Best Financial Planning Tools and Apps for Smart Money Management

Introduction In today’s fast-paced world, managing finances effectively is crucial for financial stability and long-term wealth growth. Whether you’re budgeting, investing, saving for retirement, or tracking expenses, financial planning tools and apps can simplify the process. This guide will explore…

How to Set and Achieve Realistic Financial Goals for a Secure Future

Financial security is a crucial aspect of life, yet many struggle with setting and achieving their financial goals. Whether you want to save for retirement, buy a home, or build wealth, establishing clear and realistic financial goals is the first…

Wealth-Building Habits That Can Make You Financially Independent

Financial independence is a goal many aspire to achieve, but only a few successfully attain it. The key to building wealth and securing financial freedom lies in developing strong financial habits. These habits, when consistently practiced, can help you accumulate…

How to Diversify Your Investments to Reduce Risk

Diversification is a crucial principle in investment strategy that helps reduce risk while maximizing potential returns. Whether you are a seasoned investor or just starting, a well-diversified portfolio can protect your assets against market volatility and economic downturns. This article…

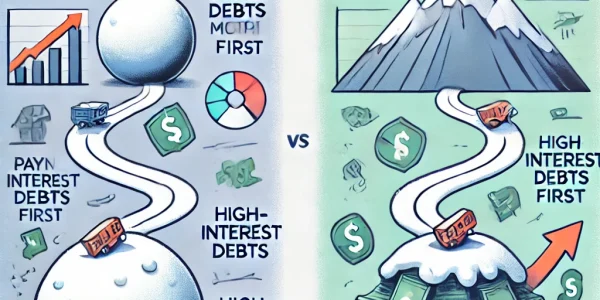

Debt Repayment Strategies: Snowball vs. Avalanche Method Explained

Managing debt can be overwhelming, but having a structured repayment strategy can help you regain financial control and achieve financial freedom. Two of the most popular methods for debt repayment are the Snowball Method and the Avalanche Method. Both approaches…

The Best Ways to Improve Your Credit Score Fast

Your credit score plays a crucial role in your financial health. A high credit score can help you secure better loan rates, get approved for credit cards, and even affect job and rental applications. If your score isn’t where you…

Estate Planning: Why You Need a Will and How to Get Started

Estate planning is a crucial aspect of financial management that ensures your assets are distributed according to your wishes after your passing. Many people overlook the importance of having a will, assuming it’s only for the wealthy or elderly. However,…

Understanding Insurance: Which Policies Do You Really Need?

Insurance is an essential part of financial planning, providing protection against unexpected events and ensuring financial stability. However, with so many types of insurance available, it can be overwhelming to determine which policies are truly necessary. This guide will help…

How to Plan for Your Child’s Higher Education Without Debt

A child’s higher education is one of the most significant investments a parent can make. However, the rising costs of tuition and associated expenses can put a financial strain on families, leading many to take on substantial debt. The good…

Passive Income Ideas to Secure Your Financial Future

In today’s fast-paced world, relying solely on a traditional 9-to-5 job can be risky. Establishing multiple income streams, especially passive income, is a smart way to secure your financial future. Passive income allows you to earn money with minimal ongoing…