access to quality education. The cost of education is rising rapidly, and saving for your child’s future education can prevent you from relying on loans or debt.

Education savings plans are designed to help you invest over time, and they typically offer attractive tax benefits. Some popular options include:

- Public Provident Fund (PPF): A government-backed investment offering tax-free returns and a long-term lock-in period, which is ideal for long-term education planning.

- Child Plans: Special insurance or investment plans designed for your child’s education, which usually include a combination of life insurance and investment.

- SIPs (Systematic Investment Plans): If you’re comfortable with equity investments, SIPs can help generate higher returns over time, which can fund your child’s education.

2. Retirement Plans

While planning for your child’s future, it’s equally important to plan for your own retirement. Many parents focus so much on their children’s needs that they forget to secure their own financial future.

A retirement saving plan will ensure that you have enough funds to support yourself once you stop working. Here are a few options:

- National Pension System (NPS): This government-backed plan offers tax benefits and is a great tool to build your retirement corpus.

- Employee Provident Fund (EPF): If you’re employed, EPF contributions are automatically deducted from your salary, making it a hassle-free way to save for retirement.

- PPF: Besides education, PPF can also serve as a long-term retirement savings option due to its tax-free interest and flexibility.

3. Emergency Fund

As a parent, you never know when an unexpected situation may arise, whether it’s a medical emergency, a sudden job loss, or an urgent repair at home. That’s why building an emergency fund is crucial. Ideally, your emergency fund should cover 3 to 6 months’ worth of living expenses.

You can start by setting aside a portion of your monthly income into a high-interest savings account, short-term fixed deposits, or liquid funds, which provide safety, liquidity, and decent returns.

Tip: Automate your savings into your emergency fund to ensure consistency and avoid dipping into it for non-urgent expenses.

4. Life Insurance Plans

Life insurance is a must-have saving plan for parents, as it provides a financial safety net for your family in case something happens to you. This is particularly important if you are the primary breadwinner.

Term life insurance plans are an affordable option for providing financial security to your family in the event of your untimely demise. Make sure the sum insured is adequate to cover your family’s living expenses, children’s education, and any outstanding debts.

5. Tax-Saving Investments

In addition to building savings for future expenses, it’s important to ensure that your wealth grows in a tax-efficient manner. Tax-saving instruments like ELSS (Equity Linked Saving Schemes), National Savings Certificates (NSC), and 5-Year Fixed Deposit can help you save on taxes while providing long-term returns.

These investments are especially useful for parents who are looking to reduce their tax liability while simultaneously growing their savings.

Tips for Building a Saving Plan That Works for You

1. Set Clear Financial Goals

Before you begin saving, sit down with your partner and define your financial goals. For example:

- How much money do you need to save for your child’s education?

- What is the amount you need for retirement?

- How much should be kept aside for emergencies?

Once you know your goals, create a roadmap to achieve them.

2. Budget Wisely and Track Your Spending

Create a family budget and track your income and expenses. Categorize your spending and make sure that saving for your goals is a priority. Regularly track your spending and make adjustments where necessary. For instance, if you’re spending too much on entertainment, consider cutting back to allocate more to savings.

3. Start Early and Be Consistent

The earlier you start saving for your family’s future, the easier it will be to achieve your goals. Time is your biggest ally when it comes to building wealth. Whether it’s contributing to a child education fund or investing for your retirement, consistent saving will allow your investments to grow over time.

4. Review and Adjust Your Plan Regularly

Your financial situation and goals may change as your family grows. It’s important to review your saving plan regularly to ensure it’s still aligned with your current needs. For example, if your income increases, consider upping your contribution to your child’s education fund or retirement savings.

Conclusion

Building a secure future for your family requires thoughtful planning and disciplined saving. As parents, you’re already juggling many responsibilities, but taking the time to set up effective saving plans can ensure that your children have access to quality education, you have enough funds to retire comfortably, and your family is protected in case of unexpected events.