How to Use Bonds to Protect Against Market Volatility

In today’s unpredictable financial landscape, market volatility is a concern for investors looking to protect their hard-earned money. While stocks are often seen as the go-to investment for growth, they come with a high degree of risk, especially during periods…

Bond Mutual Funds vs. Individual Bonds: Which Should You Choose?

When it comes to investing in bonds, you have two main options: bond mutual funds and individual bonds. Both of these investment vehicles offer distinct advantages and disadvantages depending on your financial goals, risk tolerance, and investment strategy. In this…

The Tax Benefits of Investing in Municipal Bonds

When it comes to tax-efficient investing, municipal bonds are often overlooked by many investors. However, municipal bonds can offer significant tax advantages, making them an appealing option for those looking to maximize their after-tax returns. In this blog, we will…

How Rising Interest Rates Impact Bond Prices and Investors

Investing in bonds is a popular strategy for generating stable income and diversifying your portfolio. However, one of the most significant factors that affect bond prices and returns is interest rates. When interest rates rise, they can have a major…

How to Choose Between Short-Term and Long-Term Bonds: A Comprehensive Guide

Investing in bonds is an excellent way to generate stable income while diversifying your investment portfolio. However, with so many options available, one key decision you’ll face as an investor is whether to choose short-term or long-term bonds. Each type…

The Role of Bonds in Retirement Planning: A Guide for Investors

Retirement planning is a crucial aspect of financial security. As you approach retirement, ensuring that you have a well-rounded investment portfolio becomes essential to provide stability and generate income. Among the many investment options available, bonds play a significant role…

Bond ETFs: A Guide to Investing in Bond Funds

Investing in bonds is a popular strategy for individuals seeking to diversify their portfolios and generate steady income. Traditionally, bond investments were made through purchasing individual bonds, but in recent years, bond exchange-traded funds (ETFs) have become a preferred investment…

What Are Zero-Coupon Bonds and How Do They Work?

When it comes to investing in bonds, many investors are familiar with the traditional coupon-paying bonds. However, there’s another type of bond that doesn’t pay interest in the usual way — these are called zero-coupon bonds. Zero-coupon bonds are unique…

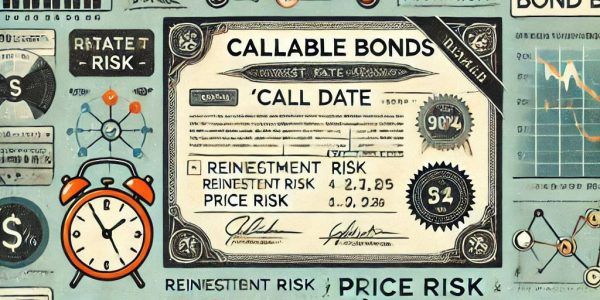

Understanding Callable Bonds and Their Risks

In the world of fixed-income securities, callable bonds are a unique and often misunderstood investment vehicle. While bonds are typically issued with a set interest rate and maturity date, callable bonds allow the issuer the right to redeem or “call”…

Exploring Foreign Bonds: What Investors Need to Know

When it comes to diversifying an investment portfolio, foreign bonds offer a unique opportunity for investors to gain exposure to international markets. Bonds are typically seen as a safer investment compared to stocks, and adding foreign bonds to your portfolio…