Understanding Bond Ratings: How They Affect Risk and Returns

Introduction Bond ratings play a crucial role in the financial market by helping investors assess the creditworthiness of bond issuers. These ratings, assigned by credit rating agencies, indicate the likelihood that a bond issuer will meet its debt obligations. Understanding…

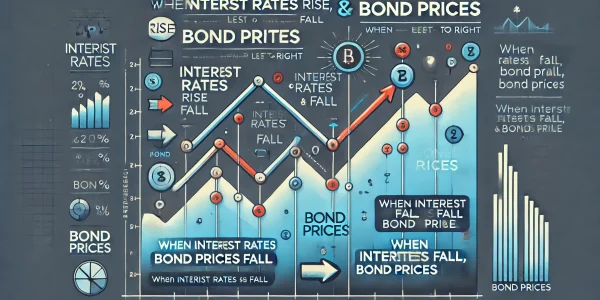

The Impact of Interest Rates on Bond Prices: What Investors Need to Know

Understanding the relationship between interest rates and bond prices is crucial for investors seeking to make informed decisions. Interest rates and bond prices share an inverse relationship: when interest rates rise, bond prices fall, and when interest rates fall, bond…

Sector Rotation Strategy: How to Profit from Market Cycles

Introduction Investing in the stock market can be a highly rewarding yet volatile journey. One of the most effective ways to navigate market fluctuations is through the Sector Rotation Strategy. This strategy capitalizes on economic cycles by shifting investments between…

Government vs. Corporate Bonds: Which One Should You Choose?

When deciding between government bonds and corporate bonds, the best choice depends on your financial goals, risk tolerance, and investment timeline. Here’s a breakdown to help you make an informed decision: ✅ Government Bonds What Are They?Debt securities issued by…

Green Bonds: Investing for Profit and a Sustainable Future

In today’s world, where environmental concerns are at the forefront, investors are increasingly looking for opportunities that not only offer financial returns but also contribute to a sustainable future. Green bonds have emerged as a powerful financial instrument that bridges…

Bond Laddering Strategy: How to Build a Diversified Bond Portfolio

What is Bond Laddering? Bond laddering is an investment strategy where an investor purchases bonds with varying maturity dates. This approach helps manage interest rate risk, ensures regular income, and provides liquidity at staggered intervals. By spreading investments across different…

The Impact of AI and Big Data on Real Estate Investment Decisions

Introduction The real estate industry has always been driven by data, from property values and market trends to neighborhood demographics. However, the advent of Artificial Intelligence (AI) and Big Data has revolutionized how investors make decisions. These technological advancements provide…

Real Estate Crowdfunding: How to Invest Without Buying Property

Real Estate Crowdfunding PSZ Real Estate Crowdfunding: How to Invest Without Buying Property – A DIY Guide Introduction Investing in real estate has traditionally required significant capital, property management expertise, and market research. However, real estate crowdfunding has changed the…

International Real Estate Investment: Risks and Opportunities

Introduction Investing in international real estate can be an exciting and profitable venture. It offers investors opportunities to diversify their portfolios, tap into emerging markets, and benefit from currency fluctuations. However, it also comes with challenges, including legal complexities, market…

Best Tax Strategies for Real Estate Investors to Maximize Returns

Introduction Real estate investment is a powerful way to build wealth, but taxes can significantly impact your returns. Smart tax strategies can help investors minimize liabilities and maximize profits legally. Understanding deductions, tax benefits, and structuring investments efficiently can lead…