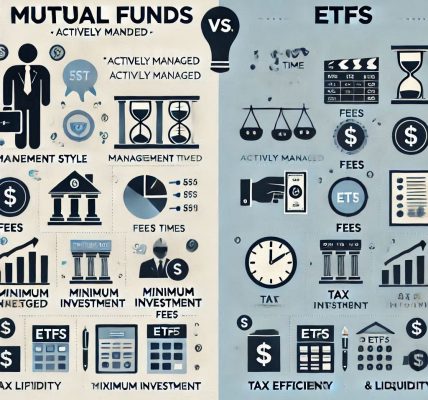

Investing in mutual funds has long been a preferred choice for individuals looking to grow their wealth over time. When selecting a mutual fund, investors are often faced with a crucial decision: Should they opt for an index fund or an actively managed mutual fund? Both have their advantages and disadvantages, and the right choice depends on an investor’s financial goals, risk appetite, and investment horizon.

In this comprehensive guide, we will explore the pros and cons of index funds and actively managed mutual funds to help you make an informed decision.

What Are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500, NIFTY 50, or Sensex. These funds invest in the same securities as the index they track, maintaining the same weightage to ensure similar returns.

Key Characteristics of Index Funds:

- Passively Managed: No active fund manager making investment decisions.

- Lower Expense Ratio: Minimal costs due to passive management.

- Market-Linked Returns: Returns mirror the performance of the underlying index.

What Are Actively Managed Mutual Funds?

Actively managed mutual funds involve a team of professional fund managers who actively buy and sell securities to outperform a benchmark index. These funds rely on research, market trends, and investment strategies to generate higher returns.

Key Characteristics of Actively Managed Funds:

- Fund Managers in Control: Investment decisions are actively made by experts.

- Higher Expense Ratio: Management fees and other costs are higher due to active involvement.

- Potential for Higher Returns: Aiming to beat market returns through research and expertise.

Pros and Cons of Index Funds vs. Actively Managed Funds

1. Performance & Returns

📈 Index Funds: Typically deliver returns that are in line with the market. Since they track an index, they do not aim to outperform but offer stable and predictable growth.

📊 Actively Managed Funds: Have the potential to generate higher returns than the market through expert management, but they also come with greater risks.

✔ Winner: Actively Managed Funds (if the fund manager makes the right decisions).

2. Cost & Expense Ratio

💰 Index Funds: Have a lower expense ratio (0.1% – 0.5%) as they do not require active management.

💸 Actively Managed Funds: Charge higher fees (1% – 2.5% expense ratio) due to fund management, research, and transaction costs.

✔ Winner: Index Funds (lower costs mean higher take-home returns).

3. Risk Factor

⚖️ Index Funds: Offer lower risk since they are diversified across the market and do not rely on a manager’s decisions.

🔥 Actively Managed Funds: Have higher risk because they rely on market predictions and fund managers’ decisions.

✔ Winner: Index Funds (for risk-averse investors).

4. Investment Strategy

🎯 Index Funds: Follow a passive investment strategy, meaning they do not react to short-term market fluctuations.

📉 Actively Managed Funds: Employ a dynamic strategy, frequently adjusting the portfolio based on market trends.

✔ Winner: Actively Managed Funds (for investors seeking high returns through market timing).

5. Transparency & Simplicity

📄 Index Funds: Highly transparent since investors know exactly which stocks the fund holds.

🔎 Actively Managed Funds: Less transparent as fund managers constantly adjust the portfolio.

✔ Winner: Index Funds (simpler and easier to track).

6. Long-Term vs. Short-Term Benefits

🕰 Index Funds: Ideal for long-term investors who seek stable growth over decades.

⚡ Actively Managed Funds: Suitable for investors with a short-term, high-risk approach aiming for quicker gains.

✔ Winner: Index Funds (for long-term investing), Actively Managed Funds (for short-term traders).

Which One Should You Choose?

| Factor | Index Funds | Actively Managed Funds |

|---|---|---|

| Returns Potential | Moderate | High (but not guaranteed) |

| Risk Level | Low | High |

| Expense Ratio | Low | High |

| Investment Style | Passive | Active |

| Transparency | High | Medium |

| Best for | Long-term investors | Active traders with high risk tolerance |

Final Verdict: Who Should Invest in What?

✅ Choose Index Funds if:

- You want low-cost, long-term stable growth.

- You prefer a low-risk, diversified investment approach.

- You do not want to actively monitor your investments.

✅ Choose Actively Managed Funds if:

- You are comfortable with higher risks for potential high returns.

- You believe in expert fund management to outperform the market.

- You are actively engaged in monitoring your investments.

Conclusion

Both Index Funds and Actively Managed Mutual Funds have their strengths and weaknesses. The right choice depends on your investment goals, risk tolerance, and cost considerations. If you want steady, long-term growth with low costs, index funds are ideal. However, if you are willing to take higher risks for potentially better returns, actively managed funds might be the way to go.

Before making any investment, it is crucial to assess your financial goals, investment horizon, and risk appetite. A well-balanced portfolio may include both types of funds, offering the best of both worlds.

Happy investing! 🚀📈