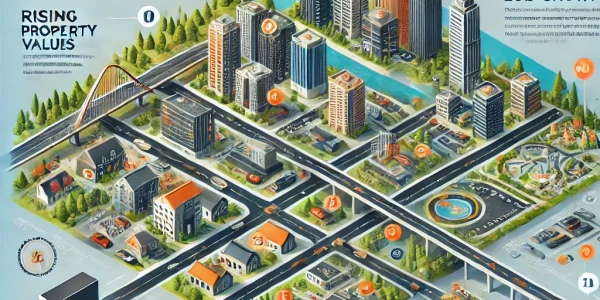

How to Identify High-Growth Areas for Real Estate Investment

Investing in real estate is one of the most effective ways to build long-term wealth, but choosing the right location is crucial. High-growth areas offer significant appreciation potential, strong rental demand, and profitable returns. In this guide, we’ll walk you…

Commercial vs. Residential Real Estate: Which is More Profitable?

Investing in real estate can be a lucrative venture, but one of the most crucial decisions investors face is choosing between commercial and residential properties. Both options come with their own set of risks, rewards, and investment strategies. This DIY…

The Impact of Interest Rates on Real Estate Investments

Interest rates play a crucial role in real estate investments. They affect everything from mortgage costs to property values and investor profitability. Whether you’re a first-time investor or a seasoned real estate professional, understanding how interest rates influence the market…

Smart Strategies for Investing in Vacation Rental Properties

Investing in vacation rental properties can be a lucrative and fulfilling venture. With the rise of platforms like Airbnb and Vrbo, short-term rental investments have become increasingly popular among real estate investors. However, success in this market requires careful planning,…

Hidden Costs in Real Estate Investments: What Every Buyer Should Know

Investing in real estate is an exciting and potentially lucrative venture, but it comes with more costs than just the price tag of the property. Many first-time buyers and even experienced investors often overlook hidden costs that can significantly impact…

Tax Planning for Parents: How to Save More with Child Education & Expenses

Tax planning is an essential aspect of financial management, especially for parents who bear the responsibility of their child’s education and other related expenses. By utilizing the right tax-saving strategies, parents can optimize their tax liabilities while ensuring a secure…

The Impact of Cryptocurrency Investments on Your Taxes

Cryptocurrency investments have gained immense popularity in recent years. While they offer lucrative returns, it is crucial for investors to understand the tax implications of dealing in digital assets. Tax laws regarding cryptocurrencies vary from country to country, and non-compliance…

A Guide to Tax-Saving for NRIs (Non-Resident Indians)

Tax planning is an essential aspect of financial management for Non-Resident Indians (NRIs) who earn income in India. Understanding the tax laws and exemptions available can help NRIs optimize their tax liabilities legally. This guide provides comprehensive insights into tax-saving…

How to Reduce Capital Gains Tax on Property Sales

Selling a property can lead to significant capital gains tax liability, which can impact the overall profit from the sale. However, strategic tax planning can help minimize capital gains tax legally. In this guide, we will explore various ways to…

Tax Advantages of Buying Electric Vehicles: What You Need to Know

As electric vehicles (EVs) gain popularity in India, many consumers are considering their financial and environmental benefits. One of the biggest advantages of purchasing an electric vehicle is the potential tax savings. The Indian government provides various incentives and tax…