Introduction

Investing in real estate can be highly rewarding, but choosing the right location is crucial for maximizing returns. High-growth areas offer strong appreciation potential, increasing rental yields, and long-term stability.

This guide will help you identify high-growth locations for property investment and provide actionable insights to make informed decisions.

1. Understanding High-Growth Locations

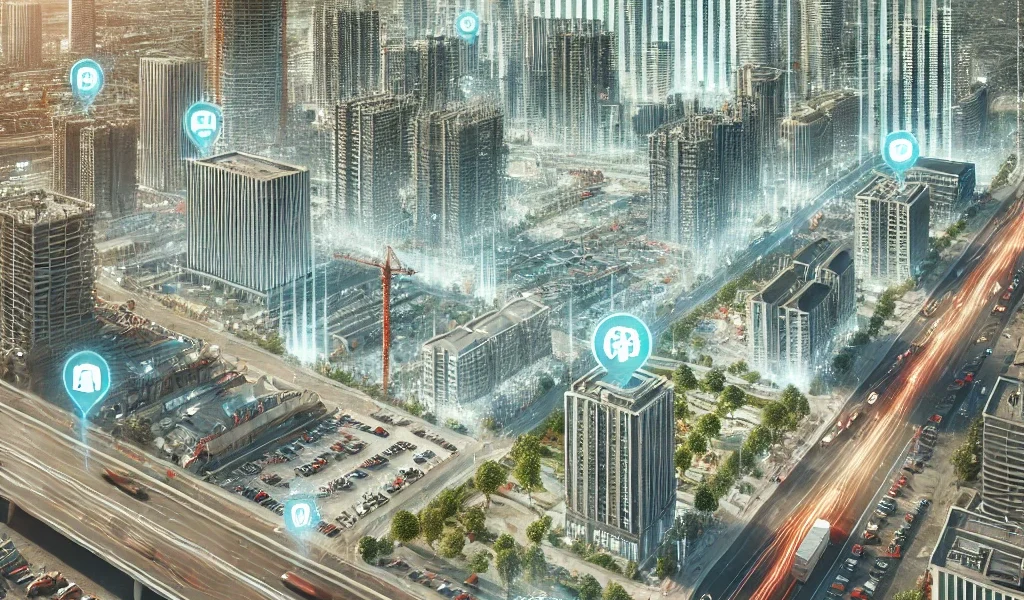

A high-growth location is an area experiencing rapid development, economic expansion, and population growth. These regions often see rising property values, increasing rental demand, and strong investor interest.

Key Characteristics:

- Economic Growth: Strong job market and business expansion

- Infrastructure Development: Improved transportation, roads, and public facilities

- Population Growth: Influx of new residents due to employment or lifestyle appeal

- Real Estate Demand: Rising property values and rental income potential

2. Key Factors to Identify High-Growth Locations

2.1 Economic Indicators

A thriving economy directly impacts real estate growth. Look for:

- Employment Rate: Low unemployment and new job opportunities attract residents.

- Business Expansion: Presence of large corporations, tech hubs, or industrial zones.

- GDP Growth: A rising economy typically supports real estate development.

2.2 Infrastructure Development

Infrastructure projects significantly boost property demand. Watch for:

- New Highways & Roads: Better connectivity improves property desirability.

- Public Transport Expansion: Metro, train, or bus network improvements attract commuters.

- Smart City Initiatives: Adoption of modern infrastructure enhances living standards.

2.3 Population Growth & Demographics

Areas with increasing populations indicate long-term demand.

- Urban Migration: Young professionals and families relocating to growing cities.

- College Towns & Universities: Steady rental demand from students and faculty.

- Retirement Destinations: Rising popularity of locations with senior-friendly amenities.

2.4 Real Estate Trends & Price Movements

- Steady Appreciation: Locations with consistent price growth over the years.

- Low Vacancy Rates: Indicates high rental demand and stable occupancy.

- Affordability Index: Emerging areas with lower property prices but high growth potential.

2.5 Government Policies & Incentives

- Tax Benefits: Property tax reductions, rebates, or incentives for investors.

- Zoning Laws: Commercial or residential expansion regulations.

- Development Grants: Government investments in infrastructure or housing projects.

3. Tools & Methods to Research High-Growth Areas

3.1 Online Real Estate Portals

- Zillow, Realtor, Redfin: Track price trends and rental yields.

- Local MLS Data: Get insights into property listings and demand.

3.2 Economic & Population Reports

- Census Data: Identify population growth and migration patterns.

- Bureau of Labor Statistics: Check employment rates and job market strength.

3.3 Local News & Government Websites

- Look for infrastructure projects, new business openings, and policy changes.

3.4 Networking & Real Estate Forums

- Join investor groups and forums like BiggerPockets.

- Attend local property investment seminars and market analysis events.

4. Case Studies of High-Growth Locations

4.1 Austin, Texas (Tech & Startups Boom)

- Increased tech company presence (Apple, Tesla, Google)

- Strong job market and rental demand

- Expanding public transport and infrastructure

4.2 Charlotte, North Carolina (Finance & Banking Hub)

- Growing financial industry with major banks

- Population influx due to job opportunities

- Affordable housing compared to other metro cities

4.3 Phoenix, Arizona (Affordable Housing & Migration)

- Significant migration from high-cost states like California

- Increasing property values due to demand

- Emerging real estate hotspots with planned developments

5. Investment Strategies for High-Growth Locations

5.1 Buy & Hold Strategy

- Invest in properties with high appreciation potential.

- Focus on rental income to generate steady cash flow.

5.2 Short-Term Rentals & Airbnb

- High-tourism areas offer excellent short-term rental yields.

- Ensure compliance with local Airbnb and rental regulations.

5.3 Fix & Flip in Emerging Areas

- Buy undervalued properties, renovate, and sell for profit.

- Research market demand and buyer preferences.

5.4 Real Estate Crowdfunding

- Invest in high-growth markets with minimal capital.

- Diversify risks across multiple property types.

Conclusion

Identifying high-growth locations for property investment requires research, market analysis, and an understanding of key economic factors. By focusing on infrastructure development, population growth, and economic stability, investors can maximize returns and build a successful real estate portfolio.