In the dynamic world of cryptocurrency, investors are always seeking innovative strategies to maximize returns while minimizing risk. One such strategy, traditionally used in the bond market, is bond laddering. Applied to cryptocurrency investments, a bond laddering approach can provide stability, consistent returns, and better risk management.

In this comprehensive guide, we will explore the concept of bond laddering in cryptocurrency, its benefits, how to implement it effectively, and essential precautions to stay legally compliant.

What is Bond Laddering in Cryptocurrency?

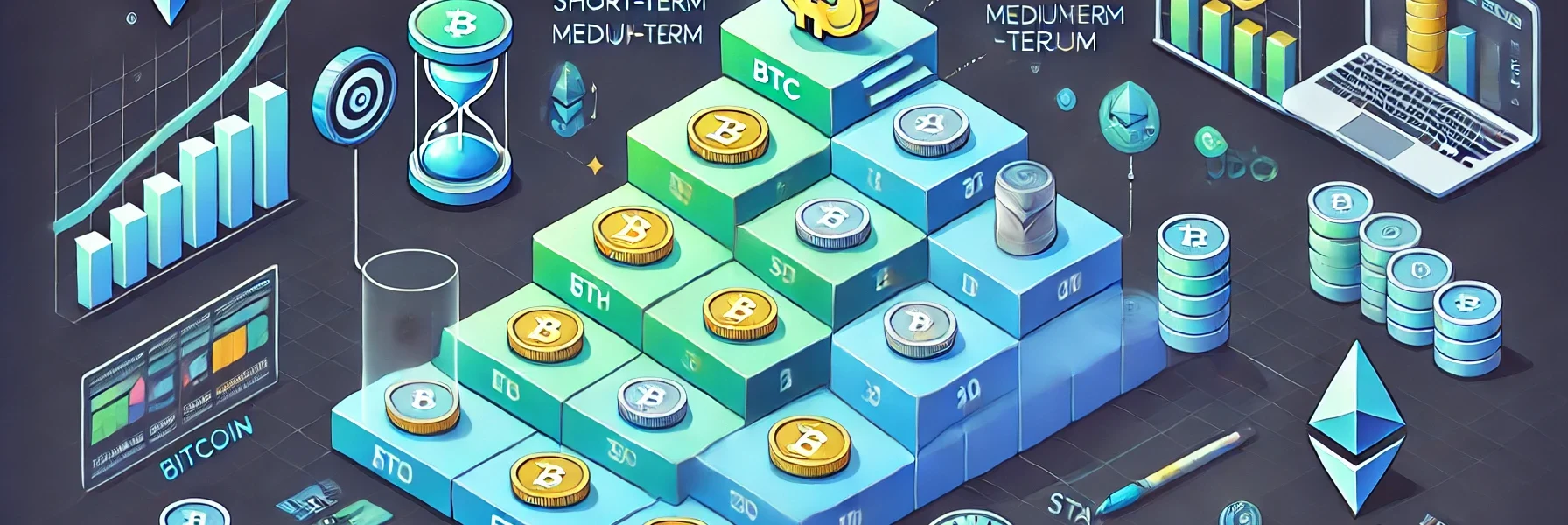

Bond laddering is an investment strategy where an investor spreads their funds across multiple fixed-income securities with staggered maturity dates. In the cryptocurrency market, this concept can be adapted by diversifying investments across different digital assets, staking platforms, or decentralized finance (DeFi) protocols with varied lock-up periods.

By adopting a crypto bond laddering strategy, investors can maintain liquidity while earning steady returns from different assets maturing at various intervals.

Why Bond Laddering Works in Cryptocurrency

Cryptocurrency markets are known for volatility. Bond laddering helps mitigate risk by:

- Diversifying Investments: Reducing dependence on a single asset or platform.

- Managing Liquidity: Providing regular cash flows from assets maturing at different times.

- Reducing Market Timing Risks: Avoiding the need to time the market perfectly.

