Tax-saving mutual funds, also known as Equity Linked Savings Schemes (ELSS), are one of the most popular investment options in India. They provide dual benefits: tax savings under Section 80C of the Income Tax Act and the potential for wealth creation over the long term. In this blog, we’ll explore how you can maximize your returns with ELSS funds while making the most of their tax-saving advantages.

What Are ELSS Funds?

ELSS funds are diversified equity mutual funds that invest primarily in stocks across various sectors and market capitalizations. They come with a lock-in period of three years, the shortest among all tax-saving options under Section 80C, making them an attractive choice for investors.

Why Should You Invest in ELSS?

1. Tax Benefits

Investments of up to ₹1.5 lakh in ELSS funds are eligible for tax deductions under Section 80C, reducing your taxable income.

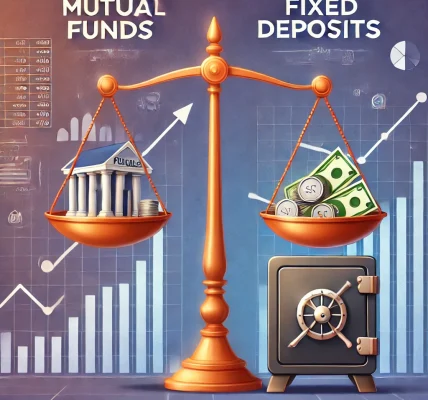

2. Potential for Higher Returns

Since ELSS funds invest in equities, they have the potential to deliver higher returns compared to traditional tax-saving instruments like PPF or NSC.

3. Shortest Lock-In Period

With a lock-in period of just three years, ELSS offers more liquidity than other 80C options.

4. Wealth Creation

By investing in equity markets, ELSS funds help you grow your wealth over the long term, leveraging the power of compounding.

How to Maximize Returns with ELSS Funds

1. Start Early

The earlier you start investing in ELSS, the longer you stay invested, giving your money more time to grow through compounding.

2. Invest via SIPs

Systematic Investment Plans (SIPs) allow you to invest small amounts regularly, making it easier to manage your finances while benefiting from rupee cost averaging.

3. Diversify Across Funds

Don’t put all your money into a single ELSS fund. Diversify across different funds to reduce risk and optimize returns.

4. Choose Funds with Strong Track Records

Research funds that have consistently outperformed their benchmarks over the long term. Look for funds managed by experienced fund managers.

5. Stay Invested Beyond the Lock-In Period

While the lock-in period is three years, staying invested for a longer duration can help you reap the full benefits of equity investments.

ELSS vs. Other Tax-Saving Options

| Feature | ELSS | PPF | NSC |

|---|---|---|---|

| Lock-In Period | 3 Years | 15 Years | 5 Years |

| Returns | Market-Linked (10-12%) | Fixed (~7%) | Fixed (~7%) |

| Risk | High (Equity Exposure) | Low (Government-Backed) | Low (Government-Backed) |

| Tax Treatment | EEE | EEE | EEE |

Factors to Consider Before Investing in ELSS

1. Risk Appetite

ELSS funds are subject to market risks. Ensure you’re comfortable with the volatility associated with equity investments.

2. Investment Horizon

While the lock-in period is three years, equity investments typically yield better returns over 5-7 years or more.

3. Fund Performance

Analyze the past performance, expense ratio, and portfolio composition of the ELSS fund before investing.

Benefits of Investing in ELSS Funds

1. High Growth Potential

ELSS funds have the potential to deliver inflation-beating returns due to their exposure to equity markets.

2. Dual Benefits

You save taxes while simultaneously building wealth.

3. Automatic Discipline

The lock-in period ensures you remain invested, preventing premature withdrawals.

Common Mistakes to Avoid

1. Focusing Solely on Tax Savings

Don’t choose an ELSS fund based solely on its tax-saving benefit. Consider its performance and suitability for your goals.

2. Investing a Lump Sum at Year-End

Instead of making a lump sum investment at the end of the financial year, start SIPs early to benefit from averaging and disciplined investing.

3. Ignoring the Lock-In Period

Remember that your funds will be locked for three years. Plan your finances accordingly.

Conclusion

Equity Linked Savings Schemes (ELSS) are a smart choice for tax-saving and wealth creation. By starting early, investing systematically, and staying disciplined, you can maximize your returns while enjoying tax benefits. Make ELSS a part of your financial strategy to secure your future.