Introduction

Providing quality education for your child is one of the most significant financial responsibilities you will face. With the rising cost of education, planning early is essential to ensure your child’s future remains secure without financial burdens. In this guide, we explore the best child education saving plans to help you build a strong financial foundation for your kid’s academic journey.

Why is Child Education Planning Important?

- Rising Education Costs – Tuition fees, accommodation, books, and other expenses continue to increase.

- Avoiding Student Loans – A well-planned savings strategy prevents financial strain caused by student loans.

- Securing the Child’s Future – Provides financial security for higher studies, even in unforeseen circumstances.

- Compounding Benefits – Early investments grow significantly over time due to compounding interest.

- Tax Benefits – Many education saving plans offer tax advantages, reducing financial strain.

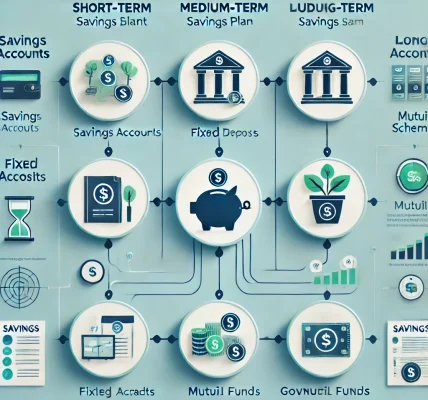

Top Child Education Saving Plans

1. Sukanya Samriddhi Yojana (SSY) (For Girl Child)

- What is it? A government-backed savings scheme exclusively for girls under 10 years old.

- Pros:

- High interest rates (government-revised annually).

- Tax benefits under Section 80C.

- Long-term savings ensuring a secure future.

- Cons:

- Only for girls.

- Funds are locked-in until the child turns 18 (partial withdrawals allowed for education).

2. Public Provident Fund (PPF)

- What is it? A long-term savings scheme that can be used for a child’s education.

- Pros:

- Tax-free returns and maturity.

- Secure, government-backed investment.

- Long tenure with compounding benefits.

- Cons:

- 15-year lock-in period.

- Limited annual investment cap (₹1.5 lakh per year).

3. Unit Linked Insurance Plans (ULIPs) for Education

- What is it? A combination of investment and insurance, ensuring funds for higher education.

- Pros:

- Market-linked returns with insurance coverage.

- Partial withdrawals allowed after the lock-in period.

- Tax benefits under Section 80C and 10(10D).

- Cons:

- Subject to market risks.

- Higher charges compared to traditional savings schemes.

4. Child Education Mutual Funds

- What is it? A diversified equity or balanced mutual fund aimed at long-term education planning.

- Pros:

- Higher returns compared to traditional savings.

- Flexible investment options via SIPs.

- No long-term lock-in periods.

- Cons:

- Market risks involved.

- No guaranteed returns.

5. Fixed Deposits for Child Education

- What is it? A secure savings option with guaranteed interest.

- Pros:

- No market risks.

- Fixed returns with capital protection.

- Available in flexible tenures.

- Cons:

- Interest earnings are taxable.

- Lower returns compared to market-linked investments.

6. National Savings Certificate (NSC)

- What is it? A government-backed savings scheme with fixed returns.

- Pros:

- Fixed and guaranteed returns.

- Tax benefits under Section 80C.

- Safe investment option.

- Cons:

- Interest is taxable at maturity.

- Fixed tenure of 5 years.

7. Education Savings Plans by Banks & NBFCs

- What is it? Dedicated education savings accounts offered by banks and financial institutions.

- Pros:

- Customizable saving options based on tenure and risk appetite.

- Easy accessibility and liquidity.

- May include insurance benefits.

- Cons:

- Interest rates may be lower than other investment options.

- May not provide inflation-adjusted returns.

How to Choose the Best Plan?

- Assess Future Education Costs – Consider tuition fees, hostel charges, and other academic expenses.

- Start Early – The earlier you start saving, the more benefits you gain from compounding.

- Diversify Investments – Combine traditional savings plans with market-linked investments.

- Consider Inflation – Opt for plans that offer inflation-beating returns.

- Check Tax Benefits – Choose schemes that provide tax exemptions to maximize savings.

Conclusion

Investing in a child education saving plan is one of the best ways to secure your child’s future. By selecting the right mix of savings and investment plans, you can ensure that financial constraints do not come in the way of your child’s dreams. The key is to start early, diversify wisely, and review your investment periodically to stay on track. Begin today to provide your child with the education they deserve!