Introduction

Market volatility is often seen as a risk, but for smart investors, it presents a great opportunity to maximize profits. Understanding how to navigate market fluctuations and implement effective strategies can help investors achieve financial success. In this blog, we will explore the key strategies to profit from market volatility while ensuring risk management and compliance with financial regulations.

Understanding Market Volatility

Market volatility refers to the rate at which the price of a financial asset increases or decreases over a given period. It is usually measured using the Volatility Index (VIX), also known as the “Fear Index.” Volatility is driven by various factors such as economic data, geopolitical events, corporate earnings reports, and investor sentiment.

While high volatility can cause sharp price swings, it also creates opportunities for traders and investors to buy undervalued assets or use advanced trading strategies to gain an edge in the market.

Key Strategies to Profit from Market Volatility

1. Buy the Dips and Sell the Rallies

A common and effective strategy in volatile markets is to buy stocks or assets when their prices drop significantly (buying the dip) and sell them when they rally back up. This approach is particularly useful for long-term investors who believe in the fundamentals of a stock but want to take advantage of short-term price swings.

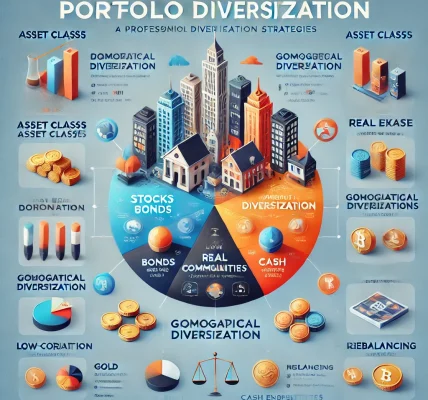

2. Diversification: Reduce Risk Exposure

Diversifying a portfolio across various asset classes, sectors, and geographical regions can help reduce the impact of volatility. A well-diversified portfolio ensures that losses in one sector are balanced by gains in another.

- Stocks: Mix large-cap, mid-cap, and small-cap stocks

- Bonds: Consider government and corporate bonds for stability

- Commodities: Invest in gold, silver, and oil as hedges against uncertainty

- Real Estate: Physical or REIT investments can provide stable returns

3. Options Trading: Hedging Against Volatility

Options trading is a powerful tool that allows investors to hedge against potential losses or profit from volatility. Some popular options strategies include:

- Covered Calls: Selling call options on stocks you own to generate income

- Protective Puts: Buying put options to protect against downside risk

- Straddles and Strangles: Buying both call and put options to profit from significant price movements

4. Utilizing Stop-Loss and Take-Profit Orders

To manage risk effectively in a volatile market, traders should use stop-loss and take-profit orders:

- Stop-Loss Order: Automatically sells a stock when it reaches a predetermined price, preventing excessive losses.

- Take-Profit Order: Locks in profits by selling a stock once it reaches a target price.

This approach ensures disciplined trading and removes emotions from investment decisions.

5. Investing in Volatility ETFs

Volatility exchange-traded funds (ETFs) track market volatility indices and can be used to hedge portfolios. Some popular ETFs include:

- VXX (iPath Series B S&P 500 VIX Short-Term Futures ETN)

- UVXY (ProShares Ultra VIX Short-Term Futures ETF)

- SVXY (ProShares Short VIX Short-Term Futures ETF)

These instruments are primarily for advanced traders and should be used cautiously due to their high-risk nature.

6. Keeping an Eye on Economic Indicators

Market volatility is often triggered by macroeconomic factors. Investors should monitor key economic indicators such as:

- GDP Growth

- Inflation Rates

- Federal Reserve Interest Rate Decisions

- Unemployment Data

- Corporate Earnings Reports

By staying informed, investors can make educated decisions and anticipate market trends.

7. Long-Term Perspective and Dollar-Cost Averaging (DCA)

For long-term investors, market volatility can be an opportunity rather than a threat. The Dollar-Cost Averaging (DCA) strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps reduce the impact of short-term market fluctuations and builds wealth over time.

Risk Management and Legal Considerations

To ensure compliance with financial regulations and avoid potential legal issues, investors should:

- Understand Securities Laws: Follow regulations set by the Securities and Exchange Commission (SEC) and other financial regulatory bodies.

- Avoid Market Manipulation: Engaging in practices such as insider trading, spreading false information, or artificially inflating stock prices is illegal.

- Consult Financial Advisors: Seek professional guidance when making complex investment decisions.

- Use Risk-Management Strategies: Never invest more than you can afford to lose, and always have a risk-mitigation plan in place.

Conclusion

Market volatility presents both risks and opportunities for investors. By implementing smart investment strategies such as buying the dips, diversification, options trading, and using stop-loss orders, investors can turn market fluctuations to their advantage. However, risk management and compliance with legal guidelines are crucial to ensure sustainable and ethical investing.

By staying informed, disciplined, and strategic, investors can profit from market volatility and build a resilient investment portfolio for the future.

Are you ready to navigate the volatility and make the most of market fluctuations? Start by educating yourself, using the right strategies, and staying disciplined in your investment approach!