Introduction

Investing in international mutual funds is a great way to diversify your portfolio and gain exposure to global markets. With economies across the world growing at different rates, international funds allow investors to benefit from opportunities outside their home country. However, before diving into global investments, it is crucial to understand how international mutual funds work, their benefits, risks, and the best strategies for investing in them.

In this article, we will explore everything you need to know about investing in international mutual funds and how to make the most of global market opportunities.

1. What Are International Mutual Funds?

International mutual funds are investment vehicles that pool money from multiple investors and invest in stocks, bonds, or other securities in foreign markets. These funds can focus on a specific country, a region, or a broader global market excluding the investor’s home country.

Types of International Mutual Funds:

- Global Funds – Invest in both domestic and international markets.

- Regional Funds – Focus on specific geographic regions such as Asia, Europe, or Latin America.

- Country-Specific Funds – Invest in a single country’s stock market.

- Emerging Market Funds – Focus on developing economies with high growth potential.

- Sector-Specific International Funds – Invest in industries like technology, healthcare, or energy across multiple countries.

2. Benefits of Investing in International Mutual Funds

1. Portfolio Diversification

Investing in international funds reduces dependency on a single economy, lowering overall risk and improving long-term returns.

2. Exposure to High-Growth Markets

Many emerging markets grow faster than developed economies, providing opportunities for higher returns.

3. Currency Diversification

Holding assets in different currencies can protect against inflation and currency depreciation in the home country.

4. Access to Leading Global Companies

International funds allow investment in world-class companies like Apple, Amazon, Alibaba, or Nestlé that may not be available in domestic stock markets.

3. Risks of Investing in International Mutual Funds

1. Currency Risk

Fluctuations in foreign exchange rates can impact returns, leading to potential losses if the home currency strengthens against foreign currencies.

2. Political and Economic Risks

Political instability, regulatory changes, and economic downturns in foreign countries can affect market performance.

3. Market Volatility

Global markets may be affected by geopolitical events, trade wars, and global economic conditions, leading to unpredictable performance.

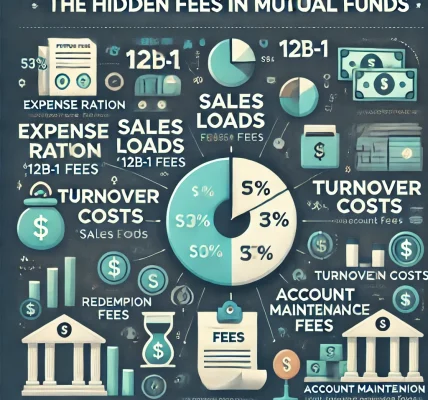

4. Higher Expense Ratios

International funds may have higher expense ratios due to transaction costs, fund management fees, and foreign market complexities.

4. How to Invest in International Mutual Funds

Step 1: Determine Your Investment Goals

Define your objectives – are you looking for long-term growth, income generation, or hedging against domestic market downturns?

Step 2: Choose the Right Type of International Fund

Select funds based on your risk appetite and investment strategy. For aggressive growth, emerging market funds may be suitable, while regional or developed market funds can be more stable.

Step 3: Research and Compare Funds

- Check past performance, expense ratios, and fund manager expertise.

- Analyze risk factors and diversification benefits.

- Compare funds using platforms like Morningstar, Value Research, or fund house websites.

Step 4: Consider Tax Implications

International funds may have different tax treatments in your home country. Check capital gains tax, dividend tax, and tax treaties between countries.

Step 5: Invest Through a Reliable Platform

Invest via:

- Direct Mutual Fund Houses – Best for lower expense ratios.

- Brokerage Firms & Financial Advisors – Offer guidance and portfolio management.

- Online Investment Platforms – Convenient for tracking and managing international investments.

Step 6: Monitor Your Investment

Regularly review fund performance, economic trends, and global market conditions to make informed decisions.

5. Key Factors to Consider Before Investing

1. Expense Ratio & Fees

Higher expenses can eat into your profits. Compare different funds to find cost-effective options.

2. Fund Manager’s Track Record

A skilled fund manager can navigate complex international markets better.

3. Market Conditions & Economic Trends

Investing in growing economies or sectors with strong future potential can yield higher returns.

4. Investment Horizon

International funds are best suited for long-term investments to mitigate short-term volatility.

6. Conclusion

Investing in international mutual funds is an excellent way to diversify your portfolio, gain exposure to global markets, and capitalize on economic growth in different regions. While these funds come with risks such as currency fluctuations and geopolitical uncertainties, a well-researched and strategic approach can help maximize returns.

Key Takeaways:

✅ International mutual funds offer diversification and global market access. ✅ Consider risks like currency volatility, political instability, and higher expenses. ✅ Choose funds based on your investment goals, risk tolerance, and research. ✅ Monitor global economic trends and review your portfolio periodically.

By understanding the fundamentals and investing wisely, you can take advantage of global opportunities and enhance your financial growth.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a professional financial advisor before making investment decisions.