Introduction

Saving money is essential for financial stability and long-term security. However, choosing the right saving plan depends on your financial goals, risk appetite, time horizon, and income level. With so many options available, selecting the most suitable plan can be overwhelming. This guide will help you navigate through the best saving plans and how to align them with your financial aspirations in 2025.

Understanding Your Financial Goals

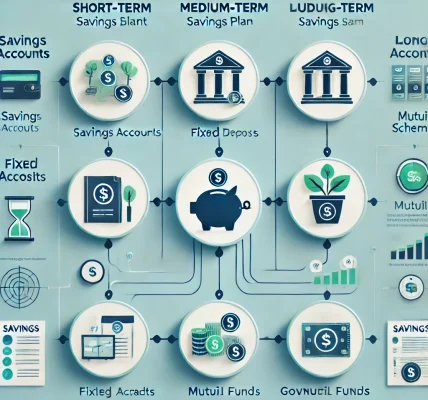

Before selecting a saving plan, it is crucial to define your financial goals. Broadly, financial goals can be categorized into three types:

- Short-Term Goals (0-3 years)

- Emergency fund

- Travel plans

- Buying gadgets or small assets

- Wedding expenses

- Medium-Term Goals (3-10 years)

- Buying a car

- Down payment for a house

- Higher education for children

- Expanding business or investment portfolio

- Long-Term Goals (10+ years)

- Retirement planning

- Child’s marriage

- Building a strong investment corpus

- Wealth accumulation

Each of these goals requires different saving plans with varied risk levels, liquidity, and return potential.

Factors to Consider While Choosing a Saving Plan

When selecting a saving plan, consider the following key factors:

- Risk Appetite: Are you comfortable with market-linked risks, or do you prefer stable and guaranteed returns?

- Liquidity Needs: Do you need access to your funds frequently, or can you lock them in for years?

- Tax Benefits: Does the plan offer tax exemptions under Section 80C or other sections?

- Return on Investment: What is the expected return? Does it outpace inflation?

- Government vs. Private Schemes: Do you prefer government-backed safety or higher returns from private institutions?

Best Saving Plans Based on Your Financial Goals

For Short-Term Goals

If you need funds within 0-3 years, you should opt for low-risk, highly liquid saving plans.

1. Fixed Deposits (FDs)

- Interest rate: 5-7% per annum

- Tenure: 7 days to 10 years

- Low risk with guaranteed returns

- Easy premature withdrawal with a minor penalty

2. Recurring Deposits (RDs)

- Interest rate: 5-6.5% per annum

- Flexible tenure from 6 months to 10 years

- Ideal for disciplined saving habits

3. High-Yield Savings Account

- Interest rate: 3-4% per annum

- Easy access to funds

- No lock-in period

- Suitable for emergency funds

For Medium-Term Goals

For goals ranging between 3-10 years, a mix of stability and moderate risk investments is advisable.

4. Public Provident Fund (PPF)

- Interest rate: 7-8% per annum (government-backed)

- Lock-in period: 15 years, partial withdrawals after 5 years

- Tax-free returns under Section 80C

- Ideal for wealth accumulation with safety

5. Sukanya Samriddhi Yojana (SSY) – For Girl Child

- Interest rate: 7-8% per annum

- Maturity at 21 years from the account opening

- Tax-free savings under Section 80C

- Best for securing a girl child’s education and marriage expenses

6. National Pension System (NPS)

- Returns: 8-12% per annum (market-linked)

- Partial withdrawals allowed for specific purposes

- Tax benefits under Section 80C & 80CCD(1B)

- Ideal for building a secure retirement corpus

For Long-Term Goals

For long-term goals (10+ years), higher risk, high-return investments with compounding benefits are recommended.

7. Employee Provident Fund (EPF)

- Interest rate: 8% per annum

- Mandatory for salaried employees

- Tax-free withdrawals after 5 years of continuous service

- Employer also contributes, leading to long-term wealth accumulation

8. Unit Linked Insurance Plans (ULIPs)

- Returns: Market-linked (8-15% per annum on equity funds)

- Lock-in period: 5 years

- Dual benefit of insurance + investment

- Tax savings under Section 80C

9. Mutual Funds (SIP)

- Returns: 8-18% depending on equity or debt funds

- Minimum investment: As low as ₹500 per month

- Ideal for wealth creation and compounding benefits

- Tax efficiency: Equity funds are tax-exempt after 1 year (up to ₹1 lakh)

10. Gold Saving Schemes

- Ideal for those planning future gold purchases

- Monthly deposits in cash for gold purchases at maturity

- Inflation hedge investment

Comparison Table for Easy Selection

| Saving Plan | Ideal For | Interest Rate | Risk Level | Tax Benefits |

|---|---|---|---|---|

| FD | Short-Term | 5-7% | Low | No |

| RD | Short-Term | 5-6.5% | Low | No |

| High-Yield Savings Account | Short-Term | 3-4% | Low | No |

| PPF | Medium-Term | 7-8% | Low | Yes |

| SSY | Medium-Term | 7-8% | Low | Yes |

| NPS | Medium/Long-Term | 8-12% | Moderate | Yes |

| EPF | Long-Term | 8% | Low | Yes |

| ULIPs | Long-Term | 8-15% | Moderate-High | Yes |

| Mutual Funds (SIP) | Long-Term | 8-18% | High | Yes (ELSS) |

| Gold Saving Scheme | Long-Term | Market-Linked | Low | No |

Conclusion

Selecting the right saving plan depends on your financial goals, risk tolerance, and investment horizon. A well-diversified combination of fixed-income and market-linked saving plans can help you maximize returns while ensuring financial security. Before investing, review the latest interest rates, tax benefits, and plan conditions to make an informed decision.

By planning ahead and investing wisely, you can achieve your financial goals with confidence and security in 2025 and beyond. Start saving today!