Introduction

Investing in bonds can be one of the most effective ways to generate a steady income while balancing risk in your investment portfolio. Unlike stocks, which can be volatile and unpredictable, bonds are a relatively stable investment that offers regular interest payments, known as coupon payments, throughout their life. Whether you’re an experienced investor or new to the world of investing, bonds can provide the income stability you need for long-term financial security.

In this blog, we’ll explore how to invest in bonds for steady income, what to consider when choosing bonds, and the best strategies to maximize returns while minimizing risk.

What Are Bonds and How Do They Work?

A bond is essentially a loan that you, the investor, make to an issuer—typically a government, municipality, or corporation. In return, the issuer agrees to pay you interest on the principal amount of the loan over a set period of time, usually at regular intervals. At the end of the bond’s term (called maturity), the issuer repays the face value of the bond.

There are many different types of bonds, but they all work on the same basic principle: the investor provides capital, and in return, they receive regular income payments.

Benefits of Investing in Bonds for Steady Income

- Predictable Income Stream

- One of the primary reasons investors turn to bonds is the ability to receive a steady, predictable stream of income. Bonds typically pay interest at fixed intervals, such as quarterly or annually. This makes bonds an attractive option for those looking to supplement their income, especially retirees or conservative investors who prefer stability over growth.

- Capital Preservation

- Bonds are generally considered less risky than stocks because they tend to be more stable in price. Government bonds, in particular, are backed by the full faith and credit of the issuing country, making them a low-risk option for income-focused investors. For more security, you can focus on high-quality, investment-grade bonds that offer lower yields but come with greater protection for your principal.

- Diversification

- Bonds are an essential component of a diversified investment portfolio. Including bonds in your portfolio can help reduce overall risk, as bonds often behave differently than stocks in various market conditions. During periods of stock market volatility, bonds may perform better, providing a cushion to your overall portfolio performance.

- Tax Benefits

- Some bonds, particularly municipal bonds, offer tax advantages. For instance, interest income from municipal bonds is often exempt from federal income tax and, in some cases, state and local taxes. This can be especially beneficial for investors in higher tax brackets looking to reduce their taxable income.

Types of Bonds to Consider for Steady Income

- Government Bonds

- U.S. Treasury Bonds, notes, and bills are some of the safest and most popular bonds available. These bonds are backed by the U.S. government, so they carry very little risk. The returns on government bonds tend to be lower than those of corporate bonds, but they provide stability and security, making them an ideal choice for income-focused investors.

- Municipal Bonds

- Issued by local governments or municipalities, municipal bonds can offer attractive tax advantages, particularly if you’re in a high tax bracket. They typically pay lower yields than corporate bonds but offer a relatively low risk. Municipal bonds are often used by investors who want a steady income stream while minimizing their tax liabilities.

- Corporate Bonds

- Corporate bonds are issued by companies to raise capital. These bonds generally offer higher yields than government or municipal bonds because they carry a higher level of risk. The risk level depends on the financial health of the issuing company. Investment-grade corporate bonds (issued by financially stable companies) offer a balance between risk and return and are a popular choice for income investors.

- High-Yield Bonds (Junk Bonds)

- High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings. These bonds offer much higher interest rates compared to investment-grade bonds, but they also come with higher risk. Investors who are willing to take on more risk in exchange for potentially higher returns may find high-yield bonds attractive.

- Bond Funds and ETFs

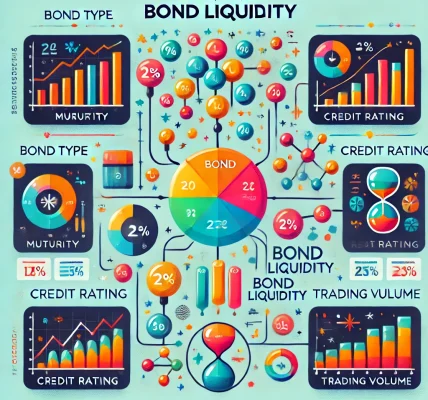

- If you want exposure to a diversified basket of bonds without purchasing individual bonds, bond funds or exchange-traded funds (ETFs) can be an excellent option. These funds pool investors’ money to buy a portfolio of bonds, which provides automatic diversification. Bond funds and ETFs also offer liquidity and ease of access compared to individual bonds, as they can be bought and sold on the stock exchange.

