Market volatility is an inevitable part of investing. It can be triggered by economic uncertainty, geopolitical tensions, changes in interest rates, or unforeseen global events. While volatility can present opportunities, it also increases risk and uncertainty for investors. One effective strategy to protect your portfolio against market swings is to use bonds as a hedge.

In this comprehensive guide, we will explore how bonds can act as a buffer during volatile market conditions, the best types of bonds for hedging, and practical strategies to safeguard your investments while maintaining steady returns.

Understanding Market Volatility and Its Impact on Investments

Market volatility refers to the degree of variation in the price of financial instruments over time. When volatility increases, the stock market experiences sharp price swings, which can lead to significant gains or losses.

Causes of Market Volatility:

- Economic Data: Reports on GDP, employment, and inflation can influence market sentiment.

- Geopolitical Events: Wars, elections, or trade disputes can increase uncertainty.

- Interest Rate Changes: Central bank policies affect borrowing costs and asset valuations.

- Investor Sentiment: Fear and speculation can drive unpredictable market behavior.

Why Bonds Are an Effective Hedge Against Volatility

Bonds are traditionally considered safe-haven assets during times of market turmoil. This is because they offer regular income, capital preservation, and lower correlation with equities.

Key Reasons Bonds Hedge Against Volatility:

- Capital Preservation: Bonds typically return the principal amount upon maturity, offering security for investors.

- Fixed Income: Regular coupon payments provide consistent cash flow, irrespective of market conditions.

- Inverse Relationship with Stocks: When equities fall, bond prices often rise as investors seek safer assets.

- Lower Volatility: Bonds are less susceptible to sharp price fluctuations compared to stocks.

Types of Bonds for Hedging Market Volatility

Not all bonds offer the same level of protection during volatile periods. The following categories are particularly effective in mitigating risks:

1. Government Bonds

- U.S. Treasury Bonds: Considered the safest form of investment due to government backing.

- Municipal Bonds: Issued by local governments and often offer tax advantages.

Why They Work:

- Low default risk.

- Highly liquid and easy to trade.

- Prices tend to rise during market downturns.

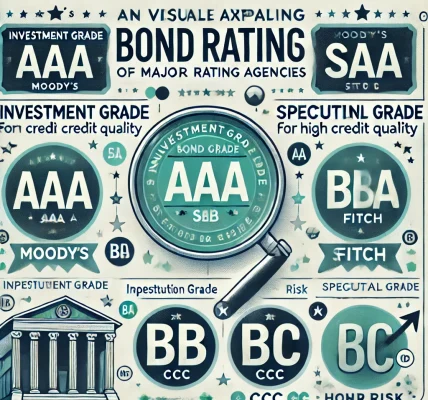

2. Investment-Grade Corporate Bonds

Issued by financially strong corporations with a high credit rating (AAA to BBB).

Why They Work:

- Offer higher yields than government bonds.

- Lower risk of default compared to high-yield bonds.

3. Inflation-Protected Bonds (TIPS)

Treasury Inflation-Protected Securities (TIPS) are designed to combat inflation.

Why They Work:

- Principal value adjusts with inflation.

- Provide a hedge against rising consumer prices and purchasing power erosion.

4. Bond ETFs and Mutual Funds

Diversified funds that hold a variety of bonds across sectors and durations.

Why They Work:

- Provide broad exposure and liquidity.

- Suitable for small investors seeking easy access to bond markets.

How to Use Bonds to Hedge Against Market Volatility

1. Diversify Across Bond Types

A well-balanced bond portfolio should include a mix of government, corporate, and inflation-linked bonds to maximize protection.

Example Allocation:

- 40% U.S. Treasury Bonds (Safety)

- 30% Investment-Grade Corporate Bonds (Yield)

- 20% TIPS (Inflation Protection)

- 10% Bond ETFs (Diversification)

2. Adjust Bond Duration

Duration measures a bond’s sensitivity to interest rate changes:

- Short Duration Bonds: Less sensitive to rate changes; suitable when rates are rising.

- Long Duration Bonds: More sensitive; perform better when rates fall.

Tip: Maintain a mix of short and medium-term bonds for flexibility during volatile periods.

3. Ladder Your Bond Portfolio

Bond laddering involves purchasing bonds with staggered maturity dates to spread risk over time.

Why It Works:

- Reduces reinvestment risk.

- Ensures regular access to capital as bonds mature.

Example: Buy bonds maturing in 1, 3, 5, and 7 years.

4. Consider High-Quality Bonds During Market Stress

Prioritize AAA-rated and government-backed bonds during turbulent times to ensure capital protection.

Why It Works:

- Lower risk of default.

- Increased demand during market downturns boosts bond prices.

5. Use Bond ETFs for Liquidity

Bond ETFs offer instant diversification and are easier to buy and sell than individual bonds.

Why It Works:

- Low cost and transparent pricing.

- Suitable for dynamic asset allocation.

Risks of Using Bonds to Hedge Volatility

While bonds are generally safer, they are not risk-free. Consider the following factors:

1. Interest Rate Risk:

When interest rates rise, bond prices fall. Long-duration bonds are particularly vulnerable.

2. Inflation Risk:

Rising inflation erodes the purchasing power of fixed bond payments. TIPS mitigate this risk.

3. Credit Risk:

Corporate bonds carry the risk of issuer default. Stick to high-quality bonds during volatile periods.

4. Liquidity Risk:

Some bonds (especially municipals) can be difficult to sell quickly without incurring losses.

Legal Disclaimer and Compliance Considerations

Important Disclaimer: “This article is for informational purposes only and does not constitute financial or investment advice. Investors should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.”

Ensure that you understand the legal implications of using bonds as a hedge and comply with all local investment regulations.

Conclusion: Protecting Your Portfolio with Bonds

Hedging against market volatility is crucial for preserving capital and ensuring long-term financial stability. Bonds, with their steady income and risk-mitigating properties, are a powerful tool for achieving this goal.

By diversifying across bond types, adjusting durations, and using strategies like bond laddering, investors can build resilient portfolios capable of weathering market storms. Always assess your risk tolerance and stay informed about changing economic conditions to make the most effective hedging decisions.