International Bonds: Opportunities and Risks in Global Markets

Investing in international bonds can be an attractive option for investors looking to diversify their portfolios and access global markets. With opportunities for higher yields, currency diversification, and exposure to growing economies, international bonds can play a crucial role in…

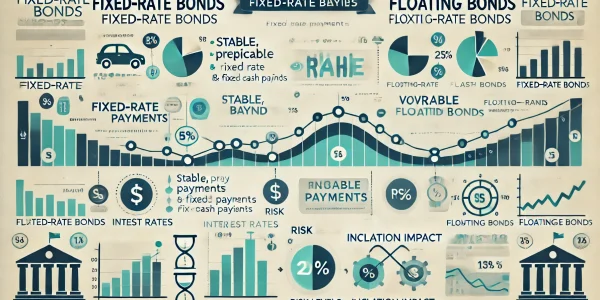

Fixed vs. Floating Rate Bonds: Which Is Better for Your Portfolio?

When it comes to bond investments, understanding the difference between fixed-rate bonds and floating-rate bonds is essential. Both types of bonds can play a crucial role in a well-balanced investment portfolio, offering unique advantages and risks. The right choice depends…

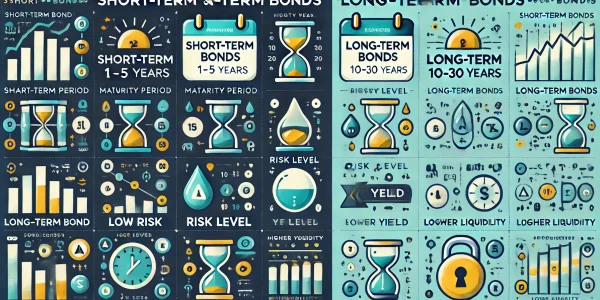

Short-Term vs. Long-Term Bonds: Pros, Cons, and Best Use Cases

Bonds play a critical role in an investor’s portfolio by offering predictable income and diversification. When choosing between short-term and long-term bonds, understanding their differences is essential to align with your financial goals and risk tolerance. Each bond type offers…

Tax-Free Bonds: Benefits, Risks, and How to Invest

Tax-free bonds are a popular investment option for individuals seeking steady income while minimizing tax liabilities. These bonds offer interest income exempt from federal or state taxes, making them attractive to high-income earners and tax-conscious investors. However, like any investment,…

Green Bonds: Investing for Profit and a Sustainable Future

In today’s rapidly evolving financial landscape, investors are increasingly seeking opportunities that deliver both financial returns and positive environmental impact. One such investment avenue gaining significant traction is green bonds. These bonds offer a unique way to align your portfolio…

How Interest Rate Changes Affect Bond Prices: What Investors Need to Know

Understanding how interest rate changes impact bond prices is essential for anyone investing in bonds. Whether you are a seasoned investor or new to the world of fixed-income securities, recognizing this relationship can help you make informed decisions and protect…

The Role of Bonds in a Diversified Investment Portfolio

In the world of investing, diversification is a key strategy to manage risk while maximizing potential returns. One essential component of a diversified portfolio is bonds. Bonds offer a reliable income stream and play a stabilizing role, particularly during periods…

Understanding Bond Ratings: What They Mean for Your Investments

When it comes to investing in bonds, understanding bond ratings is crucial for making informed decisions. Bond ratings provide a clear indication of the creditworthiness of a bond issuer, helping investors gauge the risk level and potential return on their…

Corporate Bonds vs. Government Bonds: Which One Is Right for You?

Investing in bonds is a popular way to generate steady income while preserving capital. Among the many bond options available, corporate bonds and government bonds are two primary choices for investors. Each type comes with unique features, benefits, and risks….

Bond Laddering Strategy in Cryptocurrency: How to Maximize Returns and Minimize Risk

In the dynamic world of cryptocurrency, investors are always seeking innovative strategies to maximize returns while minimizing risk. One such strategy, traditionally used in the bond market, is bond laddering. Applied to cryptocurrency investments, a bond laddering approach can provide…