Introduction

In the pursuit of higher returns, many investors turn to emerging market bonds—debt securities issued by governments or corporations in developing nations. These bonds often promise attractive yields, but they also come with elevated risks due to political instability, currency fluctuations, and economic volatility.

For investors willing to take on these risks, emerging market bonds can be a valuable addition to a diversified portfolio, offering opportunities for higher returns and portfolio growth. In this comprehensive guide, we’ll explore the intricacies of emerging market bonds, evaluate their potential rewards and risks, and provide actionable strategies to integrate them effectively into your investment plan.

🎯 What Are Emerging Market Bonds?

Emerging market bonds are debt instruments issued by developing countries or corporations operating in these regions. These bonds provide capital to support economic growth and infrastructure projects in nations with rapidly growing economies.

✅ Key Characteristics of Emerging Market Bonds:

- 🌏 Issued by Developing Nations: Countries with growing economies, such as Brazil, India, Mexico, and South Africa.

- 💸 Higher Yield Potential: Higher interest rates compared to bonds from developed countries.

- 📈 Exposure to Growth Markets: Investment exposure to economies with high growth potential.

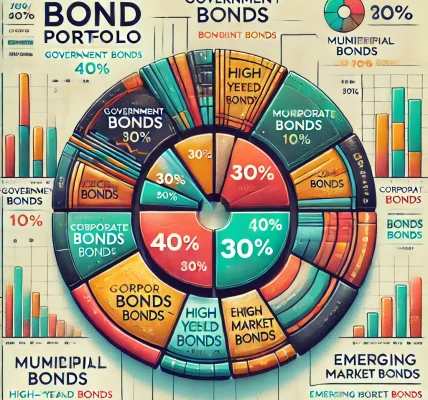

Types of Emerging Market Bonds:

- Sovereign Bonds: Issued by national governments.

- Corporate Bonds: Issued by companies operating in emerging markets.

📊 Why Consider Investing in Emerging Market Bonds?

Emerging market bonds offer an attractive risk-reward profile that appeals to investors seeking higher returns while accepting increased risk.

✅ Reasons to Consider Emerging Market Bonds:

- 💰 Higher Yields Compared to Developed Markets

- 🌱 Diversification and Portfolio Growth Opportunities

- 🔥 Potential for Capital Appreciation in Fast-Growing Economies

📈 Potential Rewards of Investing in Emerging Market Bonds

✅ 1. Higher Yields and Returns

Emerging market bonds typically offer higher interest rates than bonds from developed nations to compensate for the increased risks. These higher yields can significantly boost overall portfolio returns.

✅ Why It Matters:

- Provides higher income potential for fixed-income investors.

- Attractive option for income-seeking investors in a low-interest environment.

✅ 2. Portfolio Diversification

Including emerging market bonds in a portfolio introduces exposure to diverse economies and currencies, reducing reliance on domestic or developed market assets.

✅ Why It Matters:

- Reduces correlation with developed market assets.

- Mitigates portfolio volatility by spreading risk across regions.

✅ 3. Potential for Capital Appreciation

As developing economies grow and stabilize, the creditworthiness of emerging market issuers improves, potentially increasing the value of their bonds.

✅ Why It Matters:

- Opportunity for capital gains as bond prices appreciate.

- Increased credit ratings can lead to higher bond valuations.

✅ 4. Exposure to Rapidly Growing Economies

Emerging markets often experience higher economic growth rates compared to developed nations, providing opportunities for significant portfolio growth.

✅ Why It Matters:

- Leverages growth potential in dynamic and evolving markets.

- Benefits from improved credit conditions and economic reforms.

⚠️ Risks Associated with Emerging Market Bonds

While the rewards of emerging market bonds can be attractive, investors must carefully assess the associated risks.

⚠️ 1. Political and Geopolitical Risks

Emerging markets may experience political instability, government changes, and geopolitical tensions, which can impact bond performance.

✅ Mitigation Strategy:

- Diversify across multiple countries and regions to minimize political risk.

