Investing in bonds can provide a steady income stream and a relatively lower-risk investment compared to stocks. However, not all bonds are created equal—some carry more risk than others. Bond ratings are crucial tools for investors to assess the creditworthiness of a bond issuer and the likelihood of receiving regular interest payments and principal repayment. In this guide, we will explore how to evaluate bond ratings, understand their significance, and make informed investment decisions.

What Are Bond Ratings?

Bond ratings are assessments provided by independent credit rating agencies that evaluate the financial strength of bond issuers and their ability to meet debt obligations. These ratings help investors gauge the credit risk associated with a particular bond.

Three major credit rating agencies dominate the global bond market:

- Standard & Poor’s (S&P)

- Moody’s Investors Service

- Fitch Ratings

Each agency uses its unique grading scale to indicate the creditworthiness of a bond. Generally, higher-rated bonds carry lower risk and provide lower yields, while lower-rated bonds offer higher yields to compensate for greater risk.

Understanding Bond Rating Scales

1. S&P and Fitch Rating Scale

| Rating | Category | Risk Level |

|---|---|---|

| AAA | Prime | Lowest Risk |

| AA+, AA, AA- | High Grade | Very Low Risk |

| A+, A, A- | Upper Medium Grade | Low Risk |

| BBB+, BBB, BBB- | Lower Medium Grade | Moderate Risk |

| BB+, BB, BB- | Non-Investment Grade (Junk Bonds) | Higher Risk |

| B+, B, B- | Highly Speculative | Significant Risk |

| CCC, CC, C | Substantial Risk | Very High Risk |

| D | Default | In Default |

2. Moody’s Rating Scale

| Rating | Category | Risk Level |

| Aaa | Prime | Lowest Risk |

| Aa1, Aa2, Aa3 | High Grade | Very Low Risk |

| A1, A2, A3 | Upper Medium Grade | Low Risk |

| Baa1, Baa2, Baa3 | Lower Medium Grade | Moderate Risk |

| Ba1, Ba2, Ba3 | Non-Investment Grade (Junk Bonds) | Higher Risk |

| B1, B2, B3 | Highly Speculative | Significant Risk |

| Caa, Ca | Substantial Risk | Very High Risk |

| C | Default | In Default |

Why Are Bond Ratings Important?

Bond ratings serve as a critical measure of the issuer’s financial stability and help investors in the following ways:

- Risk Assessment: Helps evaluate the likelihood of receiving interest and principal payments.

- Investment Decision-Making: Guides investors to choose bonds aligned with their risk tolerance.

- Portfolio Diversification: Facilitates balancing low-risk and high-risk investments.

- Market Pricing: Affects bond yields—lower-rated bonds generally offer higher returns.

Factors Considered in Bond Ratings

Credit rating agencies evaluate multiple factors when assigning bond ratings, including:

- Financial Health: Examines the issuer’s cash flow, revenue stability, and debt levels.

- Economic Environment: Analyzes how external factors, like interest rate changes and economic cycles, may affect the issuer.

- Issuer’s History: Considers the issuer’s track record of repaying debts and managing financial obligations.

- Industry Conditions: Evaluates the specific industry’s stability and competitive landscape.

How to Evaluate Bond Ratings as an Investor

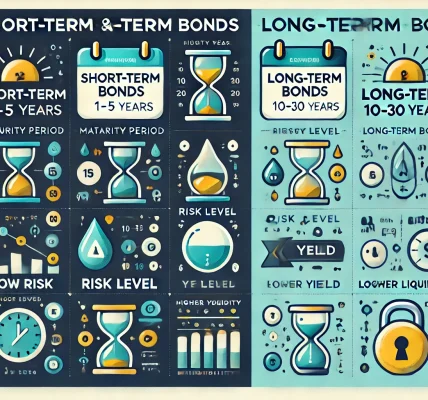

1. Understand Your Risk Tolerance

Different investors have different comfort levels with risk. High-rated bonds (AAA, AA) are ideal for conservative investors seeking security, while lower-rated bonds (BB, B) may appeal to aggressive investors willing to accept more risk for potentially higher returns.

2. Analyze the Issuer’s Creditworthiness

Review the bond issuer’s financial statements, business model, and market position. Strong companies or governments are more likely to maintain their creditworthiness over time.

3. Compare Bond Yields

Higher-rated bonds generally offer lower yields because of their stability. Lower-rated bonds, such as high-yield (junk) bonds, offer better returns but come with increased risk.

4. Monitor Rating Changes

Bond ratings are not static. Agencies regularly review and may upgrade or downgrade ratings based on changes in an issuer’s financial health. Monitor these changes to adjust your investment strategy as needed.

5. Diversify Your Bond Portfolio

Spread your investment across different types of bonds (government, corporate, municipal) and rating categories to reduce overall portfolio risk.

Types of Bonds Based on Credit Quality

- Investment-Grade Bonds: Rated BBB- or higher (S&P and Fitch) or Baa3 or higher (Moody’s), these are considered lower-risk investments suitable for conservative portfolios.

- High-Yield (Junk) Bonds: Rated below BBB- or Baa3, these bonds carry a higher default risk but offer increased returns for risk-tolerant investors.

- Government Bonds: Often carry the highest credit ratings due to the backing of national governments (e.g., U.S. Treasury bonds are rated AAA).

- Municipal Bonds: Issued by state or local governments, often carrying tax advantages and moderate credit risks.

Common Misconceptions About Bond Ratings

- A Higher Rating Does Not Mean Risk-Free: Even AAA-rated bonds have some level of risk.

- Bond Ratings Are Subject to Change: Economic shifts and issuer performance can lead to upgrades or downgrades.

- Lower-Rated Bonds Are Not Always Bad: High-yield bonds can provide diversification and higher returns when carefully selected.

Tools for Checking Bond Ratings

Investors can access bond ratings through various sources, including:

- Credit Rating Agency Websites: Directly check S&P, Moody’s, and Fitch.

- Financial News Portals: Bloomberg, Reuters, and other major financial websites.

- Brokerage Platforms: Most online brokers provide updated bond ratings and analysis.

Final Thoughts

Understanding and evaluating bond ratings is essential for making informed investment decisions. By analyzing credit ratings, comparing yields, and considering your risk tolerance, you can build a diversified bond portfolio tailored to your financial goals.

Always stay informed about changes in bond ratings and economic conditions to adjust your investments accordingly. Consulting a financial advisor can also provide valuable insights to help you navigate the complex bond market responsibly.