How to Implement a Bond Laddering Strategy in Cryptocurrency

To effectively implement this strategy, follow these structured steps:

1. Define Your Investment Goals

- Risk Tolerance: Evaluate how much risk you are willing to take.

- Return Expectations: Set realistic expectations for yield.

- Investment Horizon: Determine whether your goal is short-term liquidity or long-term wealth accumulation.

2. Select Diverse Crypto Assets

Choose a mix of reliable cryptocurrencies and DeFi products that offer staking or yield farming options. Examples include:

- Stablecoins: USDT, USDC (for lower volatility).

- Blue-Chip Cryptos: Bitcoin (BTC), Ethereum (ETH).

- DeFi Tokens: AAVE, Uniswap (for higher yields but greater risk).

3. Stagger Investment Maturities

Allocate your capital across different timeframes. For instance:

- Short-Term (3-6 months): Low-risk, liquid assets.

- Medium-Term (1-2 years): Diversified DeFi protocols.

- Long-Term (3+ years): Core crypto holdings like BTC and ETH.

4. Reinvest Upon Maturity

When an asset reaches maturity (i.e., unlocks), reinvest in new opportunities or withdraw profits to maintain the ladder structure.

5. Monitor and Adjust

Regularly review your portfolio to ensure:

- Yields remain competitive.

- Platforms maintain their security and legal compliance.

- Adjustments align with changing market conditions.

Benefits of Bond Laddering in Cryptocurrency

- Consistent Cash Flow: Regular maturity ensures periodic liquidity.

- Risk Diversification: Spread across various assets reduces reliance on any single investment.

- Market Volatility Protection: Long-term holdings smooth out market fluctuations.

- Yield Optimization: Higher returns from longer-term DeFi strategies.

Risks and Legal Considerations

While bond laddering offers advantages, the cryptocurrency market carries inherent risks. Here are key areas to consider to stay legally compliant and protect your investments:

1. Regulatory Compliance

- Ensure you use platforms compliant with local financial regulations.

- Avoid engaging in unauthorized or unregistered security offerings.

2. Tax Implications

- Cryptocurrency earnings may be taxable in many jurisdictions. Consult a tax professional to stay compliant.

- Keep detailed records of transactions and income.

3. Platform Security

- Use only reputable and audited DeFi platforms.

- Implement strong cybersecurity practices (e.g., hardware wallets, multi-factor authentication).

4. KYC/AML Procedures

- Verify the legitimacy of investment platforms that adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

5. Asset Volatility

- Diversify into stablecoins to mitigate major price swings.

- Avoid over-leveraging or relying on a single asset class.

Example of a Cryptocurrency Bond Ladder

Here is a practical example to illustrate how you could structure a cryptocurrency bond ladder:

| Term | Asset | Investment Amount | Annual Yield | Maturity Date |

|---|---|---|---|---|

| Short-Term | USDC Staking | $5,000 | 5% | 6 Months |

| Medium-Term | Ethereum Staking | $10,000 | 7% | 1 Year |

| Long-Term | Bitcoin Holding | $15,000 | 10% | 3 Years |

Pro Tips for Effective Crypto Bond Laddering

- Start Small: Begin with a small, diversified portfolio to understand the process.

- Automate: Use automated staking platforms for consistent returns.

- Stay Informed: Keep up with regulatory changes and emerging technologies.

- Diversify: Balance between high-yield DeFi and stable, established assets.

- Exit Strategy: Have a clear exit strategy for emergency liquidity needs.

Conclusion

A bond laddering strategy in cryptocurrency is a smart way to balance risk and reward. By spreading investments across different assets and maturity dates, you can secure consistent returns while protecting yourself from market volatility.

Always conduct thorough research, adhere to legal requirements, and continuously monitor your investments to optimize this strategy effectively. With careful planning and disciplined execution, crypto bond laddering can be a valuable addition to your investment toolkit.