Introduction

Investing in mutual funds is a popular way to build wealth over time. However, investors often face a crucial decision: Should they invest through a Systematic Investment Plan (SIP) or opt for a Lump Sum investment? Both strategies have their advantages and disadvantages, and the best choice depends on an individual’s financial goals, risk tolerance, and market conditions.

This blog will provide an in-depth comparison of SIP and Lump Sum investments to help you make an informed decision.

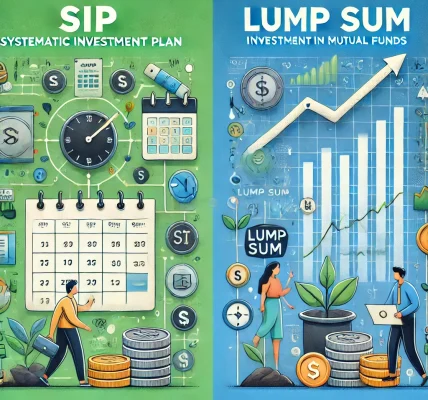

What is SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an investor contributes a fixed amount at regular intervals (monthly, quarterly, or annually). The key features of SIP include:

- Disciplined Investing: Encourages regular investment, reducing the risk of impulsive decisions.

- Rupee Cost Averaging: Investments are spread across different market conditions, reducing the impact of market volatility.

- Compounding Benefits: Long-term SIP investments can generate significant wealth due to the power of compounding.

- Affordability: Suitable for investors who prefer investing smaller amounts over time rather than a large sum at once.

What is Lump Sum Investment?

A Lump Sum investment involves investing a significant amount in a mutual fund at once, rather than in smaller, periodic installments. Key characteristics include:

- Higher Market Timing Risk: If invested at the wrong time, the portfolio may suffer losses.

- Potential for Higher Returns: If invested during a market low, lump sum investments can yield substantial returns.

- Requires Large Capital: Suitable for investors who have a substantial amount of money available for investment.

- Less Frequent Transactions: Unlike SIP, which involves multiple transactions, lump sum investing is a one-time transaction.

SIP vs. Lump Sum: A Detailed Comparison

1. Market Timing

- SIP: Since SIP spreads investments over different time periods, it reduces the risk of investing at market peaks.

- Lump Sum: The success of a lump sum investment largely depends on market timing. If invested at a market high, returns may be lower.

2. Risk Factor

- SIP: Lower risk as investments are made gradually.

- Lump Sum: Higher risk as the entire capital is exposed to market fluctuations at once.

3. Returns Potential

- SIP: The returns are averaged out over time due to rupee cost averaging.

- Lump Sum: If timed correctly, lump sum investments can yield higher returns compared to SIP.

4. Flexibility

- SIP: Offers flexibility to start, pause, or modify the investment amount.

- Lump Sum: Requires a large initial investment with no flexibility to modify later.

5. Psychological Factors

- SIP: Encourages disciplined investing and is ideal for investors who don’t want to worry about market fluctuations.

- Lump Sum: Requires emotional stability to avoid panic selling during market downturns.

6. Compounding Benefits

- SIP: Gains reinvested over time lead to compounded growth.

- Lump Sum: Longer duration of compounding if invested early.

When to Choose SIP?

SIP is ideal for:

- Beginners: Individuals who are new to investing and want to reduce risk.

- Salaried Individuals: Those who receive monthly income and prefer disciplined investing.

- Market Volatility: If the market is uncertain or expected to fluctuate, SIP helps in averaging out costs.

- Long-Term Wealth Creation: Investors who aim for long-term financial goals such as retirement or education planning.

When to Choose Lump Sum?

Lump sum investment is suitable for:

- Experienced Investors: Those who understand market trends and can time their investments well.

- Windfall Gains: If you have received a bonus, inheritance, or large sum of money, lump sum investment can be beneficial.

- Market Lows: If the market is at a downturn, lump sum investment can maximize returns.

- Higher Risk Appetite: Investors who can tolerate short-term market fluctuations in exchange for potentially higher returns.

SIP vs. Lump Sum: Real-Life Example

Consider two investors, Rahul and Priya, who each invest ₹1,20,000 in a mutual fund.

- Rahul invests through SIP, contributing ₹10,000 per month for 12 months.

- Priya invests a lump sum of ₹1,20,000 at once.

If the market fluctuates throughout the year:

- Rahul’s SIP investment benefits from rupee cost averaging—buying more units when prices are low and fewer units when prices are high.

- Priya’s lump sum investment remains exposed to market risks from the beginning, which could either yield high profits or lead to potential losses.

If the market rises consistently, Priya’s lump sum investment may generate higher returns compared to Rahul’s SIP. However, if the market is volatile, Rahul’s SIP investment offers better risk management.

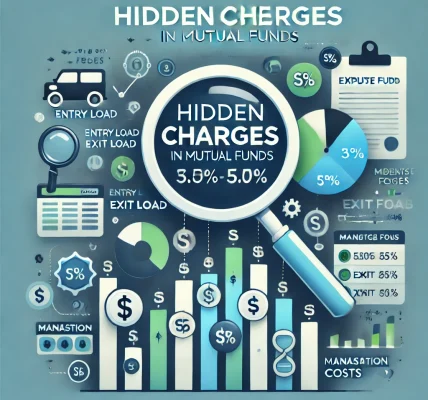

Tax Implications of SIP and Lump Sum Investments

- Equity Mutual Funds:

- STCG (Short-Term Capital Gains) tax: 15% (if units are sold within 1 year).

- LTCG (Long-Term Capital Gains) tax: 10% (on gains above ₹1 lakh if held for more than 1 year).

- Debt Mutual Funds:

- Taxed based on investor’s income slab if sold within 3 years.

- LTCG tax is 20% with indexation benefits if held for more than 3 years.

Both SIP and Lump Sum investments are taxed based on their redemption date. Each SIP installment is considered a new investment, and taxation applies individually on each.

Which Strategy is Better?

The best strategy depends on your financial goals, risk tolerance, and market conditions:

- Choose SIP if you want to invest systematically, manage risk, and reduce market timing concerns.

- Choose Lump Sum if you have a large sum ready to invest and can tolerate market volatility.

- Hybrid Approach: Many investors prefer a combination of both strategies. For example, investing a lump sum during market downturns and continuing with SIPs for regular investing.

Conclusion

Both SIP and Lump Sum investments have their advantages and limitations. The best approach depends on your financial stability, investment goals, and risk appetite. If you are a beginner or prefer a disciplined and risk-managed approach, SIP is the ideal choice. However, if you have a high-risk tolerance and can time the market effectively, Lump Sum investments can yield higher returns.

Final Tip: A combination of SIP and Lump Sum investing can provide the best of both worlds, allowing investors to balance risk and returns effectively. Always consult a financial advisor before making major investment decisions to ensure your strategy aligns with your financial goals.