Income Tax Planning for Small Business Owners & Entrepreneurs

Tax planning is an essential aspect of financial management for small business owners and entrepreneurs. By strategically planning their taxes, business owners can reduce tax liabilities, optimize profits, and ensure compliance with legal regulations. This blog will provide an in-depth…

How to Use HUF (Hindu Undivided Family) to Save Taxes in India

Tax planning is a crucial aspect of financial management, and the Hindu Undivided Family (HUF) structure offers a legitimate way for Indian families to reduce their tax burden. HUF is a separate legal entity that can earn income, own assets,…

Understanding Tax Deductions on Medical Expenses

Tax planning is an essential aspect of personal finance, helping individuals optimize their tax liabilities while ensuring compliance with legal regulations. One significant area where tax deductions can be beneficial is medical expenses. Understanding how medical expenses can be deducted,…

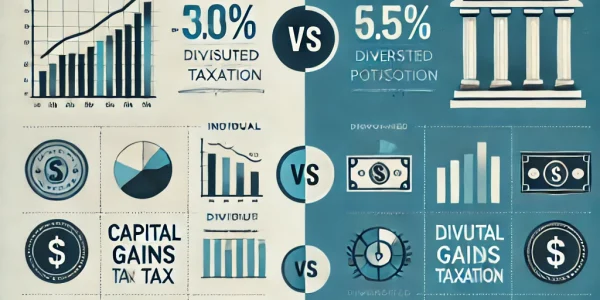

Tax Implications of Investing in Stocks vs. Mutual Funds

Investing in stocks and mutual funds can be an excellent way to grow wealth over time, but understanding the tax implications of these investment choices is crucial for maximizing returns and minimizing tax liabilities. In this guide, we will explore…

Optimizing Your Retirement Contributions for Tax Benefits

Planning for retirement is essential to secure your financial future, and one of the most effective ways to do so is by maximizing tax-advantaged contributions. By optimizing your retirement contributions, you not only build long-term wealth but also reduce your…

Tax Benefits of Home Loans: How to Save More on Taxes

Owning a home is not only a major life milestone but also a smart financial move, especially when it comes to tax savings. A home loan can provide several tax benefits that help reduce your overall tax liability while making…

How to Leverage Tax Credits to Maximize Savings

Tax credits are one of the most effective ways to reduce your overall tax liability and maximize savings. Unlike tax deductions, which lower your taxable income, tax credits directly reduce the amount of tax you owe, offering a dollar-for-dollar reduction….

Best Tax-Saving Investment Strategies for Young Professionals

For young professionals, tax planning is crucial to building a strong financial foundation while maximizing savings. Smart investment strategies not only help grow wealth but also minimize tax liabilities. By leveraging tax-efficient investments, young professionals can legally reduce taxable income…

Tax Planning for Freelancers and Gig Workers: Essential Tips

Freelancing and gig work offer flexibility and independence, but they also come with unique tax challenges. Unlike traditional employees, freelancers must handle their own taxes, deductions, and compliance with tax laws. Smart tax planning can help freelancers reduce tax liabilities…

Smart Ways to Reduce Your Taxable Income Legally

Taxes can take a significant portion of your income, but with proper planning, you can legally reduce your taxable income and maximize your savings. The key is to use government-approved deductions, credits, and exemptions wisely while ensuring compliance with tax…