Introduction

When it comes to investing, two of the most popular options are mutual funds and the stock market. Both offer the potential for wealth creation, but they come with different risks, rewards, and investment strategies. Choosing between them depends on your financial goals, risk tolerance, and investment knowledge.

This blog provides an in-depth comparison of mutual funds and direct stock market investments to help you decide where to invest your money for maximum benefits.

What is a Mutual Fund?

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. A fund manager makes investment decisions on behalf of investors, aiming to generate returns based on the fund’s objective.

Key Features of Mutual Funds

- Diversification: Invests in a mix of securities, reducing risk.

- Professional Management: Fund managers handle investment decisions.

- Liquidity: Easy to buy and sell units.

- Variety of Options: Equity, debt, hybrid, and tax-saving funds available.

- Regulated by SEBI: Ensures transparency and investor protection.

What is Stock Market Investing?

Stock market investing involves buying and selling shares of publicly traded companies. Investors directly own stocks and have control over their portfolio. Returns depend on stock price movements and company performance.

Key Features of Stock Market Investing

- Direct Ownership: Investors buy shares of individual companies.

- High Return Potential: Can generate significant returns if chosen wisely.

- Volatility: Stock prices fluctuate daily.

- Requires Market Knowledge: Investors must analyze companies and industries.

- No Fund Manager: Investors make their own decisions.

Mutual Fund vs. Stock Market: Key Comparisons

1. Risk and Volatility

- Mutual Funds: Lower risk due to diversification; fund managers mitigate risks by balancing the portfolio.

- Stock Market: Higher risk as stock prices are volatile; requires active monitoring and analysis.

2. Returns Potential

- Mutual Funds: Moderate to high returns depending on the fund type (equity funds may offer high returns, while debt funds provide stable returns).

- Stock Market: Potentially higher returns, but also comes with higher risks.

3. Investment Knowledge Required

- Mutual Funds: Ideal for beginners; fund managers handle investments.

- Stock Market: Requires expertise in stock analysis, market trends, and company financials.

4. Management and Control

- Mutual Funds: Managed by professionals; limited investor control.

- Stock Market: Investors have full control over buying and selling stocks.

5. Diversification

- Mutual Funds: Highly diversified, spreading risk across multiple assets.

- Stock Market: Investors may need to build their own diversified portfolio, which requires experience.

6. Liquidity

- Mutual Funds: Open-ended funds offer high liquidity; some funds may have a lock-in period (e.g., ELSS tax-saving funds).

- Stock Market: Highly liquid; stocks can be bought and sold anytime during market hours.

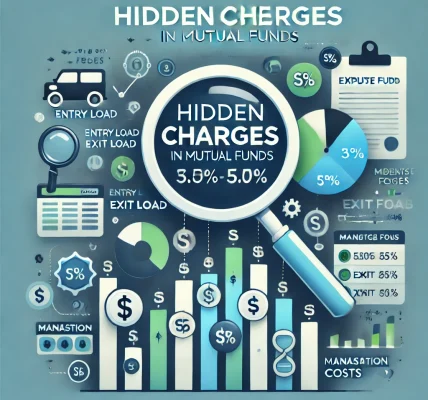

7. Tax Implications

- Mutual Funds:

- Equity funds held for more than a year attract a 10% LTCG (Long-Term Capital Gains) tax if gains exceed ₹1 lakh.

- Debt funds have different tax structures depending on holding period.

- Stock Market:

- Short-term capital gains (STCG) tax of 15% applies if stocks are sold within a year.

- LTCG tax of 10% applies to gains exceeding ₹1 lakh if stocks are held for more than a year.

8. Time and Effort

- Mutual Funds: Less time-consuming; fund managers handle investments.

- Stock Market: Requires active monitoring and research.

Who Should Invest in Mutual Funds?

Mutual funds are suitable for:

- Beginners: Those with limited market knowledge.

- Long-Term Investors: Ideal for wealth creation over time.

- Busy Professionals: Investors who prefer a hands-off approach.

- Risk-Averse Investors: Those seeking stable returns with lower risk.

Who Should Invest in the Stock Market?

Stock market investing is ideal for:

- Experienced Investors: Those with strong market knowledge.

- Aggressive Investors: People willing to take high risks for potentially higher rewards.

- Active Traders: Individuals who can monitor the market regularly.

- Long-Term Growth Seekers: Those investing in strong companies for long-term gains.

Mutual Funds vs. Stock Market: Which One is Right for You?

| Factor | Mutual Funds | Stock Market |

|---|---|---|

| Risk Level | Moderate to Low | High |

| Return Potential | Moderate to High | High |

| Management | Professional Fund Manager | Self-Managed |

| Knowledge Required | Minimal | High |

| Liquidity | High | Very High |

| Diversification | Yes | No (unless built manually) |

| Time Commitment | Low | High |

| Tax Benefits | ELSS funds offer tax savings | LTCG and STCG taxes apply |

Conclusion

Both mutual funds and the stock market have their pros and cons. Mutual funds are ideal for those looking for professional management, diversification, and relatively lower risk, while direct stock market investment is suitable for experienced investors who can actively manage their portfolio.

If you are a beginner or prefer a hands-off approach, mutual funds are the better choice. However, if you have the expertise and can handle market fluctuations, direct stock investment may offer better returns. The right investment option depends on your risk tolerance, financial goals, and investment knowledge.

Always conduct thorough research, assess your risk appetite, and consult a financial advisor if needed before making investment decisions. Happy investing!