Credit rating downgrades can have a profound impact on bond prices and investor confidence, often creating a ripple effect across the financial markets. When a bond’s credit rating is lowered, it signals a higher risk of default, causing bond prices to decline and making investors rethink their investment decisions.

In this comprehensive guide, we’ll explore how credit rating downgrades impact bond prices, influence investor sentiment, and what strategies investors can use to safeguard their portfolios during such events.

📚 What Are Credit Ratings?

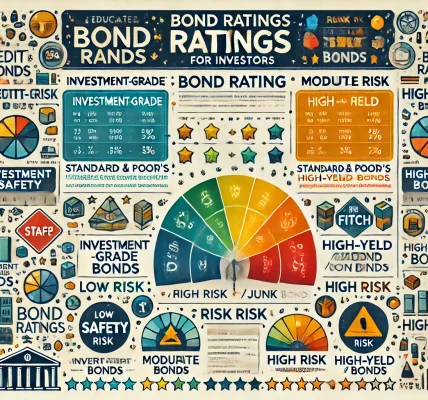

Credit ratings are assessments of the creditworthiness of an issuer, whether it’s a government, corporation, or municipality. These ratings, assigned by agencies such as Moody’s, Standard & Poor’s (S&P), and Fitch, serve as indicators of the issuer’s ability to meet its financial obligations.

📊 Credit Rating Categories:

- Investment Grade: Ratings from AAA to BBB (S&P and Fitch) or Aaa to Baa3 (Moody’s). These bonds have a low risk of default.

- High-Yield (Junk) Bonds: Ratings below BBB- (S&P and Fitch) or Baa3 (Moody’s), indicating higher risk and greater probability of default.

⚠️ What Is a Credit Rating Downgrade?

A credit rating downgrade occurs when a rating agency lowers its assessment of a bond issuer’s ability to repay debt. This can happen due to:

- Deteriorating financial performance.

- Increased leverage or rising debt levels.

- Economic downturns or industry disruptions.

- Regulatory changes affecting profitability.

📉 Examples of Credit Rating Downgrades:

- A corporate bond downgraded from BBB to BB+ moves from investment-grade to junk status.

- A government bond downgraded from AAA to AA indicates a slight increase in default risk.

📉 How Credit Rating Downgrades Affect Bond Prices

💸 1. Immediate Price Decline

When a bond is downgraded, it often leads to an immediate drop in price. This happens because:

- Investors demand higher yields to compensate for the increased risk.

- Existing bondholders may offload downgraded bonds to avoid further losses.

🔄 2. Increased Yield Due to Higher Risk

As bond prices fall, their yields rise to attract new buyers. Since bond prices and yields move inversely, a decline in price leads to an increase in yield.

💔 3. Selling Pressure from Institutional Investors

Institutional investors, such as pension funds and insurance companies, often have mandates that restrict investments to investment-grade bonds. A downgrade to junk status may force these institutions to sell off downgraded bonds, further driving prices down.

🛑 4. Lower Liquidity in Secondary Markets

Downgraded bonds often experience reduced liquidity, making it harder for investors to sell their holdings at desirable prices.

😟 Impact on Investor Confidence

⚡️ 1. Heightened Perception of Risk

A downgrade erodes investor confidence by highlighting potential financial instability. This perception of higher risk may cause investors to shy away from not only the downgraded bond but also other bonds from the same issuer or sector.

💼 2. Reduced Appetite for Corporate Bonds

Credit rating downgrades can spread uncertainty in the bond market, reducing demand for corporate bonds and increasing the preference for government bonds or safer assets.

📉 3. Market Volatility and Uncertainty

Downgrades often lead to increased volatility in the bond market, affecting investor sentiment and causing wider credit spreads.

💡 4. Re-evaluation of Portfolio Risk

Investors tend to reassess the risk profile of their portfolios, potentially reallocating their investments toward safer assets, such as U.S. Treasuries or municipal bonds.