Steps to Invest in Bonds for Steady Income

- Assess Your Investment Goals

- Before investing in bonds, it’s important to determine your investment goals. Are you looking for a steady income stream, or are you more focused on preserving capital? Understanding your financial objectives will help guide your bond investment strategy.

- Determine Your Risk Tolerance

- Bonds come in different levels of risk, from safe government bonds to higher-risk corporate or high-yield bonds. Assess your risk tolerance to determine the types of bonds that suit your investment style. If you’re risk-averse, government bonds or investment-grade corporate bonds might be the best fit.

- Choose the Right Type of Bonds

- Based on your goals and risk tolerance, choose bonds that align with your needs. Government bonds are suitable for low-risk investors, while municipal bonds offer tax advantages. Corporate bonds and high-yield bonds provide higher returns but come with more risk.

- Diversify Your Bond Portfolio

- Diversification is key to minimizing risk. Invest in bonds from different sectors, maturities, and credit ratings. A mix of government, municipal, and corporate bonds can provide a well-rounded bond portfolio that balances risk and return.

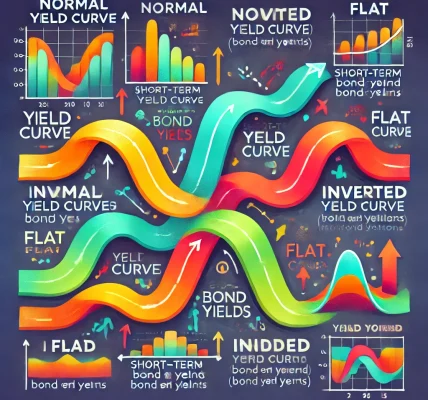

- Monitor Interest Rates

- Bond prices are inversely related to interest rates. As interest rates rise, bond prices tend to fall, and vice versa. Keeping an eye on interest rate trends is crucial to understanding how they may impact your bond investments and their income potential.

- Reinvest Interest Payments

- To grow your investment over time, consider reinvesting the interest payments from your bonds. This will allow you to take advantage of compound interest, which can significantly increase your income in the long run.

Risks to Consider When Investing in Bonds

- Interest Rate Risk

- When interest rates rise, bond prices fall, and this can negatively affect the value of your bond holdings. Long-term bonds are particularly sensitive to interest rate changes, so be aware of this risk when investing in bonds.

- Credit Risk

- If the issuer of the bond defaults or faces financial difficulty, you may lose part or all of your investment. To mitigate this risk, focus on investment-grade bonds issued by financially stable companies or governments.

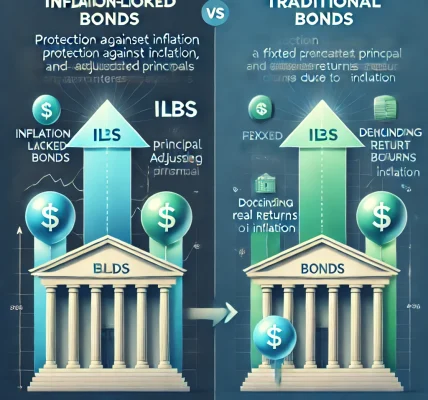

- Inflation Risk

- Inflation can erode the purchasing power of the income generated from bonds. Bonds that offer fixed interest payments may be less attractive during periods of high inflation, especially if the coupon rate is low.

Conclusion

Investing in bonds for steady income is an excellent strategy for those seeking stability and regular cash flow in their portfolios. By carefully selecting the right bonds and diversifying your holdings, you can minimize risk while ensuring a reliable income stream. Whether you’re looking to supplement your retirement income, protect your capital, or reduce overall portfolio volatility, bonds can be a valuable addition to your investment strategy.