What is Bond Laddering?

Bond laddering is an investment strategy where an investor purchases bonds with varying maturity dates. This approach helps manage interest rate risk, ensures regular income, and provides liquidity at staggered intervals. By spreading investments across different maturities, investors can reinvest maturing bonds into new ones, potentially at higher rates.

Benefits of Bond Laddering

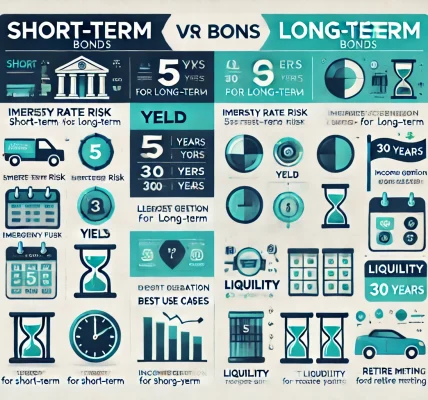

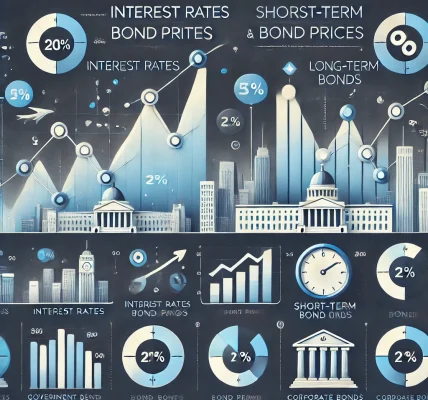

- Reduced Interest Rate Risk: Diversifying maturity dates minimizes the impact of fluctuating interest rates.

- Steady Income Stream: As bonds mature at different intervals, they provide a consistent cash flow.

- Increased Liquidity: Regular bond maturities offer access to cash without selling long-term investments.

- Portfolio Diversification: Investing in different types of bonds (government, corporate, municipal) reduces risk.

How to Build a Bond Ladder

- Define Your Investment Goals: Determine your risk tolerance, time horizon, and income needs. Are you seeking steady income, capital preservation, or growth?

- Choose the Ladder Length: Decide how many rungs (maturity periods) you want. A common ladder spans 3-10 years, but it can vary based on your financial goals.

- Select Bond Types: Diversify with government bonds (low risk), corporate bonds (higher yields), and municipal bonds (tax advantages).

- Distribute Investments Evenly: Allocate funds across different maturities. For example, if you invest $100,000 in a 5-year ladder, you might buy five $20,000 bonds maturing each year.

- Reinvest Maturing Bonds: As each bond matures, reinvest the principal into a new long-term bond to maintain the ladder and benefit from potential rate increases.

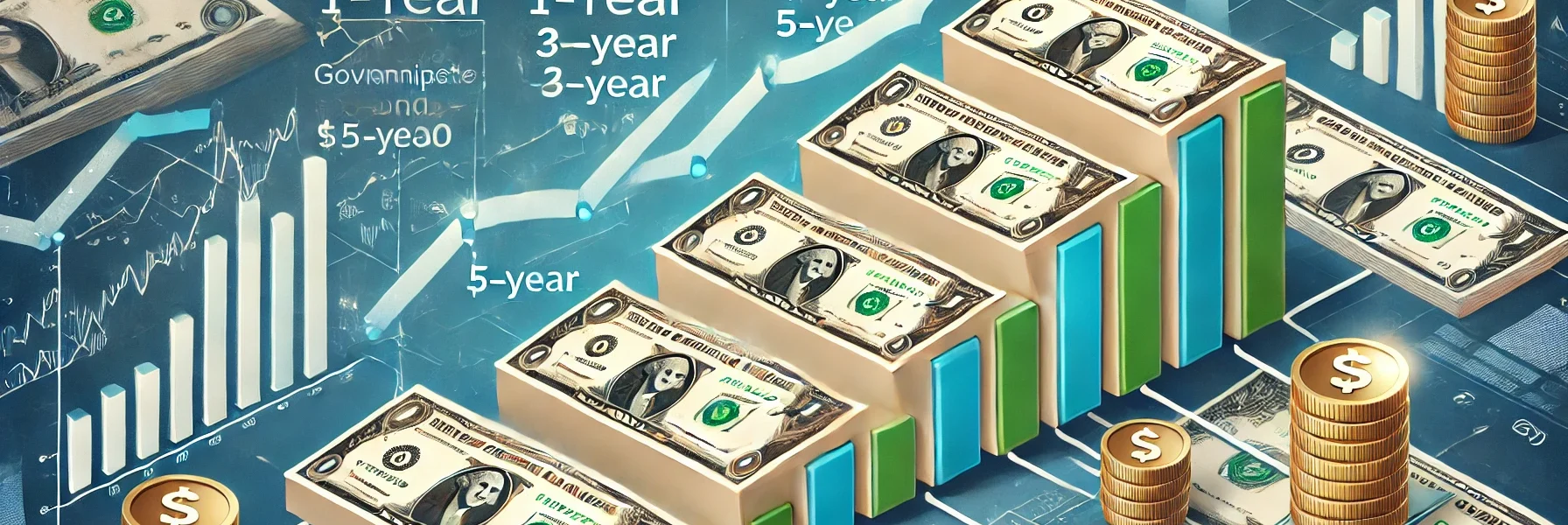

Example of a Bond Ladder

Consider you have $50,000 to invest and want a 5-year ladder:

- $10,000 in a 1-year bond

- $10,000 in a 2-year bond

- $10,000 in a 3-year bond

- $10,000 in a 4-year bond

- $10,000 in a 5-year bond

Each year, as a bond matures, you reinvest in a new 5-year bond, continuing the cycle.

Best Practices for Bond Laddering

- Diversify Issuers: Include bonds from different issuers to minimize credit risk.

- Monitor Interest Rates: Keep track of market conditions to optimize reinvestment.

- Review Regularly: Adjust your ladder as needed to align with changing financial goals.

- Understand Tax Implications: Different bonds have varied tax treatments; consult a financial advisor.

Is Bond Laddering Right for You?

Bond laddering is ideal for conservative investors seeking regular income and reduced volatility. It suits retirees, income-focused investors, and those wanting to preserve capital while managing interest rate fluctuations.

By following these steps and best practices, you can build a resilient and diversified bond portfolio that adapts to changing economic conditions.