Introduction

Investing in the stock market can be highly rewarding, but it comes with inherent risks. One of the most effective ways to manage these risks is through portfolio diversification. A well-diversified portfolio helps investors reduce volatility and protect against market downturns. In this blog, we will explore the importance of diversification, various risk management strategies, and practical tips for building a resilient investment portfolio.

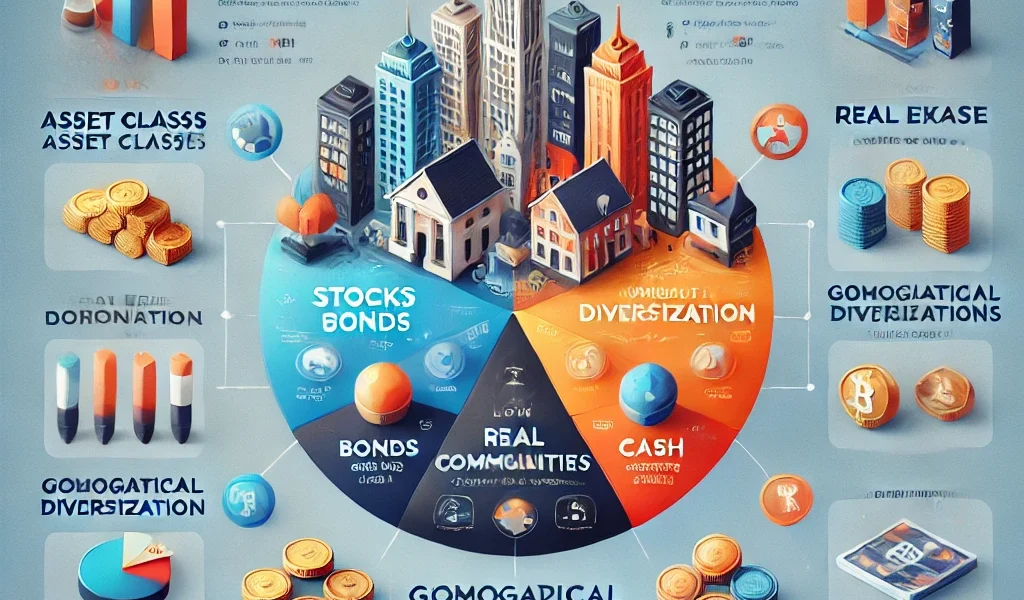

What is Portfolio Diversification?

Portfolio diversification is an investment strategy that involves spreading investments across different asset classes, sectors, and geographies to minimize risk. The idea is simple: don’t put all your eggs in one basket. By holding a mix of assets, investors can offset losses in one area with gains in another, leading to a more stable overall return.

Why is Diversification Important?

- Risk Reduction – Diversification helps mitigate losses when one investment performs poorly.

- Increased Stability – A balanced portfolio provides more consistent returns over time.

- Capital Preservation – It protects against extreme market fluctuations and downturns.

- Better Growth Opportunities – Exposure to multiple industries and regions increases the chances of capturing growth.

- Peace of Mind – A diversified portfolio reduces emotional stress caused by market volatility.

Key Strategies for Portfolio Diversification

1. Spread Investments Across Asset Classes

Different asset classes respond differently to market conditions. A well-balanced portfolio should include a mix of:

- Stocks – High potential returns but also higher risk.

- Bonds – Provide steady income and lower risk compared to stocks.

- Real Estate – A tangible asset with potential appreciation and rental income.

- Commodities – Gold, silver, oil, and agricultural products help hedge against inflation.

- Cash & Cash Equivalents – Treasury bills, money market funds, and savings accounts provide liquidity and security.

2. Diversify Within Asset Classes

Holding a mix of different stocks, bonds, or real estate types further reduces risk.

- Stock Diversification: Invest in large-cap, mid-cap, and small-cap stocks.

- Sector Diversification: Spread investments across technology, healthcare, finance, energy, and consumer goods.

- Bond Diversification: Include government bonds, corporate bonds, and municipal bonds with different maturities and interest rates.

3. Geographical Diversification

Investing in global markets can reduce risks associated with economic downturns in a single country.

- Domestic Stocks – Invest in well-established local companies.

- International Stocks – Gain exposure to emerging and developed markets.

- Foreign Bonds – Diversify income sources through international fixed-income instruments.

- Exchange-Traded Funds (ETFs) and Mutual Funds – These funds provide access to global markets with lower risk.

4. Invest in Low-Correlation Assets

Assets that do not move in the same direction help stabilize a portfolio. For example:

- When stocks decline, gold and bonds often perform well.

- When interest rates rise, real estate might still appreciate.

- Cryptocurrencies can provide diversification but come with high volatility.

5. Use Index Funds and ETFs

Index funds and ETFs allow investors to hold a diverse set of stocks or bonds in one investment. Benefits include:

- Lower costs compared to actively managed funds.

- Exposure to a broad market index like the S&P 500.

- Reduced risk through built-in diversification.

6. Rebalance Your Portfolio Regularly

Over time, the value of assets changes, which can shift your portfolio’s balance. Rebalancing helps maintain your target allocation by:

- Selling overperforming assets and reinvesting in underperforming ones.

- Aligning your portfolio with risk tolerance and financial goals.

- Preventing excessive exposure to a single asset class.

7. Follow the 5% Rule

To avoid excessive risk, limit investment in any single stock or asset to no more than 5% of your total portfolio.

8. Consider Alternative Investments

Beyond traditional stocks and bonds, investors can explore:

- Private Equity – Investing in private companies before they go public.

- Hedge Funds – Managed funds that use strategies to minimize risk and maximize returns.

- REITs (Real Estate Investment Trusts) – A way to invest in real estate without owning physical property.

- Venture Capital – Funding startups with high growth potential.

9. Utilize Stop-Loss Orders

A stop-loss order automatically sells a security when its price falls below a specified level, preventing significant losses.

10. Stay Informed and Adjust Accordingly

Markets are dynamic, and new trends emerge. Stay updated on:

- Economic indicators.

- Corporate earnings reports.

- Global market trends.

- Changes in interest rates and inflation.

Common Mistakes to Avoid in Portfolio Diversification

- Over-Diversification – Too many investments can dilute potential gains and increase complexity.

- Neglecting Risk Tolerance – Ensure your investments align with your risk appetite.

- Ignoring Fees and Taxes – Consider transaction costs and capital gains taxes.

- Chasing Past Performance – Historical success does not guarantee future results.

- Failing to Rebalance – A static portfolio may become riskier over time.

Conclusion

Diversification is a fundamental principle of investing that helps manage risk and improve long-term returns. By spreading investments across asset classes, industries, and geographies, investors can build a more resilient portfolio. However, diversification should be done strategically—over-diversifying can dilute potential gains, while under-diversifying increases vulnerability.

Regular portfolio reviews, staying informed about market trends, and aligning investments with personal risk tolerance are key to successful risk management. By following these strategies, investors can navigate market volatility with confidence and achieve their financial goals.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult with a financial advisor before making investment decisions.