Budgeting for Market Volatility: How to Stay on Track During Uncertain Times

In today’s fast-paced and unpredictable economic landscape, market volatility is a common challenge faced by individuals and businesses alike. Uncertainty can lead to anxiety and financial strain, making it crucial to adopt smart budgeting strategies that provide stability and flexibility….

Hidden Expenses That Can Derail Your Investment Budget

When planning your investment budget, most people focus on obvious costs such as purchasing assets, transaction fees, and maintenance costs. However, hidden expenses can quietly eat into your returns and destabilize your financial plans. Ignoring these costs can lead to…

The 50/30/20 Rule: How to Adapt It for Long-Term Investments

The 50/30/20 rule is a popular budgeting strategy that simplifies managing personal finances. It recommends allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. While this rule is effective for everyday budgeting,…

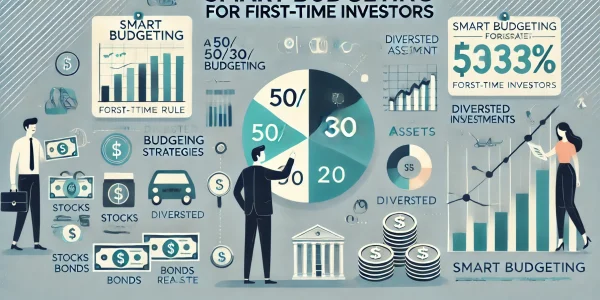

Smart Budgeting Strategies for First-Time Investors

Investing for the first time can be both exciting and overwhelming. With the right budgeting strategies, first-time investors can effectively manage their finances, mitigate risks, and optimize returns. This comprehensive guide outlines smart budgeting practices to help new investors make…

Hidden Expenses That Can Derail Your Investment Budget

When planning an investment budget, it’s easy to focus on upfront costs and expected returns. However, hidden expenses can sneak up and erode your profits if you’re not careful. Here are some common hidden costs to watch out for: 1….

The 50/30/20 Rule: How to Adapt It for Long-Term Investments

The 50/30/20 rule is a popular budgeting framework that helps you allocate your income into three categories: If you’re focusing on long-term investments, you can adapt this structure to prioritize wealth-building without compromising essential expenses. Here’s how: ✅ 1. Reframe…

Smart Budgeting Strategies for First-Time Investors

Entering the world of investing can be both exciting and intimidating. For first-time investors, smart budgeting is crucial to ensure long-term financial success while minimizing risks. Here are effective budgeting strategies to help you get started on your investment journey….

The Benefits of Life Insurance and When You Need It

Life insurance is one of the most important financial tools you can have. Whether you’re just starting out in your career or you’re thinking about securing your family’s future, life insurance provides peace of mind that your loved ones will…

Budgeting Tips for Single Parents: How to Make It Work

Being a single parent can be both rewarding and challenging. With the responsibilities of raising children, managing household tasks, and maintaining a career, budgeting might feel overwhelming. However, effective budgeting is crucial to ensure financial stability and create a secure…

How to Use Discounts, Coupons, and Cashback to Stay Within Budget: A Smart Investment Strategy

Staying within a budget is a common challenge for many, but with the right strategies, you can save more while spending wisely. One of the most effective ways to maximize savings is by using discounts, coupons, and cashback offers. These…