Investing in mutual funds is a great way to build wealth, but simply investing isn’t enough—you need to track and analyze their performance regularly. Understanding key metrics helps investors make informed decisions and ensure their investments align with their financial goals.

In this guide, we will break down the essential performance metrics to help you evaluate mutual funds effectively.

1. Net Asset Value (NAV)

What is NAV?

NAV represents the per-unit price of a mutual fund and is calculated as:

Why is NAV Important?

- Indicates the fund’s market value per unit.

- Helps investors track fund growth over time.

- Misconception: A lower NAV does not mean a cheaper fund; it just means the fund has issued more units.

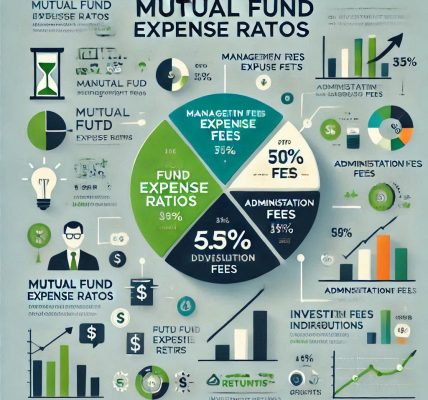

2. Expense Ratio

What is Expense Ratio?

The expense ratio represents the percentage of fund assets used for management fees and operating expenses.

Why is Expense Ratio Important?

- A lower expense ratio means higher returns for investors.

- Actively managed funds typically have higher expense ratios than passive index funds.

- Compare funds within the same category to assess cost-effectiveness.

3. Returns: Absolute vs. CAGR vs. XIRR

Absolute Returns

- Suitable for evaluating short-term gains/losses.

- Does not consider the investment period.

Compound Annual Growth Rate (CAGR)

- Shows the annualized growth rate of an investment over time.

- Useful for comparing long-term investments.

Extended Internal Rate of Return (XIRR)

- Used for irregular investments (like SIPs).

- Helps determine the actual return on investments with multiple cash flows.

4. Sharpe Ratio

What is Sharpe Ratio?

Why is Sharpe Ratio Important?

- Measures risk-adjusted returns.

- A higher Sharpe Ratio indicates better risk-adjusted performance.

- Helps investors compare funds with similar risk levels.

5. Standard Deviation & Beta

Standard Deviation

- Measures a fund’s return volatility.

- A higher standard deviation means greater fluctuations (riskier fund).

Beta

- Measures a fund’s sensitivity to market movements.

- Beta >1: More volatile than the market.

- Beta <1: Less volatile than the market.

6. Alpha & R-Squared

Alpha

- Measures a fund’s excess return compared to its benchmark.

- Positive Alpha: The fund outperformed the market.

- Negative Alpha: The fund underperformed.

R-Squared

- Measures correlation between the fund and its benchmark (0 to 100 scale).

- High R-Squared: Fund closely follows the benchmark.

- Low R-Squared: Fund deviates significantly from the benchmark.

7. Portfolio Turnover Ratio

What is Portfolio Turnover Ratio?

- Measures how frequently a fund buys and sells securities.

- High turnover means frequent trading, leading to higher costs and potential tax liabilities.

Why is Portfolio Turnover Important?

- High turnover funds can be costly for investors.

- Low turnover funds indicate a more stable investment approach.

8. Fund Manager’s Track Record

Why is Fund Manager Performance Important?

- An experienced fund manager with a consistent track record can significantly impact returns.

- Evaluate past funds managed by the same individual.

9. Asset Allocation & Diversification

Key Points to Analyze

- A well-diversified fund lowers risk.

- Check sector allocation and individual stock weightage.

- Avoid over-concentration in a single industry.

10. Consistency of Performance

Why is Consistency Important?

- Past performance does not guarantee future returns, but consistent returns indicate a stable fund.

- Compare 5-year and 10-year returns for better insights.

Conclusion: Making an Informed Decision

Analyzing mutual fund performance is crucial for maximizing returns while managing risk. By focusing on key metrics like NAV, expense ratio, returns, Sharpe ratio, standard deviation, and asset allocation, investors can make well-informed decisions.

Key Takeaways:

- Lower expense ratios lead to higher net returns.

- Higher Sharpe Ratio & Alpha indicate better risk-adjusted performance.

- Consistency over time is crucial for long-term investments.

- Diversification and fund manager experience play key roles in stability.

Before investing, always compare mutual funds within the same category and consider your financial goals and risk tolerance.