Estate planning is a crucial aspect of ensuring that your assets are managed and distributed according to your wishes after you pass away. While many people associate estate planning with wills, trusts, and life insurance, saving plans play an essential role in securing your financial future and ensuring that your loved ones are financially protected.

In this blog, we’ll explore how saving plans fit into the larger framework of estate planning and why they are a key component of your financial legacy.

What is Estate Planning?

Before we dive into the role of saving plans, let’s first understand what estate planning is. Estate planning involves organizing and managing your assets—such as real estate, investments, bank accounts, and life insurance—to ensure they are passed on to your beneficiaries according to your wishes. It also involves preparing for events that may incapacitate you, such as illness or disability.

Estate planning typically includes:

- Wills and Trusts: Legal documents that outline how your assets should be distributed.

- Power of Attorney: A document that designates someone to manage your financial and health-related decisions if you become incapacitated.

- Life Insurance: Provides financial protection to your beneficiaries after your death.

However, saving plans also play a significant role in securing your estate and ensuring your financial goals are met, both during your lifetime and after.

How Do Saving Plans Fit Into Estate Planning?

Saving plans are investment tools that help individuals build wealth and save for long-term financial goals, such as retirement, education, and even estate planning. These plans can also contribute to funding your estate and preserving your legacy.

Here’s how saving plans can support your estate planning:

1. Building a Financial Legacy for Your Beneficiaries

One of the main goals of estate planning is to ensure that your family and loved ones are financially taken care of after you’re gone. Saving plans such as life insurance, retirement accounts, and fixed deposits can accumulate wealth over time, providing a foundation for your beneficiaries.

For example, investing in long-term saving plans, such as PPF (Public Provident Fund) or SIPs (Systematic Investment Plans), can help you accumulate funds that will eventually be transferred to your heirs as part of your estate.

Why It’s Important:

By contributing to your savings regularly, you ensure that the financial burden on your loved ones is minimized. Additionally, having substantial funds in these saving plans can make it easier for your beneficiaries to manage ongoing living expenses, education, or other needs.

2. Tax Efficiency in Estate Transfer

Taxes can significantly reduce the value of your estate when it is passed on to your heirs. However, certain saving plans come with tax benefits that can reduce the tax burden on your estate. This ensures more of your wealth is preserved for your beneficiaries.

For example:

- ELSS (Equity-Linked Savings Schemes): These tax-saving mutual funds offer deductions under Section 80C of the Income Tax Act. They not only help you save taxes during your lifetime but also provide an opportunity for growth, which will benefit your heirs.

- Fixed Deposits (FDs): While FDs may not offer the same tax-saving benefits as some other plans, they provide safety and liquidity, making them useful in building a tax-efficient estate plan.

Why It’s Important:

A tax-efficient estate plan ensures that your beneficiaries receive the maximum value of your assets after taxes. With the right combination of saving plans, you can legally minimize your estate’s tax liability.

3. Creating a Buffer for Healthcare and End-of-Life Expenses

Healthcare costs and end-of-life expenses, such as funeral costs, can quickly deplete your savings if not adequately planned for. Including saving plans in your estate planning helps create a financial cushion for these expenses, relieving your family of the burden during a difficult time.

- Health Insurance and Critical Illness Plans: While these aren’t strictly saving plans, they can complement your overall estate planning strategy by ensuring your medical expenses are covered.

- Emergency Savings Fund: Setting aside money in high-interest savings accounts or liquid funds ensures you have ready access to cash if needed for any emergencies or medical costs.

Why It’s Important:

Having sufficient funds for healthcare and end-of-life expenses ensures that these costs are covered without dipping into the estate assets that are intended for your beneficiaries. It also allows you to have peace of mind knowing that your loved ones won’t have to struggle with financial hardship due to these unforeseen expenses.

4. Facilitating Wealth Transfer

Saving plans are not only essential for building wealth, but they also make wealth transfer much smoother. Some saving plans, such as life insurance, allow for the direct transfer of funds to beneficiaries upon the policyholder’s death.

Similarly, other saving plans like retirement accounts or fixed deposits can be transferred or assigned to a beneficiary, simplifying the distribution process.

Why It’s Important:

The process of transferring assets should be as simple and quick as possible for your beneficiaries. Having saving plans in place that are easily transferable can prevent delays and unnecessary complications after your passing.

5. Setting Up Trusts for Long-Term Asset Management

For high-net-worth individuals, creating a trust as part of your estate plan can help manage the distribution of assets in the future. A trust allows you to designate specific assets—such as real estate, investments, and saving plans—to be transferred to your beneficiaries according to specific terms.

For instance, a revocable living trust can hold your saving plans, which will be distributed to your heirs according to your preferences after your death.

Why It’s Important:

A trust not only helps with the smooth transfer of assets but also provides protection from estate taxes and creditor claims. By using saving plans within a trust, you can maintain control over your wealth while ensuring it benefits your beneficiaries.

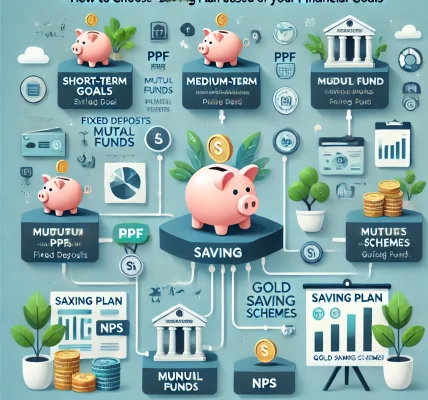

Types of Saving Plans That Contribute to Estate Planning

When it comes to estate planning, not all saving plans are created equal. Here are some types of saving plans that can be instrumental in your estate planning strategy:

- Life Insurance Policies: These are often the cornerstone of estate planning. The payout from a life insurance policy is typically tax-free and can help beneficiaries cover funeral costs, debts, and ongoing living expenses.

- Retirement Accounts (PPF, NPS): These accounts not only help with retirement savings but can also be passed on to heirs, providing long-term financial security.

- Fixed Deposits (FDs): A safe, low-risk option for wealth preservation, FDs can be transferred to heirs with ease and provide steady returns.

- Systematic Investment Plans (SIPs): For those looking to build wealth for their heirs over time, SIPs in mutual funds can help generate a substantial corpus.

Conclusion

Saving plans are an essential part of any well-rounded estate plan. Whether you’re looking to minimize taxes, ensure your family’s financial security, or leave behind a meaningful financial legacy, saving plans offer valuable tools for achieving these goals. By incorporating saving plans like life insurance, retirement accounts, and fixed deposits into your estate planning strategy, you can ensure a smooth transfer of wealth to your loved ones and protect them financially for years to come.