Introduction

Planning for retirement is one of the most important financial decisions you will ever make. Without proper savings and investments, post-retirement life can be financially challenging. To ensure a comfortable and stress-free retirement, you need to choose the best retirement savings plan that aligns with your financial goals and risk tolerance.

In this guide, we will explore the best retirement saving plans, their benefits, tax advantages, and strategies to maximize your returns while ensuring financial security.

Why Retirement Planning is Essential

- Financial Security – Retirement savings provide a stable income stream after you stop working.

- Inflation Protection – The cost of living increases over time, and a well-planned retirement fund ensures that you can maintain your lifestyle.

- Medical Expenses – Healthcare costs tend to rise as you age, making a well-funded retirement essential.

- Avoiding Dependence – A robust retirement plan ensures you don’t have to rely on family members or government support.

- Tax Benefits – Many retirement plans offer tax advantages that help you grow your wealth efficiently.

Best Retirement Saving Plans

1. Employer-Sponsored Retirement Plans

(A) 401(k) Plan (For U.S. Residents)

✅ Employer Contributions – Many employers match your contributions, increasing your savings. ✅ Tax Benefits – Contributions are tax-deferred, reducing taxable income. ✅ Investment Growth – Funds grow tax-free until withdrawal.

📌 Tip: Maximize employer match contributions to get free money.

(B) Employee Provident Fund (EPF) (For India)

✅ Mandatory Contributions – Employees contribute a fixed percentage of their salary. ✅ Government-Backed Security – Ensures a steady retirement corpus. ✅ Tax Benefits – Contributions and interest earned are tax-free.

📌 Tip: Increase voluntary contributions to grow your savings faster.

2. Individual Retirement Accounts (IRA)

(A) Traditional IRA

✅ Tax-Deferred Growth – Pay taxes only when you withdraw funds. ✅ Flexible Investment Options – Choose from stocks, bonds, mutual funds, etc. ✅ Contribution Limits – Set annually by the IRS.

📌 Tip: Choose a mix of high and low-risk investments to balance growth and security.

(B) Roth IRA

✅ Tax-Free Withdrawals – Contributions are made with after-tax income. ✅ No Required Minimum Distributions (RMDs) – Funds can grow indefinitely. ✅ Great for Young Investors – Tax-free growth over decades maximizes retirement wealth.

📌 Tip: Open a Roth IRA early to maximize compounding benefits.

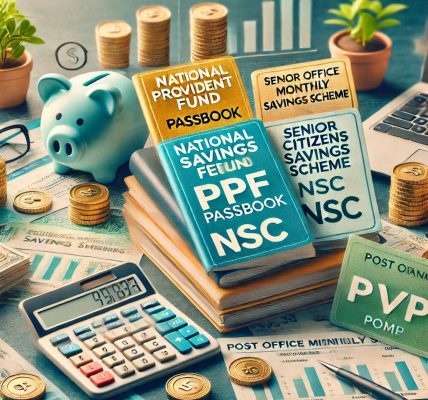

3. Government-Backed Retirement Plans

(A) National Pension System (NPS) – India

✅ Market-Linked Returns – Invests in equities and debt instruments. ✅ Tax Benefits – Up to ₹50,000 deduction under Section 80CCD(1B). ✅ Pension Benefits – Provides a lifelong pension post-retirement.

📌 Tip: Allocate investments based on your risk tolerance for better returns.

(B) Public Provident Fund (PPF) – India

✅ Guaranteed Returns – Government-backed with stable interest rates. ✅ Tax-Free Growth – Contributions and interest earned are tax-exempt. ✅ Long-Term Investment – Lock-in period of 15 years ensures disciplined saving.

📌 Tip: Start a PPF account early to maximize compounding interest.

4. Annuities – Secure Lifetime Income

✅ Guaranteed Income – Receive regular payments after retirement. ✅ Customizable Plans – Choose between fixed, variable, or indexed annuities. ✅ Tax-Deferred Growth – Contributions grow tax-free until withdrawal.

📌 Tip: Combine annuities with other investments to create a balanced retirement portfolio.

5. Mutual Funds and Exchange-Traded Funds (ETFs) for Retirement

✅ Higher Growth Potential – Invest in stocks and bonds to build long-term wealth. ✅ Diversification – Reduce risk by spreading investments across multiple assets. ✅ Liquidity – Easily withdraw funds if needed.

📌 Tip: Opt for low-cost index funds to reduce fees and maximize returns.

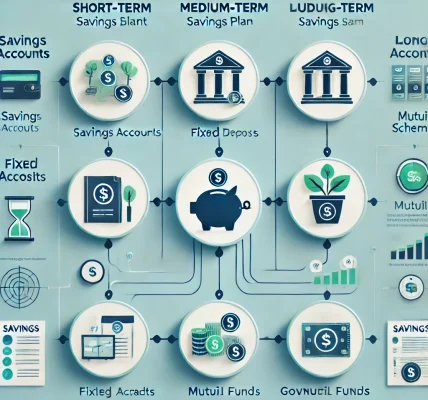

How to Choose the Right Retirement Plan

- Assess Your Retirement Goals – Estimate how much you need to maintain your desired lifestyle.

- Consider Risk Tolerance – Young investors can take more risks, while retirees should focus on stability.

- Maximize Employer Benefits – Take advantage of employer contributions in 401(k) or EPF.

- Look for Tax Advantages – Choose plans that offer tax-deferred or tax-free growth.

- Diversify Investments – Balance between equity, fixed income, and safe investments.

- Start Early – The earlier you invest, the more you benefit from compounding growth.

Mistakes to Avoid in Retirement Planning

❌ Delaying Savings – Start as early as possible to benefit from compound interest. ❌ Relying Only on One Plan – Diversify across different retirement saving options. ❌ Ignoring Inflation – Choose investments that outpace inflation. ❌ Withdrawing Funds Prematurely – Early withdrawals may lead to penalties and tax liabilities. ❌ Not Reviewing Your Plan Regularly – Adjust investments based on financial goals and market conditions.

Conclusion

Securing your future through smart retirement planning ensures financial freedom and peace of mind. By choosing the right retirement savings plan, maximizing employer benefits, and diversifying investments, you can build a stable and comfortable post-retirement life.

🚀 Start planning today to enjoy a stress-free retirement tomorrow! ✅