Introduction: Investing in foreign government bonds can be an excellent way to diversify your portfolio and gain exposure to different economies. These bonds offer a stable source of income while spreading investment risk across various countries. In this guide, we will walk you through everything you need to know about investing in foreign government bonds, including their benefits, risks, and how to get started.

What Are Foreign Government Bonds? Foreign government bonds are debt securities issued by foreign governments to raise funds. When you invest in these bonds, you are essentially lending money to the government of a foreign country in exchange for interest payments (coupons) over a set period. Upon maturity, the principal amount is returned to you.

Unlike domestic bonds, foreign government bonds are influenced by various factors, including international politics, currency exchange rates, and global economic conditions. This makes them an attractive option for investors looking to expand their portfolios internationally.

Why Should You Invest in Foreign Government Bonds?

- Diversification: One of the key reasons to invest in foreign government bonds is diversification. By holding bonds from different countries, you can spread your risk across multiple economies. This reduces the impact of domestic economic downturns on your portfolio.

- Stable Income Streams: Foreign government bonds often pay regular interest payments, which can provide a reliable source of passive income. Many stable economies offer bonds with attractive yields, making them an appealing option for income-focused investors.

- Currency Exposure: Investing in foreign bonds gives you exposure to different currencies. This can be advantageous if the foreign currency strengthens relative to your home currency, potentially leading to higher returns.

- Access to High-Quality Issuers: Foreign government bonds from developed countries, such as the U.S., Germany, or Japan, are typically considered low-risk due to the financial stability of these governments. This makes them an excellent choice for risk-averse investors.

Types of Foreign Government Bonds: Foreign government bonds come in various types, and understanding these can help you make informed investment decisions. Here are some of the most common types:

- Sovereign Bonds: Sovereign bonds are issued by national governments and are considered some of the safest investments. Examples include U.S. Treasury Bonds, German Bunds, and UK Gilts. These bonds are often highly liquid and have lower yields compared to bonds from developing countries.

- Emerging Market Bonds: These bonds are issued by governments in developing countries. While they offer higher yields, they come with increased risk due to economic instability, political uncertainty, and currency fluctuations. However, for risk-tolerant investors, emerging market bonds can offer substantial returns.

- Euro-denominated Bonds: Issued by governments of countries in the Eurozone, these bonds are denominated in euros. They provide exposure to European markets, with the added benefit of currency diversification.

- Inflation-Protected Bonds: Some foreign government bonds are inflation-protected, meaning their principal and interest payments are adjusted based on inflation rates. These bonds can help protect your investment from the eroding effects of inflation.

How to Invest in Foreign Government Bonds: Investing in foreign government bonds may seem complex, but it can be broken down into manageable steps. Here’s a guide to help you get started:

- Determine Your Investment Objectives: Before investing in foreign government bonds, you need to determine your investment goals. Are you looking for income, capital appreciation, or diversification? Understanding your risk tolerance and financial objectives will help you choose the right bonds.

- Research Foreign Bond Markets: The next step is to research the foreign bond markets. Pay attention to factors like interest rates, economic conditions, and political stability. Countries with stable economies and low inflation, such as the U.S., Germany, or Switzerland, are generally safer bets. For higher returns, consider emerging markets, but be aware of the added risks.

- Choose the Right Bonds: Select the bonds that best align with your investment goals. You can invest in sovereign bonds, inflation-protected bonds, or even bonds issued by foreign corporations. Look at the bond’s yield, maturity date, credit rating, and the issuing country’s economic outlook.

- Open an International Brokerage Account: To invest in foreign government bonds, you’ll need to open an international brokerage account that allows you to trade bonds in foreign markets. Many major brokerage firms offer access to foreign markets, but it’s essential to check if they provide bonds from the specific countries you’re interested in.

- Monitor Currency Exchange Rates: Since foreign government bonds are usually denominated in the local currency, fluctuations in exchange rates can impact your returns. A favorable exchange rate can enhance your returns, while an unfavorable one can reduce them. Keep an eye on currency trends and consider hedging strategies if needed.

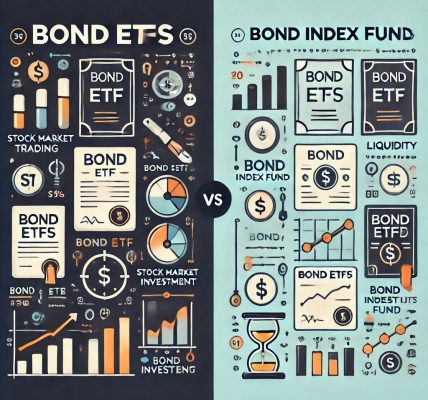

- Consider Bond Funds or ETFs: If you’re hesitant about investing in individual foreign bonds, you can opt for bond funds or exchange-traded funds (ETFs). These funds pool money from multiple investors and invest in a diversified portfolio of foreign government bonds. Bond funds and ETFs provide exposure to foreign bonds while reducing the risks associated with individual investments.

Benefits and Risks of Investing in Foreign Government Bonds:

Benefits:

- Global Diversification: Investing in foreign government bonds allows you to diversify your portfolio across different regions, reducing your exposure to the risks of a single economy.

- Stable Income: Foreign government bonds can provide regular interest payments, making them a reliable source of passive income.

- Currency Diversification: By investing in bonds denominated in foreign currencies, you can gain exposure to currency movements, which can be advantageous if the foreign currency strengthens.

Risks:

- Currency Risk: Since foreign bonds are often denominated in the local currency, fluctuations in currency exchange rates can affect your returns.

- Political and Economic Risk: Bonds from foreign governments, especially from emerging markets, can be subject to political instability, economic downturns, or changes in government policies, which can impact your investment.

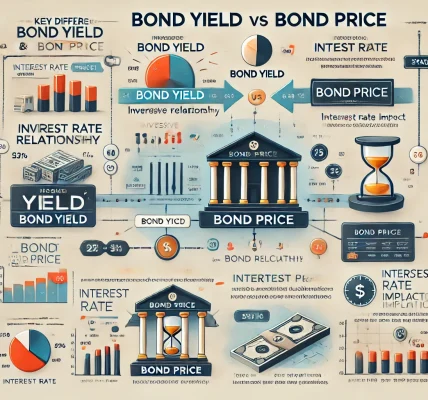

- Interest Rate Risk: Foreign bonds are subject to interest rate changes in their respective countries. Rising interest rates can cause bond prices to fall, impacting your investment.

Conclusion: Investing in foreign government bonds can be a great way to diversify your portfolio, generate passive income, and access opportunities in different economies. However, it’s important to carefully research and understand the risks involved, including currency fluctuations and political stability. By following the steps outlined in this guide, you can confidently begin your investment journey in foreign government bonds.