Introduction

Saving money is one of the most important financial habits, but it can be challenging to stay consistent. Automating your savings is a smart and effortless way to build wealth over time. By setting up automated systems, you can save without thinking about it, ensuring financial stability and long-term growth. This guide will help you understand how to automate your savings effectively and make your money work for you.

Why Automate Your Savings?

Automating your savings provides several key benefits:

- Consistency – You save regularly without forgetting or skipping months.

- Discipline – It eliminates the temptation to spend before saving.

- Time-Saving – You don’t need to manually transfer money every month.

- Financial Growth – Small, consistent savings accumulate into substantial wealth over time.

- Stress Reduction – You can set it and forget it, knowing your financial future is secure.

Steps to Automate Your Savings

1. Set Clear Financial Goals

Before automating your savings, define your financial objectives. Your goals will determine how much you need to save and the best saving strategies. Common financial goals include:

- Emergency Fund – Saving for unexpected expenses (medical bills, car repairs, job loss, etc.).

- Retirement Savings – Building wealth for financial freedom in your later years.

- Major Purchases – Buying a home, car, or funding your child’s education.

- Vacation or Short-Term Goals – Setting aside money for travel or luxury purchases.

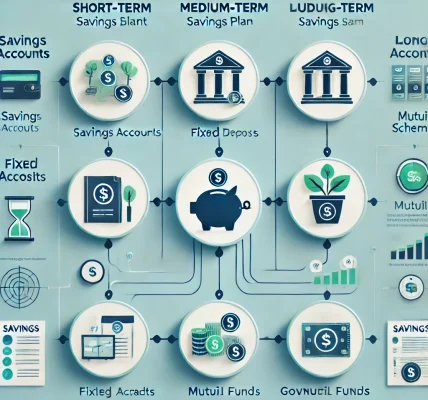

2. Choose the Right Savings Account

Different savings accounts offer various features, so select one that aligns with your needs:

- High-Interest Savings Accounts – Earn more on your savings.

- Fixed Deposits (FDs) or Recurring Deposits (RDs) – Ideal for structured savings with fixed returns.

- Retirement Accounts (e.g., PPF, EPF, 401(k), IRA) – Long-term savings with tax benefits.

- Investment-Linked Accounts – Grow wealth through stocks, mutual funds, or ETFs.

3. Automate Direct Deposits

Most employers allow direct deposit into multiple accounts. Set up a portion of your salary to go directly into your savings account before it reaches your spending account. This ensures that saving becomes a priority rather than an afterthought.

4. Set Up Automatic Transfers

If your employer doesn’t allow multiple deposits, schedule automatic transfers from your checking account to your savings account. Most banks provide an option to set up recurring transfers (weekly, biweekly, or monthly).

5. Use Savings Apps and Tools

Many fintech apps and budgeting tools help automate savings:

- Digit – Analyzes spending habits and saves small amounts automatically.

- Acorns – Rounds up purchases and invests spare change.

- YNAB (You Need a Budget) – Helps allocate funds automatically to savings goals.

- Bank Auto-Roundup Features – Some banks round up your purchases and save the difference.

6. Leverage Employer-Sponsored Plans

If your employer offers a retirement savings plan (e.g., 401(k), EPF), enroll in automatic deductions. Some employers even match contributions, providing free money for your future.

7. Set Up Investment Automation

Investing is a crucial part of wealth building. Set up automated investments through:

- Systematic Investment Plans (SIPs) – Invest in mutual funds at regular intervals.

- Robo-Advisors – Automated investment platforms that manage your portfolio.

- Dividend Reinvestment Plans (DRIPs) – Automatically reinvest stock dividends.

8. Use Budgeting Techniques

The 50/30/20 Rule is an effective budgeting method:

- 50% Needs – Essentials like rent, bills, groceries.

- 30% Wants – Entertainment, dining out, non-essentials.

- 20% Savings – Emergency fund, investments, debt repayment.

Automate the 20% savings portion so you stay financially disciplined.

9. Review and Adjust Your Plan

Financial goals and income levels change over time. Regularly review your automated savings strategy to ensure it aligns with your needs. Increase savings contributions as your income grows and adjust investments based on market conditions.

Tips for Maximizing Automated Savings

- Start Small and Increase Gradually – Begin with small amounts and raise them as your budget allows.

- Take Advantage of Employer Matching – Maximize contributions to employer-sponsored retirement plans.

- Use Windfalls Wisely – Automate savings from bonuses, tax refunds, or unexpected income.

- Avoid Easy Access to Savings – Use accounts with withdrawal restrictions to prevent impulsive spending.

- Combine Automation with Manual Contributions – If you receive irregular income, supplement automated savings with additional deposits.

Conclusion

Automating your savings is an effortless way to secure your financial future and grow your wealth. By setting up direct deposits, automatic transfers, and investment contributions, you eliminate the stress of manual saving while ensuring consistency. The earlier you start, the more you benefit from compounding returns, helping you achieve financial freedom sooner. Take action today, set up your automated savings plan, and watch your wealth grow effortlessly!