Building a balanced investment portfolio is one of the most essential steps in ensuring long-term financial growth while managing risk. Mutual funds provide an excellent vehicle for diversifying your investments, offering access to different asset classes, and reducing the overall risk of your portfolio. In this guide, we’ll walk you through how to build a balanced portfolio using mutual funds, the key factors to consider, and tips to make sure you are on the right path.

What is a Balanced Investment Portfolio?

A balanced investment portfolio is one that seeks to balance the potential for returns with the level of risk an investor is willing to take on. It typically consists of a mix of asset classes such as equities (stocks), fixed income (bonds), and sometimes alternative investments like real estate or commodities. The key goal is to diversify, reducing the chances of major losses while still achieving steady growth over time.

1. Why Use Mutual Funds for Building a Balanced Portfolio?

Before we dive into how to build your portfolio, let’s understand why mutual funds are a popular choice.

- Diversification: Mutual funds pool money from multiple investors and invest in a variety of assets. This allows you to diversify even with a smaller investment.

- Professional Management: Mutual funds are managed by professional fund managers who have expertise in selecting and managing investments.

- Accessibility: Mutual funds provide access to asset classes that individual investors might find hard to invest in on their own, such as international stocks or corporate bonds.

- Liquidity: Most mutual funds allow you to buy or sell shares at the end of any trading day, providing easy access to your investments.

2. Steps to Build a Balanced Mutual Fund Portfolio

Step 1: Define Your Investment Goals

The first step in building any investment portfolio is to define your goals. Are you saving for retirement, buying a house, or funding your child’s education? Your goals will dictate the type of mutual funds you select, how long you plan to invest, and your risk tolerance.

- Long-term goals (retirement, wealth accumulation) may call for a higher percentage of equities.

- Short-term goals (saving for a car, emergency funds) may require more conservative investments, such as bond funds.

Step 2: Assess Your Risk Tolerance

Risk tolerance is the amount of risk you are comfortable taking on in your investments. If you’re younger and have a longer time horizon, you might be able to tolerate more risk, and thus allocate a larger portion of your portfolio to equity (stock) mutual funds.

Conversely, if you are nearing retirement or have a lower risk tolerance, you may want to allocate more to safer, lower-risk funds like bond funds or balanced funds.

- High-risk tolerance: Invest more in equity funds (growth stocks, sector-specific funds, international funds).

- Low-risk tolerance: Focus on bond funds, money market funds, or target-date funds.

Step 3: Choose the Right Asset Allocation

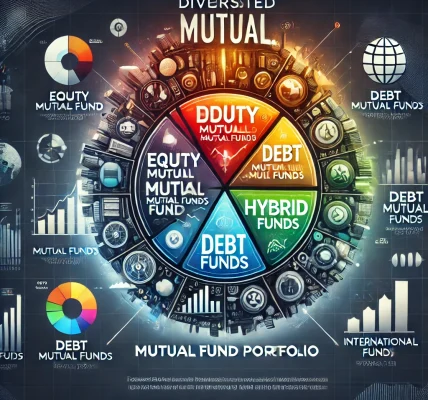

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. A balanced portfolio typically contains a mix of both higher-risk (equity) and lower-risk (bonds) investments. The specific mix will depend on your risk tolerance and investment goals.

Here’s an example of a balanced portfolio:

- 60% Equity Funds (for growth)

- Invest in large-cap, mid-cap, and international equity funds.

- 30% Bond Funds (for stability)

- Choose corporate or government bond funds, depending on your risk level.

- 10% Cash or Money Market Funds (for liquidity)

- Keep a portion in easily accessible funds for emergencies or short-term needs.

Step 4: Select the Right Mutual Funds

Now that you have a clear understanding of your goals, risk tolerance, and asset allocation, the next step is selecting the mutual funds that align with your strategy. Here’s what to consider when selecting funds:

- Fund Type: Choose between equity funds, debt funds, hybrid funds, index funds, or sectoral funds.

- Performance: Research the historical performance of the fund. While past performance isn’t a guarantee of future results, it can give you an idea of how well the fund has managed through different market conditions.

