Tax planning is an essential aspect of financial management, and Equity-Linked Savings Schemes (ELSS) offer a great way to save taxes while also earning substantial returns. ELSS funds are a type of mutual fund that not only provide tax benefits under Section 80C of the Income Tax Act but also have the potential for high growth due to their equity exposure.

In this article, we will explore the best ELSS funds for maximum returns, their benefits, risks, and strategies to maximize your investment.

What is an ELSS Fund?

An Equity-Linked Savings Scheme (ELSS) is a diversified equity mutual fund with a mandatory lock-in period of 3 years. Investments in ELSS are eligible for tax deductions of up to ₹1.5 lakh per year under Section 80C of the Income Tax Act. Since these funds invest primarily in equities, they offer the dual advantage of tax saving and wealth creation.

Key Features of ELSS Funds:

✅ Tax Benefits: Deduction under Section 80C (up to ₹1.5 lakh) ✅ Short Lock-in Period: 3 years (lowest among tax-saving instruments) ✅ High Return Potential: Exposure to equity markets ✅ Flexibility: Option to invest via SIP or lump sum ✅ No Upper Limit on Investment: But tax exemption is limited to ₹1.5 lakh

Benefits of Investing in ELSS Funds

1. Tax Savings

By investing in ELSS, you can reduce your taxable income, thereby lowering your overall tax liability.

2. Shortest Lock-in Period

Compared to other tax-saving options like PPF (15 years) and NSC (5 years), ELSS has the shortest lock-in period of 3 years.

3. Higher Returns Compared to Other Tax-Saving Instruments

Since ELSS invests primarily in equities, it has the potential to generate higher returns than traditional tax-saving options like fixed deposits and PPF.

4. Systematic Investment Option (SIP)

You can invest in ELSS funds via Systematic Investment Plans (SIP), making it easier to invest small amounts regularly and reduce market risk.

5. Capital Gains Tax Benefits

After the lock-in period, gains above ₹1 lakh per year are subject to Long-Term Capital Gains (LTCG) tax at 10%, which is relatively low compared to short-term gains.

Best ELSS Funds for Maximum Returns

Here are some of the top-performing ELSS funds based on historical returns, consistency, and portfolio quality:

1. Mirae Asset Tax Saver Fund

- 5-Year Return: ~16% CAGR

- Expense Ratio: ~0.5%

- AUM: ₹14,000+ crore

- Why Choose It? Consistent performer, low expense ratio, and well-diversified portfolio.

2. Axis Long Term Equity Fund

- 5-Year Return: ~14% CAGR

- Expense Ratio: ~0.7%

- AUM: ₹30,000+ crore

- Why Choose It? Focuses on quality stocks, suitable for long-term wealth creation.

3. Quant Tax Plan

- 5-Year Return: ~18% CAGR

- Expense Ratio: ~0.8%

- AUM: ₹3,500+ crore

- Why Choose It? Aggressive strategy, high alpha generation, good for high-risk investors.

4. Canara Robeco Equity Tax Saver Fund

- 5-Year Return: ~15% CAGR

- Expense Ratio: ~0.6%

- AUM: ₹8,000+ crore

- Why Choose It? Stability and lower volatility compared to peers.

5. DSP Tax Saver Fund

- 5-Year Return: ~14% CAGR

- Expense Ratio: ~0.7%

- AUM: ₹12,000+ crore

- Why Choose It? Strong mid-cap exposure, good for long-term investors.

How to Choose the Right ELSS Fund?

When selecting an ELSS fund, consider the following factors:

1. Past Performance

Look for funds with consistent returns over the last 5-10 years rather than just recent performance.

2. Expense Ratio

A lower expense ratio ensures more of your money is invested rather than spent on fees.

3. Fund Manager’s Track Record

A skilled fund manager with a proven track record is crucial for superior performance.

4. Portfolio Allocation

Diversified funds with a mix of large, mid, and small-cap stocks tend to offer balanced growth.

5. AUM (Assets Under Management)

A fund with excessively high AUM may face challenges in agility and performance.

SIP vs. Lump Sum: Which is Better for ELSS?

Investing via SIP:

✅ Reduces market risk through rupee-cost averaging. ✅ Ideal for salaried individuals with a monthly income. ✅ Helps in disciplined investing.

Investing via Lump Sum:

✅ Suitable for investors with surplus funds. ✅ Works well if markets are low at the time of investment. ✅ Lock-in period ends simultaneously for the entire amount.

Best Strategy: SIP is recommended for new investors, while lump sum can be considered during market corrections.

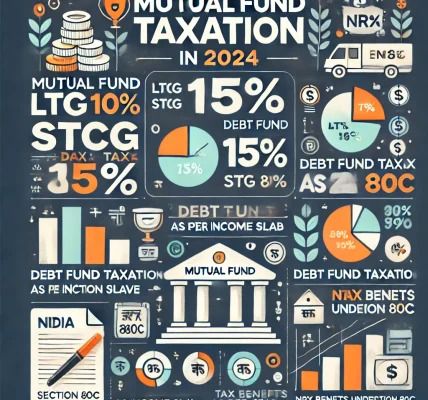

Taxation on ELSS Funds

- Investment Limit for Tax Deduction: ₹1.5 lakh per year under Section 80C

- Lock-in Period: 3 years (mandatory)

- Tax on Gains:

- LTCG (above ₹1 lakh): 10%

- LTCG (up to ₹1 lakh): Exempt from tax

- No tax benefits on withdrawals after 3 years

Common Mistakes to Avoid While Investing in ELSS

🚫 Investing without checking past performance and fund consistency. 🚫 Choosing funds based solely on highest returns without risk assessment. 🚫 Not aligning ELSS investments with long-term financial goals. 🚫 Withdrawing immediately after 3 years without considering market conditions. 🚫 Ignoring the expense ratio, which affects overall returns.

Final Thoughts: Is ELSS the Best Tax-Saving Investment?

ELSS funds are one of the best tax-saving investment options due to their combination of tax benefits, short lock-in period, and high return potential. However, since they are market-linked, investors should have a long-term perspective and be prepared for fluctuations.

Who Should Invest in ELSS?

✔️ Salaried individuals looking for tax-saving options ✔️ Long-term investors willing to take moderate to high risk ✔️ Young professionals starting their investment journey ✔️ Investors who prefer market-linked returns over fixed-income options

By choosing the right ELSS fund and investing systematically, you can maximize tax savings while building wealth for the future. Start investing today and take advantage of the dual benefits of tax saving and capital growth! 🚀

Disclaimer: Mutual fund investments are subject to market risks. Please read the scheme-related documents carefully before investing.