Introduction

Investing in mutual funds for the long term can be a powerful strategy to build wealth, secure financial stability, and achieve goals like retirement planning or funding a child’s education. However, with thousands of mutual fund options available, choosing the best one can be overwhelming for investors.

This guide will provide a step-by-step approach to selecting the best mutual funds for long-term investment, considering critical factors such as risk tolerance, performance history, fund type, and expense ratios.

Understanding Long-Term Investment in Mutual Funds

Long-term investing typically refers to holding investments for five years or more. The goal is to allow your money to grow through the power of compounding while mitigating short-term market volatility. Mutual funds are an excellent option for long-term investment due to their professional management and diversified asset allocation.

Key Factors to Consider When Choosing a Mutual Fund

1. Define Your Financial Goals

Before selecting a mutual fund, determine your investment objectives:

- Wealth creation – Are you looking for high returns over a long period?

- Retirement planning – Do you need stable, long-term growth with minimal risk?

- Children’s education – Are you investing for a future milestone?

Your goals will influence your choice of fund type and risk level.

2. Assess Your Risk Tolerance

Risk tolerance varies from investor to investor. Understanding your comfort level with market fluctuations is essential:

- High risk tolerance: Equity mutual funds (best for aggressive investors)

- Medium risk tolerance: Balanced or hybrid funds (suitable for moderate investors)

- Low risk tolerance: Debt funds or index funds (ideal for conservative investors)

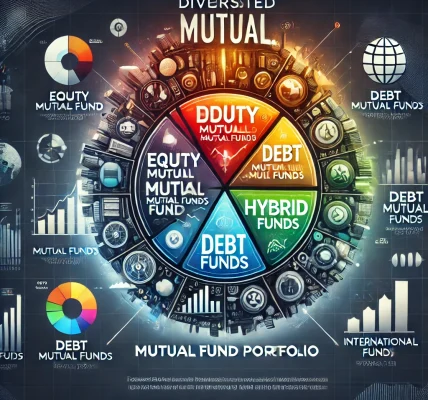

3. Choose the Right Type of Mutual Fund

Different types of mutual funds cater to long-term investors:

- Equity Mutual Funds (Ideal for wealth creation)

- Large-cap funds: Invest in well-established companies with stable growth.

- Mid-cap funds: Offer higher returns but with more risk.

- Small-cap funds: High-risk, high-return potential for aggressive investors.

- Multi-cap funds: Diversified across large, mid, and small-cap stocks.

- Debt Mutual Funds (Ideal for stability and fixed income)

- Government bond funds: Low risk, predictable returns.

- Corporate bond funds: Moderate risk with higher yields than government bonds.

- Hybrid Funds (Best for balancing risk and returns)

- Equity-oriented hybrid funds: Higher allocation in stocks.

- Debt-oriented hybrid funds: Focus more on debt instruments.

4. Analyze the Fund’s Performance History

A fund’s past performance is a key indicator of its consistency and reliability. However, past returns do not guarantee future performance. Consider these factors:

- Compare the fund’s 5-year and 10-year returns.

- Benchmark performance against market indices like Nifty 50 or S&P 500.

- Assess how the fund performed in bear and bull markets.

5. Check the Expense Ratio

The expense ratio is the annual fee a mutual fund charges to manage investments. Lower expense ratios mean higher net returns for investors. Actively managed funds typically have higher fees, whereas passive funds (like index funds) have lower fees.

6. Examine the Fund Manager’s Track Record

A skilled and experienced fund manager can significantly impact the fund’s performance. Look for:

- The manager’s investment strategy and consistency.

- Their experience and past performance with similar funds.

7. Evaluate Portfolio Diversification

A well-diversified portfolio reduces risk. Ensure the mutual fund invests across multiple sectors and industries to protect against market volatility.

8. Consider Tax Implications

Long-term investors should understand the tax impact on their mutual fund returns:

- Equity funds: Long-term capital gains (LTCG) above ₹1 lakh are taxed at 10%.

- Debt funds: Gains after three years are taxed at 20% with indexation benefits.

- ELSS (Equity Linked Savings Scheme): Offers tax benefits under Section 80C.

9. Look at Exit Load and Lock-in Period

Some mutual funds charge an exit load (penalty) if redeemed within a specific timeframe. ELSS funds, for example, have a three-year lock-in period. Ensure you choose a fund with a redemption policy that aligns with your investment horizon.

10. Investment Mode: SIP vs. Lump Sum

- SIP (Systematic Investment Plan): Invest small amounts regularly to average market fluctuations and benefit from rupee cost averaging.

- Lump Sum Investment: Suitable for investors with a large sum and an appetite for market timing.

Best Mutual Funds for Long-Term Investment (2025 Edition)

Here are some mutual fund categories that are historically known for delivering strong long-term returns:

Top Performing Large-Cap Funds:

- Fund A – Consistent 10-year returns with a stable portfolio.

- Fund B – Low expense ratio and strong large-cap holdings.

Top Performing Mid-Cap Funds:

- Fund C – High growth potential with diversified mid-cap exposure.

- Fund D – Proven track record of outperforming the benchmark.

Top Performing Hybrid Funds:

- Fund E – Balanced allocation for moderate risk-takers.

- Fund F – Best for retirees seeking growth with stability.

Note: Please conduct independent research or consult a financial advisor before investing.

Common Mistakes to Avoid

- Chasing past performance: A fund that performed well in the past may not repeat its success.

- Ignoring risk assessment: Not matching the fund’s risk level with your own tolerance can lead to losses.

- Investing without research: Blindly following trends or recommendations without analyzing the fund’s fundamentals.

- Frequent switching of funds: Constantly moving money can lead to higher fees and tax implications.

- Neglecting fund reviews: Regularly reviewing fund performance is essential to ensure it aligns with your financial goals.

Conclusion

Choosing the best mutual funds for long-term investment requires careful analysis and a clear understanding of your financial objectives. By considering factors such as risk tolerance, fund performance, expenses, and tax implications, you can make informed decisions that maximize returns while minimizing risks.

Start investing early, stay consistent, and allow compounding to work its magic for long-term wealth creation!

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance is not indicative of future returns. Consult a financial advisor for personalized investment advice.