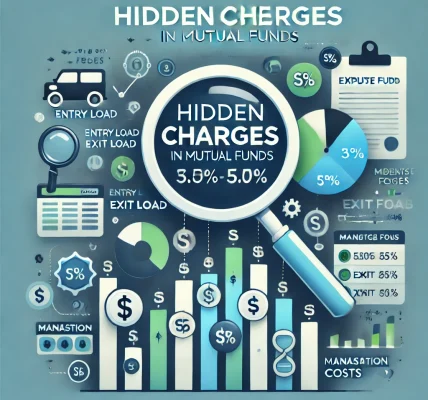

- Expense Ratio: This is the fee charged by the fund manager. A lower expense ratio is better, as it means less of your investment goes toward fees.

- Fund Manager’s Track Record: Look for funds managed by experienced and skilled managers who have consistently outperformed their benchmarks.

- Risk Level: Review the fund’s risk profile. You may want to steer clear of funds with high volatility if you are risk-averse.

Step 5: Monitor and Rebalance Your Portfolio

Investing is not a “set it and forget it” activity. It’s crucial to periodically review your portfolio to ensure that it remains aligned with your investment goals and risk tolerance.

- Rebalancing: Over time, some of your investments will grow faster than others. For instance, if your equity funds outperform and make up a larger portion of your portfolio, you may need to sell some and invest in bond funds to maintain your original allocation.

- Tracking Performance: Regularly monitor the performance of your mutual funds and compare them to their benchmarks. This helps you determine if the fund continues to meet your needs.

3. Key Factors to Consider Before Investing in Mutual Funds

Before diving into mutual fund investments, here are some crucial factors you should consider to ensure you are making informed decisions.

a) Understand Your Investment Horizon

Your investment horizon refers to how long you plan to keep your money invested. The longer your horizon, the more risk you can afford to take, as the market has more time to recover from downturns. However, if your goals are short-term, you’ll need to choose more conservative investments to avoid potential market volatility.

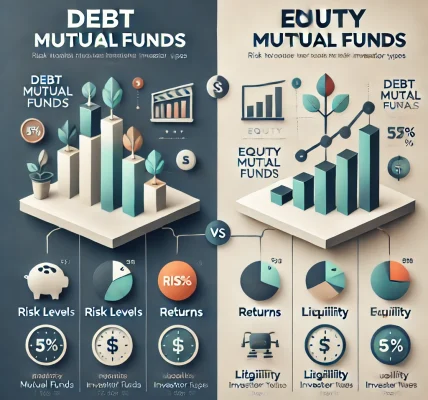

b) Risk Profile of the Mutual Fund

Not all mutual funds are created equal when it comes to risk. Equity funds tend to be more volatile, whereas bond funds provide more stability but with lower returns. Consider the risk level of each fund to match it with your risk tolerance.

c) Past Performance and Fund Manager Experience

While past performance should never be the sole determinant of whether you invest in a fund, it is still an important factor to consider. Look at how the fund has performed over 1, 3, and 5-year periods. A solid track record from the fund manager is an indicator of their ability to navigate changing market conditions.

d) Expense Ratios and Fees

High fees can erode your returns over time. Compare the expense ratios of similar funds and choose those that offer a good balance between low cost and good performance.

e) Tax Implications

Investments in mutual funds can generate taxable income in the form of dividends and capital gains. Before you invest, understand how mutual funds are taxed in your jurisdiction and factor this into your overall return expectations.

f) Fund’s Investment Strategy and Objectives

Each mutual fund has a specific investment strategy and objective. Ensure that the fund’s strategy aligns with your financial goals. For instance, if you are looking for growth, equity funds might be a good choice. If you want income and stability, bond funds or hybrid funds might better suit your needs.

4. The Importance of a Well-Balanced Portfolio

A well-balanced portfolio is designed to weather the ups and downs of the market while still achieving reasonable returns. By diversifying across different mutual funds, you can mitigate the risks associated with investing in a single asset class.

- Reduce risk: By investing in multiple asset classes, you reduce the risk of a significant loss should one sector or asset class underperform.

- Steady growth: While some funds may underperform, others may outperform, leading to steady overall growth in your portfolio.

Conclusion

Building a balanced investment portfolio with mutual funds requires thoughtful planning, careful selection of funds, and periodic monitoring. By following the steps outlined in this guide, you can create a diversified portfolio that aligns with your financial goals and risk tolerance.

Remember, investing in mutual funds is a long-term strategy, and patience is key. With the right balance, you’ll be better positioned to achieve your financial goals while minimizing unnecessary risks. Always ensure you do your due diligence before making investment decisions and consult with a financial advisor if necessary to get tailored advice based on your individual situation.

By following these steps and principles, you can confidently navigate the world of mutual fund investments and create a portfolio that suits your needs for the long term