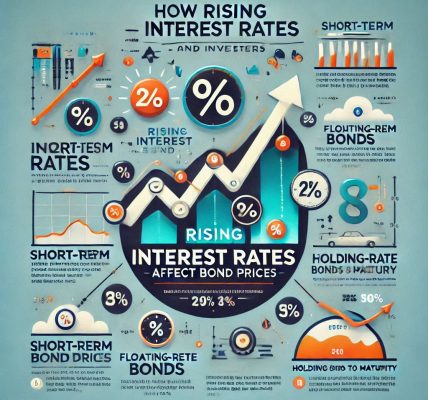

⚠️ 2. Currency Risk and Exchange Rate Volatility

Emerging market bonds are often denominated in local currencies, exposing investors to exchange rate fluctuations that can affect returns.

✅ Mitigation Strategy:

- Opt for dollar-denominated bonds to reduce currency risk.

- Use currency hedging to protect against exchange rate volatility.

⚠️ 3. Credit and Default Risk

Emerging markets may have lower credit ratings and higher default risks due to weaker regulatory environments and economic instability.

✅ Mitigation Strategy:

- Focus on bonds with higher credit ratings and stable governments.

- Invest in a diversified bond fund to mitigate individual issuer risk.

⚠️ 4. Liquidity Risk

Emerging market bonds may experience lower liquidity compared to developed market bonds, making it difficult to buy or sell them during volatile market conditions.

✅ Mitigation Strategy:

- Allocate a portion of the portfolio to more liquid assets to balance risk.

📊 Comparing Emerging Market Bonds with Developed Market Bonds

| Feature | Emerging Market Bonds | Developed Market Bonds |

|---|---|---|

| Interest Rate | Higher Yields | Lower Yields |

| Credit Risk | Higher Risk | Lower Risk |

| Currency Risk | High Volatility | Minimal Risk |

| Political Stability | Less Stable | High Stability |

| Return Potential | High Returns | Moderate Returns |

| Suitability for Risk Tolerance | High-Risk Investors | Conservative Investors |

🎯 Strategies for Investing in Emerging Market Bonds

✅ 1. Diversify Across Countries and Sectors

To minimize political and economic risk, spread investments across multiple countries and sectors in emerging markets.

✅ Why It Works:

- Reduces concentration risk.

- Balances exposure across different economies.

✅ 2. Consider Dollar-Denominated Bonds

Investing in U.S. dollar-denominated emerging market bonds eliminates currency risk while maintaining exposure to high-yielding assets.

✅ Why It Works:

- Protects against local currency depreciation.

- Provides stability in returns.

✅ 3. Use Bond Funds or ETFs for Risk Mitigation

For investors unfamiliar with emerging markets, bond funds and exchange-traded funds (ETFs) offer a diversified and professionally managed approach to investing.

✅ Why It Works:

- Provides instant diversification.

- Reduces risk by spreading exposure across multiple issuers.

✅ 4. Monitor Credit Ratings and Economic Indicators

Stay informed about changes in credit ratings, inflation, and economic policies in emerging markets to manage risk effectively.

✅ Why It Works:

- Helps anticipate bond price movements.

- Allows for timely adjustments in the portfolio.

💡 Case Study: Balancing Risk and Reward with Emerging Market Bonds

Scenario:

- Investor A is seeking higher returns but is concerned about volatility.

- They decide to allocate 15% of their portfolio to emerging market bonds, splitting the allocation between sovereign and corporate bonds from multiple countries.

✅ Result:

- The portfolio experiences higher yields while managing risk through diversification and careful selection of bonds.

🎉 Conclusion: Are Emerging Market Bonds Right for Your Portfolio?

Emerging market bonds offer high returns and exposure to rapidly growing economies, making them an attractive option for investors seeking diversification and higher yields. However, these opportunities come with elevated risks, including political instability, credit risk, and currency fluctuations.

By diversifying across countries, opting for dollar-denominated bonds, and using professionally managed bond funds, investors can harness the potential of emerging market bonds while mitigating the associated risks. For those willing to embrace some risk, emerging market bonds can play a vital role in enhancing portfolio returns and achieving long-term financial goals.