Understanding Sovereign Bonds: Are They Risk-Free?

Introduction Sovereign bonds have long been considered a safe haven for investors seeking stable returns and low risk. Issued by national governments, these bonds offer an opportunity to invest in a country’s economic future while earning periodic interest. However, despite…

Bonds vs. Fixed Deposits: Which Investment Offers Better Returns?

Introduction When it comes to safe and stable investments, two popular options often come to mind: bonds and fixed deposits (FDs). Both offer a predictable return on investment, but each has unique characteristics that affect their profitability, risk levels, and…

How to Spot Undervalued Bonds in the Market

Introduction In the world of investing, finding undervalued bonds can offer a lucrative opportunity for those who know where to look. Undervalued bonds are securities that trade below their intrinsic value, providing investors with potential capital appreciation and higher yields….

Investing in ESG Bonds: A Guide to Ethical Fixed Income Investing

Introduction In today’s world, investors are becoming increasingly conscious of how their money impacts society and the environment. This growing awareness has fueled the rise of Environmental, Social, and Governance (ESG) bonds. These bonds not only offer potential financial returns…

Are Bonds a Good Investment During a Recession?

During periods of economic uncertainty, investors often seek safe and stable assets to protect their portfolios. One of the most common questions during a recession is whether bonds are a good investment. Bonds, known for their lower risk compared to…

Bond Refinancing: When and Why Companies Do It

Bond refinancing is a common financial strategy used by companies to improve their debt structure and reduce costs. This process involves issuing new bonds to pay off existing ones, often to take advantage of lower interest rates or more favorable…

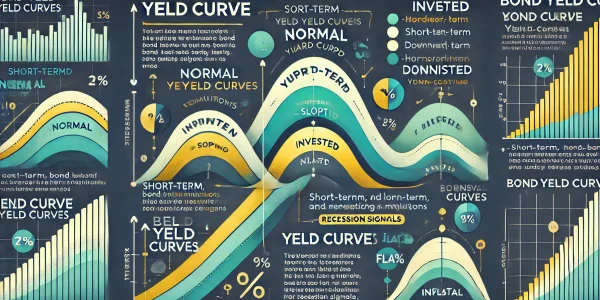

How to Read and Analyze Bond Yield Curves

Understanding bond yield curves is essential for investors who want to make informed decisions about bond investments and overall market conditions. Yield curves provide a visual representation of the relationship between bond yields and maturities, offering insights into future interest…

A Beginner’s Guide to Understanding and Investing in Bonds

Bonds are a fundamental part of the investment world, offering a reliable way to preserve capital and earn steady returns. For beginners, understanding how bonds work and how to invest in them is key to building a balanced and diversified…

The Impact of Credit Rating Agencies on Bond Investments

Credit rating agencies play a critical role in the global financial markets by providing independent assessments of the creditworthiness of bond issuers. Their ratings influence investor decisions, bond yields, and the overall perception of risk in bond markets. Understanding the…

How to Hedge Against Market Volatility Using Bonds

Market volatility is an inevitable part of investing. It can be triggered by economic uncertainty, geopolitical tensions, changes in interest rates, or unforeseen global events. While volatility can present opportunities, it also increases risk and uncertainty for investors. One effective…