In the world of fixed-income investing, understanding the relationship between interest rates and bond prices is crucial. Whether you’re a seasoned investor or just beginning your journey, knowing how interest rate changes affect your bond investments can help you make informed decisions and manage risks effectively.

This comprehensive guide will explore how interest rates impact bond prices, why this relationship exists, and what investors should consider to optimize their bond portfolios.

Understanding the Basics: What Are Bonds?

A bond is a fixed-income instrument that represents a loan from an investor to a borrower (typically a government or corporation). In exchange, the issuer pays periodic interest (coupon payments) and returns the principal amount at maturity.

Key Bond Characteristics:

- Face Value: The amount the bondholder receives at maturity.

- Coupon Rate: The fixed annual interest rate paid on the bond’s face value.

- Maturity Date: The date when the bond’s principal is repaid.

- Market Price: The price at which the bond is bought or sold in the secondary market.

The Inverse Relationship Between Interest Rates and Bond Prices

The price of bonds moves inversely to interest rates. When interest rates rise, bond prices fall. Conversely, when interest rates decline, bond prices increase. This inverse relationship is fundamental to bond market dynamics.

Why Do Bond Prices Fall When Interest Rates Rise?

When new bonds are issued with higher interest rates, existing bonds with lower rates become less attractive. As a result, their market price must decrease to offer a comparable yield to new investors.

Example: If you hold a bond with a 4% coupon and new bonds offer 6%, your bond becomes less valuable because investors can earn more elsewhere.

Key Factors Affecting the Sensitivity of Bond Prices

1. Duration

Duration measures a bond’s sensitivity to interest rate changes. Bonds with a longer duration experience greater price fluctuations when interest rates change.

- Short-term bonds: Less sensitive to interest rate changes.

- Long-term bonds: More sensitive to interest rate changes.

2. Coupon Rate

Bonds with higher coupon rates are less affected by interest rate fluctuations because they provide more frequent cash flows.

- High-coupon bonds: Less price volatility.

- Low-coupon bonds: Greater price volatility.

3. Market Environment

The broader economic environment and central bank policies can significantly impact interest rates and bond markets. For example, when inflation rises, central banks often increase interest rates to control it.

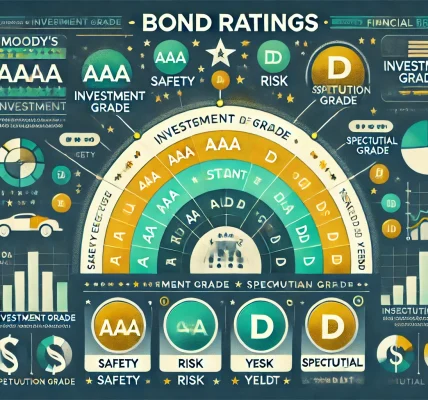

How Different Types of Bonds React to Interest Rate Changes

1. Government Bonds

Generally considered safer, but sensitive to rate changes. Longer-term government bonds exhibit greater price swings.

2. Corporate Bonds

Higher yields may cushion against rising rates, but riskier corporate bonds are also subject to credit risk.

3. Municipal Bonds

Often offer tax advantages but react similarly to government bonds in terms of price movements.

4. Floating Rate Bonds

Less sensitive to rate changes as their interest payments adjust with market rates.

Strategies to Manage Interest Rate Risk

1. Diversify Your Bond Portfolio

Hold a mix of short, medium, and long-term bonds to balance risk and returns.

2. Laddering Strategy

Invest in bonds with staggered maturities. This approach helps manage reinvestment risk and provides flexibility as rates change.

Example: Buy bonds maturing in 2, 4, and 6 years. As each matures, reinvest in new bonds at prevailing rates.

3. Invest in Floating Rate Bonds

These bonds adjust their coupon payments with market rates, offering protection against rising interest rates.

4. Consider Bond Funds or ETFs

Bond funds diversify across various bonds and maturities, reducing the impact of rate changes on individual holdings.

How Rising and Falling Rates Impact Bond Investors

1. When Interest Rates Rise

- Bond Prices Drop: Existing bonds lose value as new bonds offer higher yields.

- Opportunity for Higher Yields: New bonds provide better income potential.

- Reinvestment Advantage: Maturing bonds can be reinvested at higher rates.

2. When Interest Rates Fall

- Bond Prices Increase: Existing bonds with higher coupons become more valuable.

- Lower Yield on New Bonds: Future investments offer lower income potential.

- Prepayment Risk: Issuers may redeem callable bonds early to refinance at lower rates.

Practical Considerations for Bond Investors

1. Understand Your Investment Goals

Align bond investments with your financial objectives, whether seeking income, preserving capital, or diversifying a portfolio.

2. Monitor Interest Rate Trends

Keep track of economic indicators, central bank policies, and inflation trends to anticipate rate movements.

3. Balance Risk and Return

Evaluate the trade-offs between higher yields and interest rate sensitivity when constructing a bond portfolio.

Conclusion

Interest rates play a pivotal role in shaping bond prices and overall investment returns. By understanding the inverse relationship between bond prices and interest rates, you can make informed decisions to manage risk and optimize your portfolio.

Diversifying across maturities, considering floating-rate instruments, and staying informed about economic trends are practical strategies to navigate interest rate fluctuations. As an investor, being proactive and adaptable will position you to succeed in the ever-changing bond market.