Comparing Retirement Planning Services: Which One Offers the Best Returns?

Best for Hands-Off Investors: Robo-Advisors Best for Personalized Strategies: Financial Advisors Best for Experienced Investors: Self-Directed Investment Accounts Conclusion Choosing the right retirement planning service depends on your financial goals, risk tolerance, and level of involvement. For most individuals, a…

Financial Planning for Millennials: Best Practices & Tools

Financial Planning Millennials ARS Financial Planning for Millennials: Best Practices & Tools Introduction Millennials, born between 1981 and 1996, face unique financial challenges compared to previous generations. Rising student debt, uncertain job markets, and high living costs make financial planning…

Investment Planning Strategies: Expert Insights & Recommendations

Introduction Investment planning is a critical component of financial stability and wealth building. A well-thought-out investment strategy helps individuals achieve their financial goals, whether it’s securing retirement, buying a home, or funding education. With expert insights and strategic recommendations, you…

Comprehensive Review of Budgeting Software: Which One Suits You Best?

Introduction Managing finances effectively is essential for achieving financial stability and long-term wealth. With the advent of technology, budgeting software has become an indispensable tool for individuals and businesses looking to track expenses, set savings goals, and optimize their financial…

Top-Rated Financial Advisors: How to Choose the Right One for You

Introduction Choosing a financial advisor is one of the most important decisions for your financial well-being. The right advisor can help you manage wealth, plan investments, reduce tax burdens, and secure your retirement. However, not all financial advisors are the…

Best Financial Planning Tools and Apps for Smart Money Management

Introduction In today’s fast-paced world, managing finances effectively is crucial for financial stability and long-term wealth growth. Whether you’re budgeting, investing, saving for retirement, or tracking expenses, financial planning tools and apps can simplify the process. This guide will explore…

How to Set and Achieve Realistic Financial Goals for a Secure Future

Financial security is a crucial aspect of life, yet many struggle with setting and achieving their financial goals. Whether you want to save for retirement, buy a home, or build wealth, establishing clear and realistic financial goals is the first…

Wealth-Building Habits That Can Make You Financially Independent

Financial independence is a goal many aspire to achieve, but only a few successfully attain it. The key to building wealth and securing financial freedom lies in developing strong financial habits. These habits, when consistently practiced, can help you accumulate…

How to Diversify Your Investments to Reduce Risk

Diversification is a crucial principle in investment strategy that helps reduce risk while maximizing potential returns. Whether you are a seasoned investor or just starting, a well-diversified portfolio can protect your assets against market volatility and economic downturns. This article…

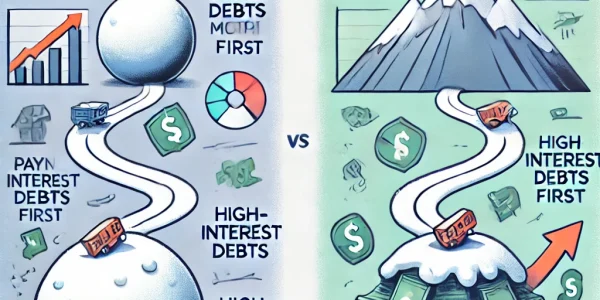

Debt Repayment Strategies: Snowball vs. Avalanche Method Explained

Managing debt can be overwhelming, but having a structured repayment strategy can help you regain financial control and achieve financial freedom. Two of the most popular methods for debt repayment are the Snowball Method and the Avalanche Method. Both approaches…