Tax Benefits of Real Estate Investments: What Every Investor Should Know

Introduction Real estate investing is one of the most effective ways to build wealth, and one of the biggest advantages is the array of tax benefits available to investors. Whether you’re a seasoned property owner or just starting out, understanding…

Understanding Capital Gains Tax: How to Minimize Your Liability

Capital gains tax is a levy imposed on the profit realized from the sale of a non-inventory asset, such as stocks, bonds, real estate, or other investments. In India, the tax structure for capital gains has undergone significant changes with…

How to Legally Reduce Your Taxable Income: Smart Planning Tips

Effective tax planning is a critical component of personal financial management, enabling individuals to optimize their income by legally minimizing tax liabilities. In India, the Income Tax Act, 1961, provides various provisions and deductions that taxpayers can leverage to reduce…

Tax-Saving Strategies for High-Income Earners in 2025

Navigating the complexities of taxation is crucial for high-income earners aiming to optimize their financial portfolios. The 2025 Union Budget of India introduced significant changes to the tax structure, offering both challenges and opportunities for taxpayers. This guide delves into…

Monthly Budgeting Checklist to Maximize Investment Returns

In today’s fast-paced world, managing personal finances effectively is crucial to achieving long-term financial goals. One of the most effective ways to enhance your wealth is by creating a structured monthly budgeting plan that not only manages your expenses but…

How to Build an Emergency Fund Without Compromising Your Investment Goals

In today’s unpredictable financial environment, having a robust emergency fund is not just a safety net – it’s a necessity. Simultaneously, achieving long-term investment goals is essential for securing a stable financial future. Many individuals face a common dilemma: How…

Budgeting for Market Volatility: How to Stay on Track During Uncertain Times

In today’s fast-paced and unpredictable economic landscape, market volatility is a common challenge faced by individuals and businesses alike. Uncertainty can lead to anxiety and financial strain, making it crucial to adopt smart budgeting strategies that provide stability and flexibility….

Hidden Expenses That Can Derail Your Investment Budget

When planning your investment budget, most people focus on obvious costs such as purchasing assets, transaction fees, and maintenance costs. However, hidden expenses can quietly eat into your returns and destabilize your financial plans. Ignoring these costs can lead to…

The 50/30/20 Rule: How to Adapt It for Long-Term Investments

The 50/30/20 rule is a popular budgeting strategy that simplifies managing personal finances. It recommends allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. While this rule is effective for everyday budgeting,…

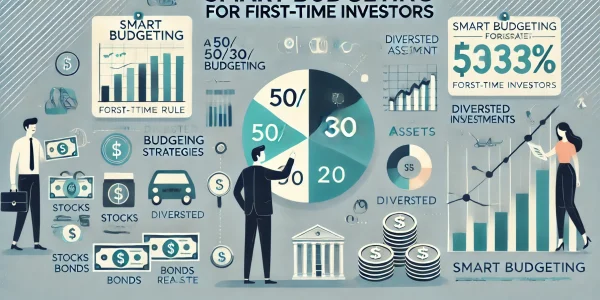

Smart Budgeting Strategies for First-Time Investors

Investing for the first time can be both exciting and overwhelming. With the right budgeting strategies, first-time investors can effectively manage their finances, mitigate risks, and optimize returns. This comprehensive guide outlines smart budgeting practices to help new investors make…