Municipal Bonds vs. Treasury Bonds: Which Offers Better Tax Benefits?

When building a diversified investment portfolio, bonds play an essential role in ensuring stability, predictable income, and capital preservation. However, when it comes to tax efficiency, not all bonds are created equal. Municipal bonds (munis) and U.S. Treasury bonds (T-bonds)…

How to Choose the Best Mutual Fund for Your Financial Goals

Introduction Investing in mutual funds is an excellent way to grow your wealth, but selecting the right fund can be challenging. With so many options available, it’s essential to align your investment choices with your financial goals, risk tolerance, and…

Mutual Funds 101: A Beginner’s Guide to Investing Wisely

Introduction Mutual funds have become one of the most popular investment options for beginners and experienced investors alike. They offer a simple yet effective way to diversify a portfolio while benefiting from professional fund management. If you are new to…

Zero-Coupon Bonds: A High-Risk, High-Reward Investment?

Zero-coupon bonds, often considered a niche investment vehicle, provide investors with a unique opportunity to maximize returns by purchasing bonds at a deep discount and receiving a lump sum at maturity. While these bonds may offer higher returns than traditional…

Inflation-Linked Bonds: A Hedge Against Rising Prices

In an era of unpredictable inflation and fluctuating interest rates, protecting investment portfolios from the eroding effects of rising prices is essential. Inflation-linked bonds (ILBs), also known as inflation-protected securities, offer investors a powerful hedge against inflation by adjusting their…

Callable Bonds vs. Non-Callable Bonds: Pros and Cons for Investors

Bonds are a preferred investment choice for risk-averse investors seeking stable returns and predictable income. However, not all bonds are created equal. Callable bonds and non-callable bonds differ in terms of structure, risk, and return potential, making it essential for…

How Interest Rate Changes Impact Bond Prices: What Investors Should Know

Bonds are a popular investment vehicle for those seeking predictable income and lower volatility compared to stocks. However, one critical factor that can significantly impact the value of bonds is interest rate changes. As interest rates fluctuate, bond prices react…

Centralized vs. Decentralized Exchanges: Which One is Right for You?

Introduction Cryptocurrency trading has gained immense popularity, and investors now have multiple platforms to choose from. Among these, centralized exchanges (CEXs) and decentralized exchanges (DEXs) are the two primary types. Both have their unique features, advantages, and risks. Choosing the…

Crypto Trading Bots: Are They Profitable for Beginners?

Introduction With the growing popularity of cryptocurrency trading, many investors are turning to automation to maximize their profits. Crypto trading bots are software programs that execute trades based on predefined rules and algorithms. These bots promise to eliminate human error,…

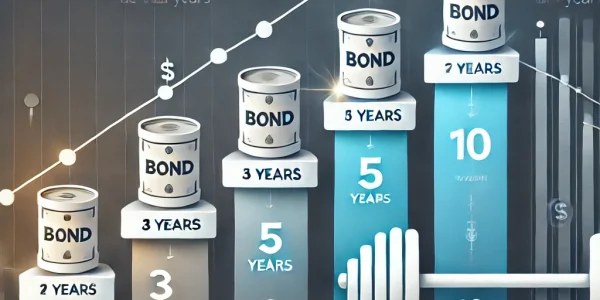

📚 Bond Laddering vs. Bond Barbells: Which Strategy is Right for You?

Investors often seek predictable returns and reduced risk through fixed-income investments like bonds. However, choosing the right bond investment strategy can make a significant difference in achieving financial goals. Two commonly used strategies are Bond Laddering and Bond Barbells. While…