🎯 Key Factors Influencing the Impact of Downgrades on Bond Prices

📈 1. Severity of the Downgrade

- A minor downgrade (e.g., AAA to AA) may not significantly impact bond prices.

- A major downgrade (e.g., from BBB to BB) can lead to sharp price declines.

📊 2. Market Perception of Risk

If the market has already anticipated a downgrade, the impact may be less severe. However, an unexpected downgrade can trigger a stronger reaction.

🏦 3. Issuer’s Financial Health

Bonds from financially stable issuers are likely to withstand downgrades better than those from distressed entities.

🌐 4. Broader Economic Conditions

During periods of economic uncertainty, downgrades tend to have a more pronounced impact as investors become more risk-averse.

🛠️ How Investors Can Mitigate Risks from Credit Downgrades

📚 1. Diversify Across Bond Issuers and Sectors

Avoid concentrating too much exposure in a single issuer or sector. A well-diversified bond portfolio reduces the impact of a single downgrade.

💡 2. Focus on Investment-Grade Bonds

Stick to high-quality, investment-grade bonds to minimize the risk of sudden downgrades and avoid speculative-grade bonds with higher volatility.

🔄 3. Monitor Credit Ratings and Issuer Fundamentals

Regularly review the credit ratings of bonds in your portfolio and keep an eye on the issuer’s financial performance to identify early warning signs.

📊 4. Consider Short-Term Bonds for Flexibility

Short-term bonds are less sensitive to interest rate changes and offer greater liquidity, allowing investors to quickly adjust their portfolios if a downgrade occurs.

🔁 5. Allocate to U.S. Treasuries for Safety

In times of market stress or uncertainty, U.S. Treasuries provide a safe haven and preserve capital.

🕰️ 6. Include Treasury Inflation-Protected Securities (TIPS)

TIPS safeguard against inflation while providing the security of U.S. government backing, making them a reliable addition to a defensive bond portfolio.

📊 Case Study: Impact of a Major Downgrade

🏢 Scenario: Corporate Downgrade from BBB to BB

A well-known telecommunications company is downgraded from BBB to BB due to rising debt levels and declining revenues. This downgrade:

- Triggers selling pressure from institutional investors.

- Increases yield to compensate for higher risk.

- Reduces liquidity as fewer investors are willing to purchase downgraded bonds.

Within days, the bond’s price drops by 15%, leading to a surge in volatility across the corporate bond market.

📉 Potential Consequences for the Broader Market

💡 1. Widening of Credit Spreads

A significant downgrade can lead to wider credit spreads across the bond market, affecting similar bonds with comparable risk profiles.

🏦 2. Contagion Effect on Related Sectors

Downgrades can spill over to related sectors, creating uncertainty and selling pressure across the bond market.

📉 3. Shift Toward Safe-Haven Assets

As investor confidence wanes, capital tends to flow toward safer assets, such as U.S. Treasuries or gold.

📈 Strategies to Take Advantage of Bond Price Drops After Downgrades

🔄 1. Identify Undervalued Bonds

Look for bonds that may have been oversold after a downgrade but still retain strong fundamentals.

💸 2. Purchase Higher-Yield Bonds at Discounted Prices

Downgrades often lead to higher yields, presenting an opportunity for risk-tolerant investors to lock in attractive returns.

📊 3. Consider Distressed Bond Investing for High Returns

For sophisticated investors, distressed bonds offer the potential for high returns if the issuer recovers from its financial challenges.

🎨 Final Thoughts: Managing Risk and Opportunity with Credit Rating Downgrades

Credit rating downgrades can significantly impact bond prices and investor confidence, but proactive management strategies can mitigate risks and unlock potential opportunities. By diversifying your portfolio, focusing on high-quality bonds, and staying informed about issuer fundamentals, you can navigate credit downgrades effectively and protect your investment portfolio.