Tax planning is an essential aspect of financial management that helps individuals legally reduce their taxable income and save money. While many people are aware of common deductions such as Section 80C investments, home loan benefits, and health insurance deductions, there are several lesser-known tax deductions that taxpayers often overlook. In this guide, we will uncover hidden tax deductions that you might be missing out on, helping you maximize your tax savings without violating any legal requirements.

1. Standard Deduction for Salaried Individuals

The government provides a standard deduction of ₹50,000 to all salaried individuals and pensioners. Unlike other deductions, it does not require any investment or proof of expense, making it one of the easiest tax-saving options.

- Who can claim it? Salaried individuals and pensioners.

- How to claim? Automatically applied while filing your Income Tax Return (ITR).

2. Tax Benefits on Savings Account Interest (Section 80TTA & 80TTB)

For Individuals Below 60 Years (80TTA)

- Interest earned on a savings account (up to ₹10,000 per year) is deductible under Section 80TTA.

- Applicable for savings accounts held in banks, post offices, or cooperative societies.

For Senior Citizens (80TTB)

- Senior citizens can claim a deduction of up to ₹50,000 on interest earned from savings accounts, fixed deposits, or recurring deposits.

3. Deduction on Interest Paid for Education Loans (Section 80E)

If you have taken an education loan for yourself, your spouse, children, or a legal guardian, you can claim unlimited deductions on the interest paid under Section 80E.

- Who can claim it? Individuals who have taken loans from financial institutions.

- Time limit? Up to 8 consecutive years from the year of repayment.

4. Rent Deduction for Self-Employed Individuals (Section 80GG)

Many salaried individuals claim House Rent Allowance (HRA), but self-employed individuals or those who do not receive HRA can still claim rent deductions under Section 80GG.

- Maximum Deduction: ₹60,000 per year (₹5,000 per month) or 25% of total income, whichever is lower.

- Condition: You should not own any residential property in the city where you work.

5. Additional Tax Benefits on Home Loan Interest (Section 80EE & 80EEA)

While most people claim home loan benefits under Section 24(b) (up to ₹2 lakh on interest payments), additional benefits are available:

- Section 80EE: First-time homebuyers can claim an extra ₹50,000 deduction on home loan interest.

- Section 80EEA: If you purchase an affordable house (below ₹45 lakh), you can claim an additional ₹1.5 lakh on home loan interest.

6. Deduction for Donations to Charitable Organizations (Section 80G & 80GGA)

Section 80G – Donations to Approved Charitable Organizations

- Contributions made to government-approved NGOs and charitable trusts qualify for 50% or 100% deductions.

- Donations above ₹2,000 should be made digitally (no cash allowed).

Section 80GGA – Donations for Scientific Research

- 100% deduction is available for donations made to scientific research institutions or rural development programs.

7. Tax Benefits on Preventive Health Checkups (Section 80D)

Most people are aware that health insurance premiums qualify for tax deductions under Section 80D (up to ₹25,000 for individuals, ₹50,000 for senior citizens). However, many miss out on an extra ₹5,000 deduction for preventive health checkups.

- Applies to: Health checkups for self, spouse, parents, and children.

- How to claim? Keep bills and medical reports as proof.

8. Deduction on Medical Treatment of Specified Diseases (Section 80DDB)

If you or your dependent family members suffer from specified diseases such as cancer, kidney failure, Parkinson’s disease, or other chronic illnesses, you can claim a tax deduction of up to ₹40,000 (₹1 lakh for senior citizens) under Section 80DDB.

- Requirement: Doctor’s certificate from a recognized specialist.

- Who can claim? Individuals and HUFs (Hindu Undivided Families).

9. Tax Benefits on Employer’s NPS Contribution (Section 80CCD(2))

While self-contributions to NPS qualify for deductions under Sections 80CCD(1) & 80CCD(1B) (up to ₹2 lakh), many miss out on the tax benefit for the employer’s contribution.

- Deduction limit: Up to 10% of basic salary (14% for government employees) is tax-free.

- Who can benefit? Employees whose employers contribute to NPS.

10. Leave Encashment Exemption (Section 10(10AA))

If you receive leave encashment while retiring or resigning from your job, you may be eligible for a tax exemption.

- Government employees: Fully exempt.

- Private employees: Exempt up to ₹3 lakh.

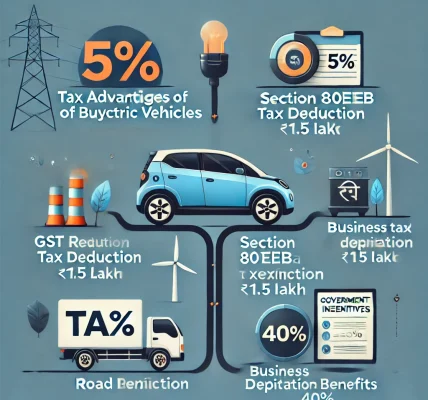

11. Deduction for Interest Paid on Electric Vehicle Loans (Section 80EEB)

To promote electric vehicles (EVs), the government provides a deduction of up to ₹1.5 lakh on interest paid for EV loans under Section 80EEB.

- Who can claim it? Individuals purchasing electric vehicles.

- Loan must be taken from: Banks or financial institutions.

12. Deductions for Differently-Abled Individuals (Sections 80DD & 80U)

Section 80DD – Deduction for Medical Expenses & Care of a Disabled Dependent

- ₹75,000 deduction for 40%-80% disability.

- ₹1.25 lakh deduction for 80% or more disability.

Section 80U – Deduction for Differently-Abled Individuals

- Similar deduction for self-disability conditions.

- No medical bills required, only a disability certificate.

Final Thoughts

By leveraging these hidden tax deductions, you can significantly reduce your taxable income and maximize your savings. Many people overlook these deductions due to a lack of awareness, but taking the time to understand tax laws can result in thousands of rupees in savings every year.

Always consult a tax professional or financial advisor before claiming deductions to ensure compliance with the latest tax laws. With the right planning and documentation, you can make the most of the available tax benefits and secure a stronger financial future.